Jasmine Hasegawa is a painter and often participates in art exhibitions in Brasilia. These are good times to engage with the public and sell your work. She says the process became easier after Bix was launched five years ago, and she feels people have started buying more since then.

“A lot of times, we don’t have money in our wallet, and Pix has arrived to help in these times. I imagine another reason for the increased use of Pix is that the public wants to make it easier for small entrepreneurs to get money, so we don’t have to pay card fees,” he says.

/i.s3.glbimg.com/v1/AUTH_63b422c2caee4269b8b34177e8876b93/internal_photos/bs/2025/i/p/1xe48sTD6P5FgB5NE9qw/20250725-174231.jpg)

At 16 years old, Bix has changed the way millions of Brazilians pay – and the logic of many companies. According to Hasegawa, in some events, the percentage of payouts in this way exceeds the percentage of cards. In other cases, nearly half and half.

Painter’s experience is also captured in Pix’s usage statistics. In October, the number of person-to-business (P2B) payments exceeded the number of person-to-person (P2P) transfers. According to Central Bank (BC) data, there were 2.72 billion P2P transactions, or 44% of the total in the month, and 2.69 billion P2P transactions, 43% of the total.

Data shows the evolution of Pix as a payment method. Once launched, the system made its debut in person-to-person transfers, replacing physical money and traditional TED and DOC documents (which no longer exist). Little by little, they are also being adopted for payments between customers and businesses. Business adoption gained momentum as the benefits became clear, such as instant settlement of online sales and the possibility of offering greater discounts, due to the lower cost of card fees.

This change, while subtle, reflects a continued growth in the number of legal entities registered with Pix and a BC-led innovation agenda that is opening up new spaces for the spot broker. This year alone, the authority launched Pix by contact and Pix Automatic, two payment initiatives for businesses. He is still working on the Pix Parcelado project, which will function as a kind of digital credit card.

/i.s3.glbimg.com/v1/AUTH_63b422c2caee4269b8b34177e8876b93/internal_photos/bs/2025/g/m/KviBlETAipPVkJEBuIzQ/pix-aniversario-01.jpg)

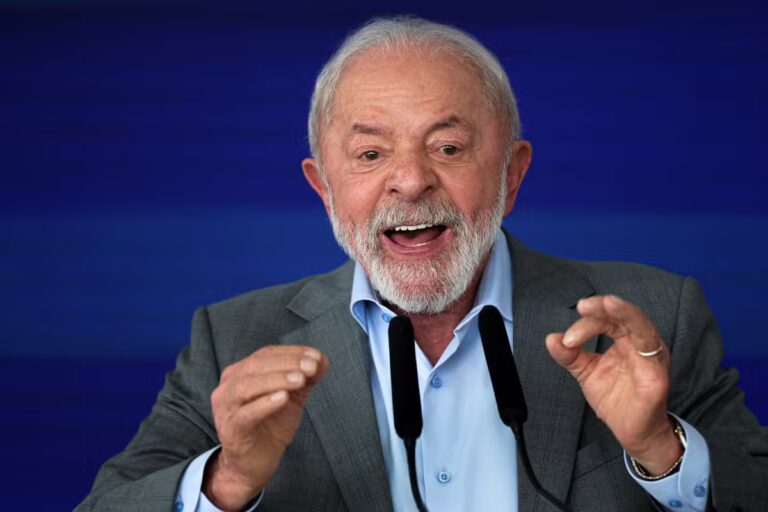

As a result of a project by British Columbia technicians, the development of Pix was led by former mayor Ilan Goldwagen and his successor Roberto Campos Neto accelerated its development, with active private sector participation in the discussions. The project agenda is still ongoing under the current management of Gabriele Gallipolo.

This year, Pix represented 51% of transactions completed across all payment methods, according to a survey conducted by Oliver Wyman using data from B.C. However, Rogerio Banca, senior consultant at the consultancy, highlighted a context: the number of operations has increased in general, and therefore, even with a decrease in participation, the number of credit card operations has increased, for example.

The number of credit cards issued has also risen since the launch of Pix, demonstrating the coexistence of payment methods, Banka said. “Pix provides access to banking services and allows issuers to recognize that customer and eventually offer a debit or even credit card first,” he said.

The expert says he has not dropped “on the tip of a pencil”, but believes the number of transactions from people to businesses should rise further in the coming months, with shopping at the end of the year.

Panca also says the Pix Automatic “has space to fill.” Launched in June, the tool has been growing in use and can replace automatic debit and other recurring payment methods. In August, the volume of transactions in this way reached R$1.1 million, a record high that rose to R$7.3 million in October.

British Columbia’s director of financial and decision regulation, Renato Gomez, said the job has generated competition in many markets. “With Pix Automático, the smallest banking or payments institution can compete on equal terms with ‘the bank,’ just as the gym on the corner can compete on equal terms with a larger gym, because the same convenience that automatic debit provides will be available,” he said in a webcast this week.

Pix by contact was another change this year. Since February, customers have been able to link their accounts at a bank or payment institution to a digital wallet, such as Google Pay, to make face-to-face payments in the same way they would use a card: by bringing a cell phone closer to the device. The method has gained momentum in recent months, reaching 8.7 million in October.

The agenda also includes the launch of rules to unify the Pix Parcelado viewing experience, already available by many institutions. The rules were expected to be published in October, which did not happen. This week, BC’s president said the product has already been demonstrated and explained there is discussion about what kind of experience should have “more friction” when hiring.

Mariska Teveron, partner at Viseu Advogados, says Pix’s news agenda is “innovative and lively” and that the tool has advantages, especially for small businesses – such as reduced operating costs and immediate receipt of resources. “This means that companies end up having more flexibility to attract more customers and even offer discounts,” he says.