Cranes have once again become an important part of the Spanish landscape, especially in large cities. It has nothing to do with the brick years of the 2000s, but the numbers do show that housing construction is an upward trend. … That is why it is essential that bank credit flows again to developers so that they can build those buildings that in the past 16 years were considered drab.

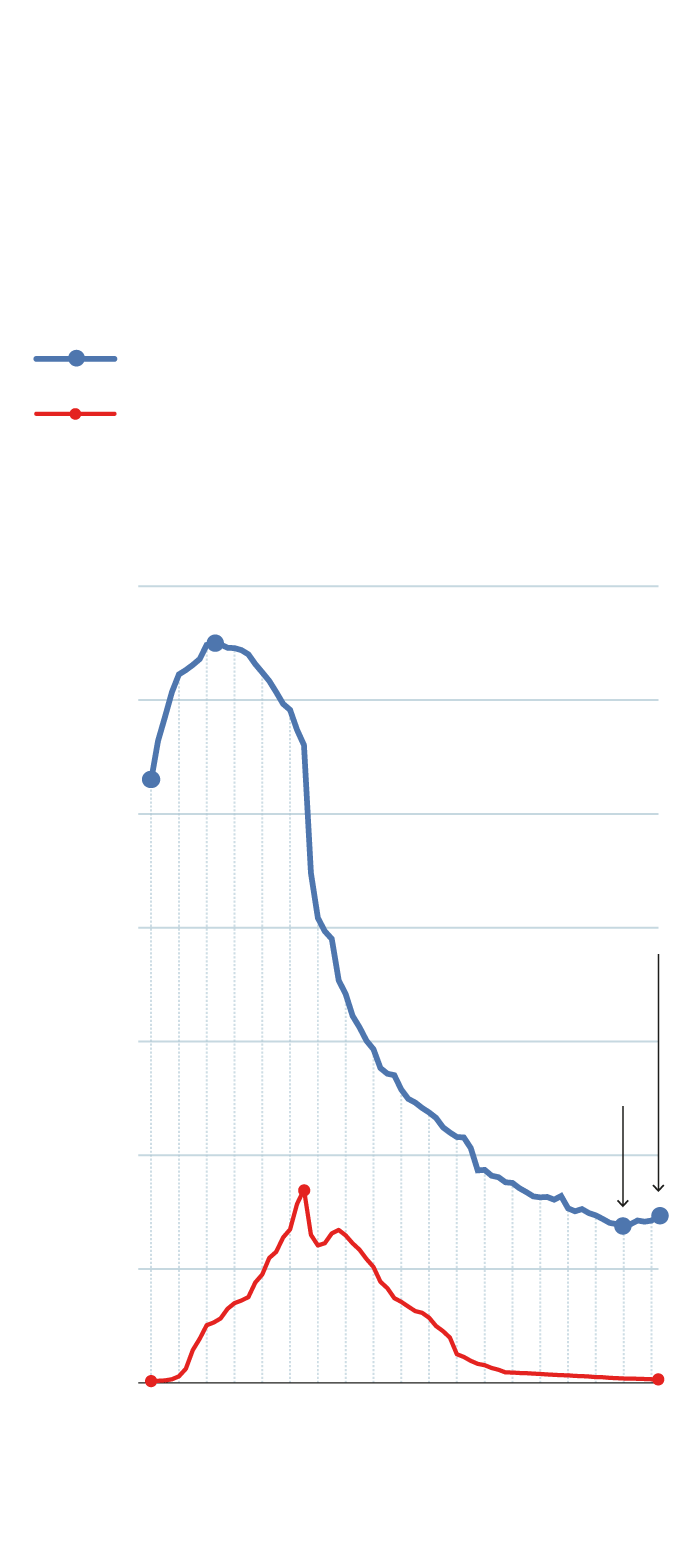

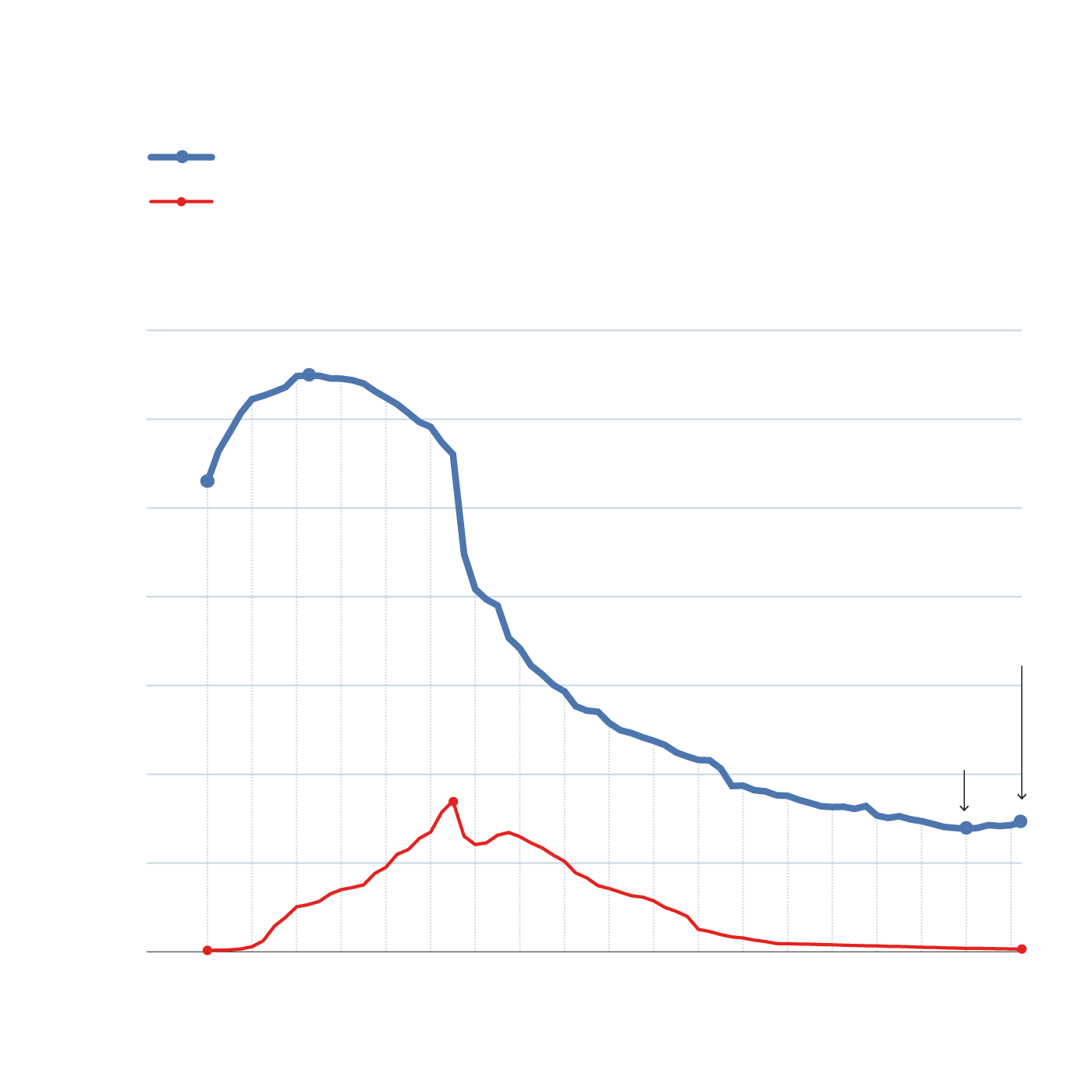

statistics Bank of Spain It appears that loans provided by financial entities for real estate development are now growing at a remarkable rate. The data under loans for real estate activities, which includes developer credit, is clear. At the end of June 2025, financing for this sector had risen to a total balance of €73,276 million, compared to the €69,235 million that existed at the beginning of 2024, when the bottom was touched in the current cycle.

Growth in just over a year has reached 6%, following the credit of the so-called Real estate activities The crisis has been in free fall since September 2009, with the real estate bubble already bursting. The historic maximum was reached in June of that year with a credit of €324,663 million, figures very far from those seen today.

That year the real estate crash was like an earthquake. In the midst of the brick crisis, which later became a financial crisis, everything went down the drain in the sector. Cranes stopped, many developers went bankrupt, and the desire to build faded; In fact, the drama at the time was that construction and mortgage payments could not continue, residents were losing their jobs very quickly, and the country was aiming for a bailout from Europe.

The scale of the problem can be seen in the credit numbers of real estate businesses that ended up in delinquency. The peak funds in these loans reached $324,663 million in June 2009; Well, in September 2012, the promoter’s unpaid loans amounted to €84,989 million, which meant that 30% of the existing outstanding credit was in arrears. This led to the collapse of the real estate development sector, as well as some banks, and put many other banks in trouble. As an exceptional measure, “SARB” was launched, the so-called “bad bank” that acquired, through public debt, the most toxic assets of financial entities, among which Credit promoter.

development

Credit for activities

Real estate

In millions of euros

Quarterly data

(March, June, September, December)

Credit for real estate activities

Credit for real estate activities

This is in default mode

Development of credit for real estate activities

In millions of euros / quarterly data (March, June, September, December)

Credit for real estate activities

Credit for real estate activities that are in default

After more than a decade, the balance of defaulters in this sector reached only 1,429 million euros. This allows the credit tap to be reopened to finance the renewed desire to rebuild residential buildings in Spain. Banking sources understand that credit for real estate development has been (and still is) under the microscope for years in light of what has happened in the past. They add, however, that it allowed them to learn lessons after going through a period when everything was financed, requirements were lower and the economy did not stop growing.

Sources from the banking sector confirm that there is a noticeable acceleration in credit allocated to real estate development. Although it is cross-sectional because it is a large margin business, sources indicate that they are Caixabank and Banco Santander The two most active entities in Spain. However, in this sector they insist that their caution with this credit remains maximum, while following the highest standards when granting loans.

Furthermore, banks point out that offering this type of financing now requires more capital requirements, so each process is being reviewed individually. Because of this caution on the part of banks, it is common that the first financing of promotions is usually done through investment funds, and then, with all licenses, technical requirements and the specific project, the debt is refinanced with banks, which undertake the financing throughout the development of the promotions and their subsequent sale.

Soil problem

Likewise, financial institutions assert that credit is happily flowing again in order to promote due to the reactivation of demand. What’s more, everyone is at the table with the diagnosis that Spain’s big housing problem is one of supply, which is not matching demand and prices are skyrocketing. A diagnosis in which the Bank of Spain and the entities themselves agree and the role of analysis…

In this sense, if the upgrade balance is at low hours, it is also because Terminal land shortage For construction, building permit numbers were six or seven times lower than they were in the golden age of brick. Last year, permits to build new housing recorded their best year since 2008 when 127,721 visas were registered, a 17% increase on the previous year, but far from the historic peak reached in 2006 when 865,561 visas were reached.

This is a big problem that the promoter sector was hoping to solve by approving land law reform, which the Socialist Workers Party withdrew from the House of Representatives last year due to lack of support. The new text has received the approval of businessmen, and aspires to provide legal certainty for city councils’ urban plans so that they do not get stuck in the courts when submitting any appeal. Currently, there are about a hundred municipalities affected by this paralysis, according to calculations by the APCEspaña Promoters Association.

Housing

It is the housing deficit that the Bank of Spain calculates exists

According to the calculations of this association, it takes an average of 10 to 15 years to convert land allocated for construction into a residential product in Spain, at a time when Spain needs about 700,000 homes To cover the current deficit in relation to the annual growth in the number of households, according to the Bank of Spain. On the other hand, promoters estimate that the housing shortage could reach a total of 2.74 million units within 15 years, which would leave Spain in a state of complete housing collapse.

Regarding financing, the sector also considers legislative reform necessary so that developers can qualify for bank loans for the implementation of industrial housing – houses built in a factory – which is the most sought-after solution to accelerate the creation of products, because it significantly reduces construction time.

In fact, the government is now also turning to this option after approving this year the Berti Housing Industrialization Programme, through which it hopes to provide €1.3 billion in financing from European recovery funds. The aim is to reach between 15,000 and 20,000 industrial homes annually over the next decade, but the development sector is yet to detect progress from the Housing Ministry on the project.