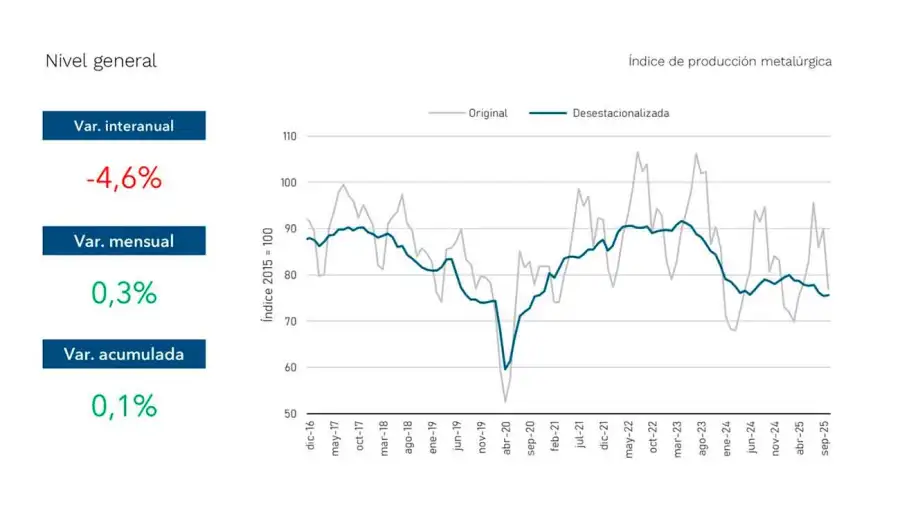

Mineral activity recorded in October A Annual decrease of -4.6% and increase of 0.3% Compared to the previous month, according to the report of the Association of Metal Industrialists of the Argentine Republic (ADIMRA).

In this way, sector A accumulates Growth of 0.1% during the first ten months of this yearThis is compared to the same period in 2024.

“October deepened the overall decline in metallurgy activity. Most sectors continue to do so “Negative fluctuations between years and there are no clear signs of a change in trend.”The entity said.

The “Framework” agreement between Argentina and the United States: point by point, which are the sectors with the greatest impact

On the other hand, the use of Installed capacity (ICU) Recording a decrease of 6.0 percentage points compared to the same month of the previous year. “From here, “It is at one of the lowest values historically.”“, says the report.

Regarding the level of employment, there was a decrease of -2.9% year on year and -0.1% month on month.

Sector analysis

Sectors Agricultural machinery (-0.8%) and car bodies and trailers (+2.6%)The index, which led the recovery in the first half of the year, showed signs of moderation again in October. “In agricultural machinery, the sector continues to go through a cycle of weakness.”

For her part, The chassis and trailers have managed to maintain a positive recordbut maintains a slowing trend with respect to the highs reached in the middle of the year, as the report describes.

“On the side of the most backward sectors, Auto parts (-2.5%), foundry (-12.7%) and capital goods (-3.9%) It remained in negative territory, reinforcing the observed fragility scenario with no signs of recovery in the short term. These elements remain the main sources of shrinkage within the metal frame, according to ADIMRA.

The rest of the segments also showed negative results: Other metal products (-2.8%)Electrical equipment and appliances (-8.6%) and medical equipment (-3.7%) continued the negative trend that intensified at the end of the third quarter.

Regarding expectations, he said 67.4% of companies indicated that they expect their production level to remain unchanged or decrease.

According to ADIMRA, “The employment outlook also remains weak, with an increasing number of companies anticipating potential adjustments in their employment. In this sense, 83.3% of companies do not anticipate changes in their workforce or expect to reduce it.