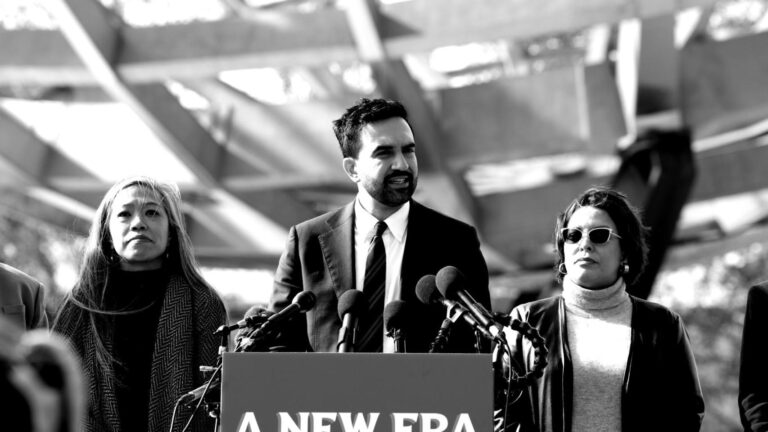

Wednesday was fulfilled a year after Trump’s victory in the US presidential election. NY has gone sour. The election of a young Muslim and Democratic candidate is a slap in the face. Especially when Trump himself publicly spoke out against his candidacy.

Trump Tower, a symbol of the president’s economic power, is on Avenue V, near Central Park. But New Yorkers don’t identify with him. Its basic electorate is based, above all, on the conservative horizon of the American Midwest and South.

However, there is one area of NY where Trump gets better news: Wall Street, the world’s most important stock market, including futures and commodity trading.

The Dow Jones Industrial Index rose in 2025. This year it went from 42,625 points on January 8th to 47,336 on November 3rd. A growth of 11%.

What does this mean?: that long-established industrial companies, the traditional American business heartland, are catching up.

Trump served as a real estate negotiator throughout his life

US industrial production has seen a sustained rate of monthly increases throughout this year and although it has slowed down in recent months, it continues to increase month by month. Something consistent with the “import substitution” policy that Trump’s tariff increase implies.

This would be a profound change in the American economic structure. But it is still too early to make a definitive assessment of Trump’s management in this area. Not enough time has passed to see the effects. Although it is certain that there will be.

This is within the USA. Abroad, we do not know precisely the effect of changing the global economic agreement to bilateral negotiations; a staple of Trump politics.

For now, its first effect has been the proliferation of these bilateral negotiations. Which brings with it a feeling of temporary insecurity of any agreement.

Trump served as a real estate negotiator throughout his life. A profession where agreements are easily signed and broken. A phenomenon that may be tolerable in the short term, but which leads to significant commercial instability in the medium and long term.

A speculative market in which knowledge of “insider information” is the path to accumulating profits

In the beginning, there were times when, faced with announcements of possible tariff increases, certain sectors chose to import to fill warehouses. They did so while awaiting the increase in restrictions that would make this import difficult. Therefore, for now, instead of restricting trade, in the very short term it accelerated it, and then entered a period of commercial drought. Then Trump created moratoriums, only to announce subsequent tariff increases with continuous and surprising negotiations.

It hasn’t even been two weeks since the US reduced the tariff on Chinese products and days later China suspended the provisional 24% tax on imports from the United States. Provisional lien that he had maintained since the summer. Everything to unlock, among other things, the trade in rare earths necessary for North American production.

Faced with this confusion, investors resort to buying gold. The typical safe harbor value, which at times exceeded US$3,700 per ounce, per stabilize around US$3,300, but with ups and downs.

A speculative market in which knowledge of “inside information” is the way to accumulate profits.

Consequently, Proximity to Trump can become a factor of wealth. Knowing your decisions a little in advance allows you to make progress in this and other speculative markets.

Given this, there are suspicions that the US president’s entourage is getting rich. Something that, curiously, the media does not comment on. Will it really be known one day?

**JR Pin Arboledas is a professor at IESE.