Family delinquency grows and a warning light turns on in the financial system. The latest edition of the central bank’s report on banks, with data up to September 2025, revealed that while credit to the private sector is growing again and banks are showing good levels of liquidity and solvency, Household defaults continue to increase It becomes a wake-up call for financial intermediation.

Butler: The level of default is the highest in the past 15 years

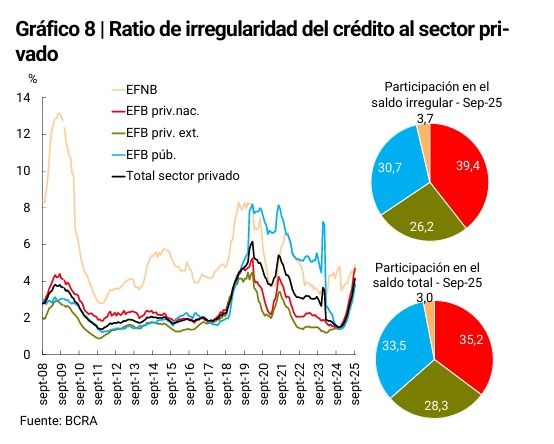

According to BCRA data, Percentage of credit violations for the private sector It was located in 4.2% In September, an increase of 0.4 percentage points from the previous month. Within this total, Families are the most committed segment: Loan defaults for people rose to 7.3% of that portfoliomuch higher than 1.7% shown by companies; This shows that fragility is more evident in the world of families than in the world of productive finance.

Defaults on the rise in highly indebted households

The increase in violations occurs in a context in which credit begins to regain its standing. In September, the real balance of private sector financing in pesos rose 0.5% per month And accumulated 47% on an annual basisWith a strong presence Secured loans And inside them who Mortgage for familieswhich included more than 4,700 new debtors per month alone And more 41,200 in the last 12 months.

But this dynamic coexists with a harsher reality regarding households’ ability to repay. The rise in delinquencies reflects the impact of income that remains laggingpartial recombination of the real wage and Moving forward with commitments made in a high-nominal environment.

Delinquency is increasing among high-income sectors

At the same time, Consumption does not show a significant expansion in stocks, But yeah one Increased pressure on classes Especially in cards, personal cards, and to a lesser extent pledges.

The picture that September leaves is an image Households are more active in demand for medium and long-term credit (mortgage and mortgage), but have difficulties in timely maintenance of obligations already undertaken. Hence the jump in defaults to 7.3% of its investment portfolio, which contrasts with the decline in tension in the corporate world.

Stronger companies and better covered banks

On the business side, the report shows a stronger picture. Delays in repayment of financing have been identified for companies in 1.7%much less families. Credit to companies in pesos and foreign currencies grew, driven by higher interest rates Industry and primary productionIt did so with limited deterioration in portfolio quality.

Faced with this scenario, banks Maintain a high cushion of expectations: The total balance of allocations is equivalent to: 102% of financing is in irregular statuswhich implies that entities, on average, have the entire stock of non-performing loans covered by provisions. These represent expectations measured against the total portfolio of the private sector 4.2% of creditThis level rose slightly compared to the previous month.

In other words, Family delinquencies are increasing and concentrated in the most vulnerable section of the system, but banks still have sufficient coverage margin To absorb this deterioration without compromising its solvency.

lr/ff