Oil company Continental resourcesFrom an American businessman Harold Hammknown in the United States as “King of Hydraulic Fracturing” Because she is one of Leading oil tankers in exploiting unconventional hydrocarbons in their country, I officially landed in Vaca Muerta. Although it has already met with the government to evaluate investment options in one of the country’s most prosperous regions, the company announced on Monday Buy a block in Neuquén Basinwhich was previously in the hands of Pluspetrol.

According to the document published today by Pluspetrol at the National Securities Commission (CNV), Continental Resources has been left with… 90% of the company’s shares are in the Los Toldos II Oeste transitional business consortium. It should be noted that the rest 10% It is in the hands of the Neuquén State Corporation Neuquén Gas and Oil (GyP).

The official document stated that the agreement was concluded with continental Resources Argentina, The subsidiary that the company opened in the country Harold Hamm. So, the operation, although it represents the company’s entry into the country’s major hydrocarbon basin, It still depends on the fulfillment of preconditions and regulatory approvals.

The block was part of the package of regions that Pluspetrol bought almost two years ago from ExxonMobil in North America, which is why the region became a subsidiary Pluspitrol Basin Neuquén. Its sale is part of a plan launched by the Argentine company to focus its efforts and resources on the star region it acquired from ExxonMobil: Bajo del Choique-La Invernada.

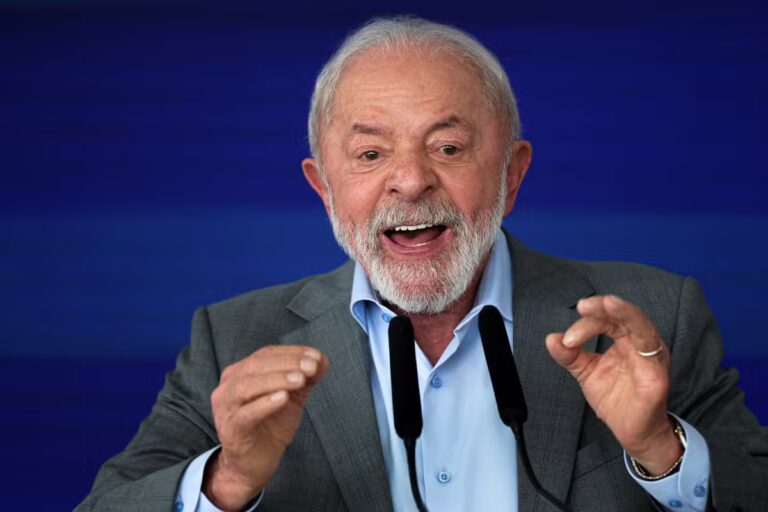

Minutes after the news spread, Economy Minister Luis Caputo posted on his account One of the pioneers of unconventional development in the United States arrives at Vaca Muerta. Excellent news for Argentina and that It is sure to be imitated by other American independent oil companies that see its potential Oil shale In Argentina now “It has a political and economic framework that justifies the investment.”

This decline occurs a little more than a month after significant President Javier will visit Miley in Olivos. According to official records of his visit published by the government itself, the businessman met with the CEO Discussing the present and future of the country’s hydrocarbon industry.

Hamm founded Continental Resources in 1967. Today, it is One of the 10 largest independent oil companies in the United States. Based in Oklahomain 2024The production volume was from 400 thousand barrels of oil equivalent per day. It focuses a large part of its activity on the website Cryinglocated in North Dakota and mountain. In addition, it has major operations in the regions scoop and pile (Oklahoma) It is part of the watershed Anadarko. Recently, he bought positions in Wyomingin a basin Powder RiverAnd in Permianl Texas.

One of the pioneers in developing hydraulic fracturing technologies, and was one of the leading companies in the field of developing hydraulic fracturing technologies. Heroes of the unconventional hydrocarbon explosion. It was listed on the New York Stock Exchange until 2022, when it decided to withdraw to operate with more strategic freedom from environmental, social and governance regulations and standards.

Meanwhile, Pluspetrol acquired the area last year, when it won a bidding process led by the investment bank. Jefferies To find a new owner for Five oil blocks belonging to ExxonMobil after leaving the country. among them, Bajo del Chuic-La Invernadathe only one in which the American company began its activity. Pluspetrol offered near 1.7 billion US dollarswith payment terms that made their proposals more competitive compared to those offered by competitors such as PAE, VISTA, Techpetrol and YPF.

Until then, Pluspetrol – the fourth largest oil and gas producer in Argentina, also had a presence in… Peru, Colombia, Ecuadorthe USA, Holland and Uruguay– I was just in Vaca Muerta CaleraWhere he is a partner 50-50 With YPF. To develop that cluster, it has identified an investment plan 600 million US dollars,scalable 1000 million US dollars.

The company acquired the new assets in December. He currently works at A $2 billion planwhich will seek to be applied to the Large Investment Incentives (RIGI) system. To this end, this year it issued its report The first commitment is negotiable in the amount of US$450 million.

We want to meet you!

Register for free At El Cronista for an experience tailored just for you.