Starting in 2026, license fees for cars registered in the Province of Buenos Aires will be paid monthly. This is what I announced Buenos Aires Provincial Collection Agency (ARBA), Who reported that the procedure was carried out “With the aim of facilitating financial planning for families”.

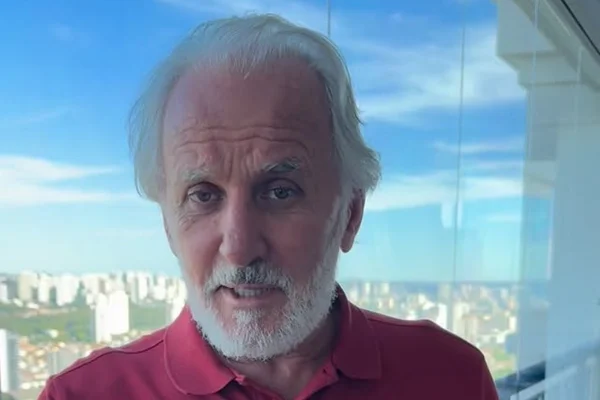

As the CEO of the Buenos Aires collection agency, Christian Girard, explained, The car tax will be paid starting in March in ten equal monthly installments. Currently, the patent is annual.

“In addition, we are nominally reducing license fees for 75% of vehicle owners. Three out of every four Buenos Aires residents will pay less this year, thanks to a reformulation of scales that restores fairness, protects the middle sectors and prevents tax pressures from falling disproportionately on them.”Gerard said.

The new tax structure will reduce brackets from 15 to 5, with rates ranging from 1% to 4.5%, which will place the county among the jurisdictions with the lowest tax rates in the country.

They explained from the collection agency that Tax Code 2026 It maintains a “progressive and pro-production orientation”, without increases in gross income rates or in property tax, and modernizes the departments by 40%, which will benefit more than 46 thousand small and medium-sized companies located in the region headed by Axel Kiselov.

“The economic context is crucial for the people of Buenos Aires, which is why this law is in dialogue with this reality: it does not include surcharges or property increases, which represents a tangible relief for families and the rural sector,” Girard said.

The Buenos Aires provincial government on Monday presented a series of guidelines for its fiscal and tax code of 2026. At a press conference, Girard dismissed that the Kicilloff administration would exert strong tax pressure and, along these lines, highlighted the project’s points related to taxes on real estate, cars and gross income. He called for the initiative to be approved, contrary to what happened with the Finance and Taxation Law of 2025, which did not pass legislative approval.

Regarding urban and rural property taxes, Girard noted that the tax burden will not increase. “With regard to the year 2024 (the last approved fiscal and tax law), we have not introduced changes in the tables or rates. The same theoretical tax burden of the 2024 project is the same as the tax burden contained in the 2026 project. We also do not apply a multiplier to the tax base, so every property will be in the same category as in 2024. We have eliminated the surcharge,” Girard explained, at a conference led by the Minister of Government. Carlos BiancoIn which the President of Banco Provincia also participated, Juan Cuatromo.