Mitsubishi Materials has announced a strategy to turn around its struggling copper sector, with plans to build a foundry in Europe that will process recycled printed circuit boards. This measure aims to protect the company from potential supply disruptions related to China.

The Japanese company said on Wednesday that it expects not to achieve financial goals for the fiscal year 2025 and announced new goals for the fiscal year 2028.

The return on equity (ROE) target for fiscal 2028 is 8% or higher, while the return on invested capital (ROIC) target is 7% or higher. The company was expecting a 10% return on equity and a 5.5% return on investment for fiscal 2025, but now expects to achieve just 3% and 3.5%, respectively.

The Company’s copper smelting business is negatively impacting its results. Pre-tax profits for the metals sector, which includes copper smelting, fell to 5.3 billion yen ($34 million) in the first half (April-September), down 12.7 billion yen from a year earlier.

Japanese copper smelters import copper concentrates that are produced by processing copper ore. When you buy the position, they receive fees from mining companies for processing. This foundry profit margin becomes part of the net profit.

Demand for copper in China has increased rapidly, leading to a growth in the number of smelters. Competition with Chinese copper concentrate companies has forced smelters to cut their profit margins.

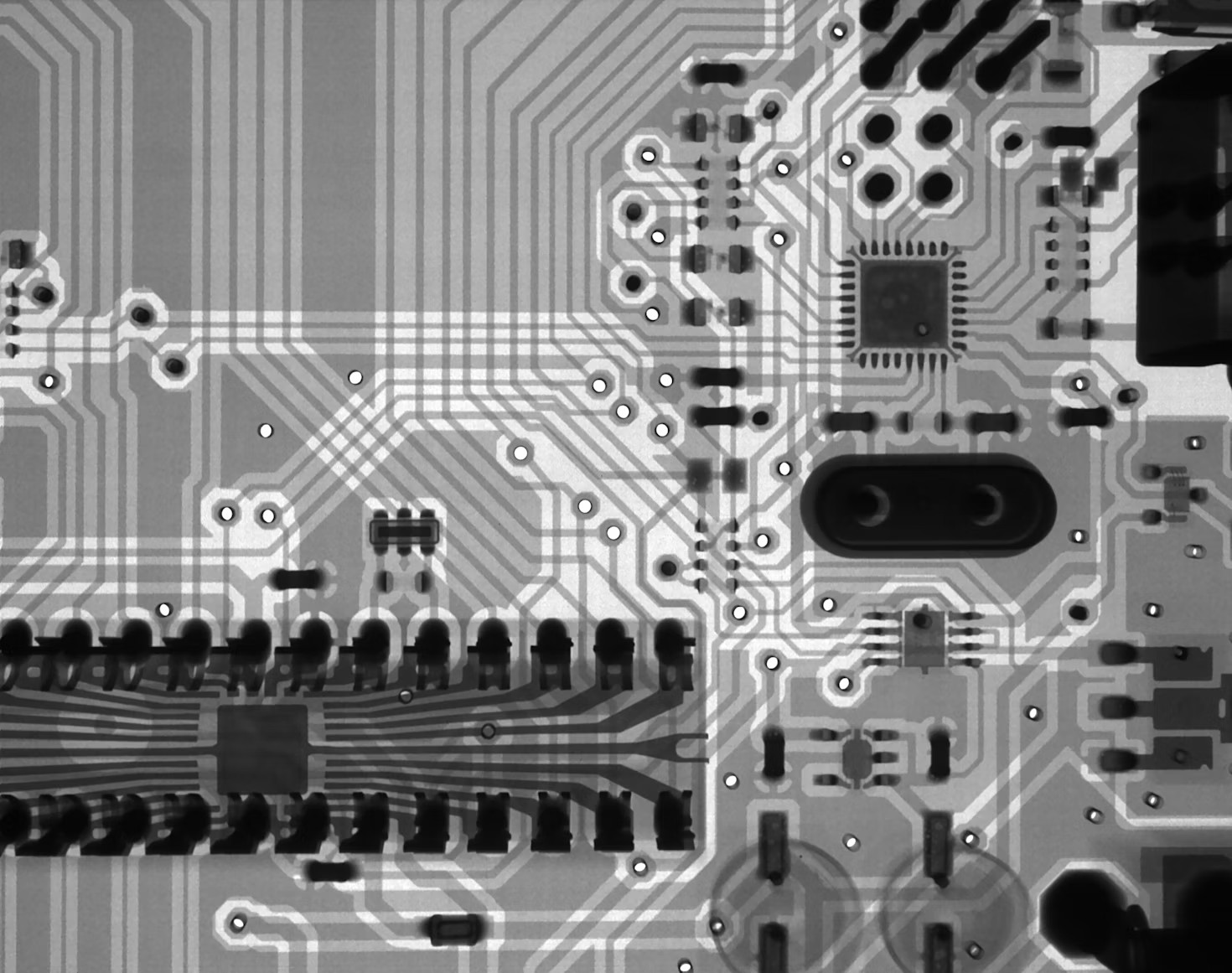

To reverse this situation, President Tetsuya Tanaka plans to increase the smelting of recycled copper. Copper can be smelted from raw or recycled materials such as discarded printed circuit boards.

“Discarded printed circuit boards have a profit margin several times higher than casting them from copper concentrates,” Tanaka said. The company plans to extract copper from discarded printed circuit boards in Europe, a process known as secondary smelting.

Mitsubishi Materials also plans to build a similar foundry that processes only recycled materials in the United States, in partnership with a British company it has invested in, which will help double the company’s capacity to process waste printed circuit boards to more than 300,000 tons by fiscal 2035.

The company will also increase its tungsten recycling rate from the current 70% to 100%, excluding China, by fiscal year 2030.

At the same time, it will reduce copper concentrate processing capacity by 30% to 40% in fiscal 2035 compared to fiscal 2025. It will also seek to increase the use of recycled materials at two smelters in Japan.

To improve efficiency in the copper sector, Mitsubishi Materials announced on November 11 that it will consolidate the raw material purchasing and sales divisions of Pan Pacific Copper, which includes JX Advanced Metals, Mitsui Kenzoku smelter and Marubeni trading company as investors.

The goal is to improve negotiating power with mining companies. Until now, “there has been absolutely no talk about merging our smelting and refining operations,” Tanaka said.