The list of economic achievements that the government strives almost daily to shine and which highlights the strong pace of economic growth after the pandemic, the gradual reduction of deficit and public debt levels and record numbers. … Tax collection was not enough to allay OECD economists’ concerns about the future sustainability of Spanish accounts. In light of the latest report issued by the multilateral organization on Spain, which was presented on Wednesday in Madrid by the organization’s Secretary-General, Matías Cormann, and the Minister of Economy, Carlos Corbo, they still believe that this path Spain is heading towards financial disaster Reforms, not light, but deep, will be needed to ensure that public accounts do not succumb to the impact of an aging population.

The focus, which is not new, is primarily on the pension system, which appears in all reports assessing the country’s future financial sustainability as something like “Armageddon.” The Organization for Economic Cooperation and Development believes that the pension reform approved by the government means progress in some aspects, such as incentives to extend the working life beyond retirement age, but He did not solve his main problem: Projections of retirement benefit expenses continue to exceed the ability of contributions to generate income.

International organization She sees it as inevitable that Spain will undertake another pension reform In the short term, in its report, it proposes a set of proposals that could, according to its calculations, save up to 40 thousand million euros for the public treasury.

Some of those listed by the OECD Secretary-General on Wednesday are part of the institution’s regular recipe book. «Linking retirement age to life expectancy Requiring that the most important parameters of the system such as the legal retirement age be adapted to the evolution of life expectancy, or to take into account the first years of professional life when calculating the pension is something most developed countries are already doing and would help to face more sustainable payments in the future, said Mathias Cormann, repeating his already well-known proposals to restore the sustainability factor abolished by the government of Pedro Sánchez. The retirement pension is calculated based on the last 35 years of contributions, not based on the 25 contributions as is the case now.

That subsidies do not contribute

But the foundation went further in its latest report, and directly pointed out what was controversial Special benefit for unemployed people over the age of 52which ensures, among other things, Social Security overpayment of 125% of the minimum system base for its beneficiaries to reduce their future pension burden as little as possible, although there are negative effects on expectations or incentives to search for a job, as one of the aspects that can increase the pension bill.

The Foundation is concerned that, in conjunction with its revitalization in 2019, traditional… The percentage of supported people over the age of 50 increased from 52% to 70%with marginal levels of reintegration into the labor market. It concludes that “the design of unemployment benefits continues to generate significant disincentives for older workers” and to mitigate these disincentives, it calls for preventing the assistance portion of unemployment protection from generating retirement rights.

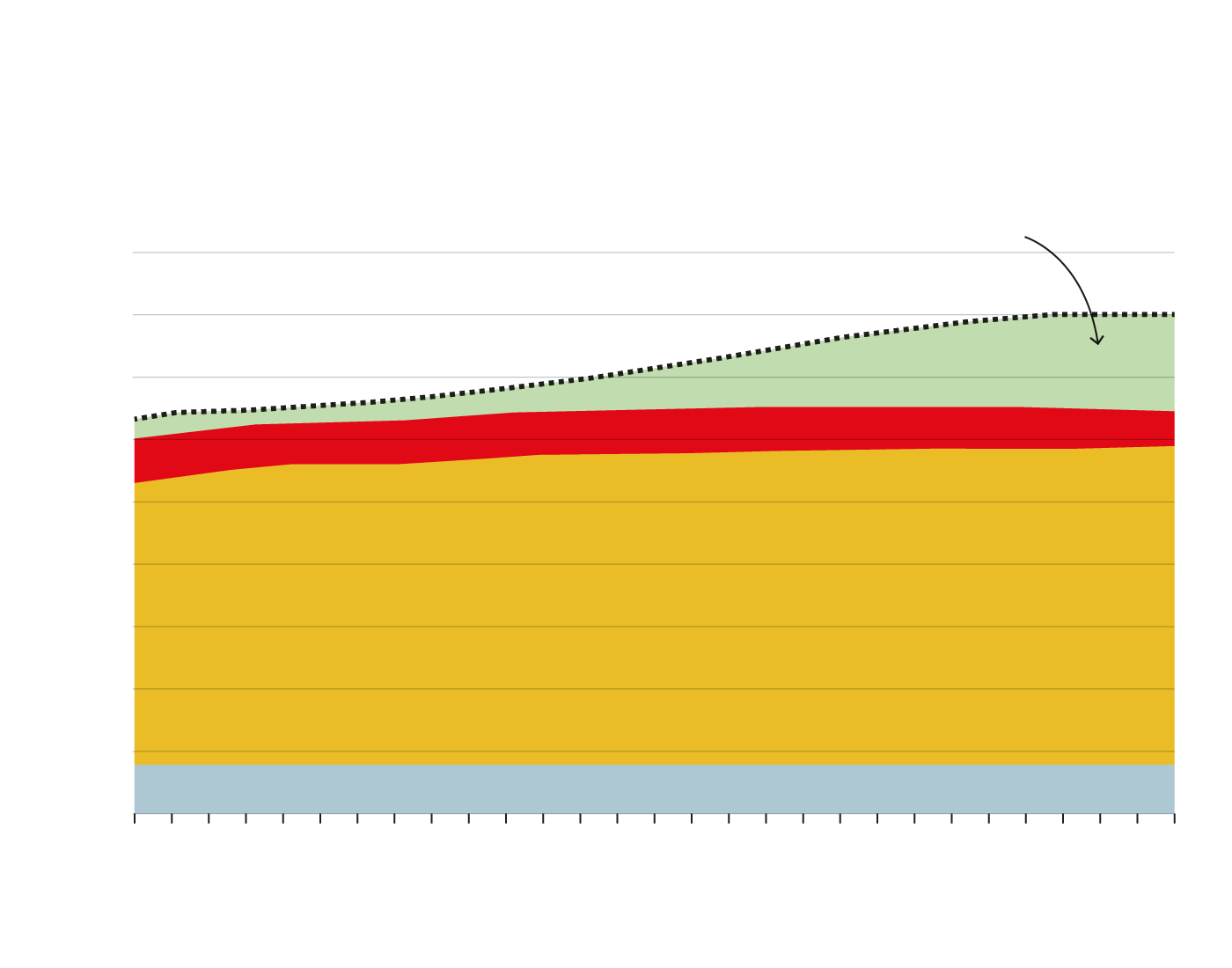

Expected development

of pension spending

And funding sources

Central government transfers

Additional transfers to cover retirement expenses

The expected development of spending on pensions

And funding sources

Additional transfers to cover retirement expenses

Central government transfers

This measure alone means saving about 10.5 billion euros in the medium term for the public treasury, according to calculations included by the Organization for Economic Cooperation and Development in its latest report on Spain. Adjusting the retirement age to match life expectancy would reduce pension spending in the medium term by another €15,000 million, and Spain’s own plan savings of €40,000 million would be rounded off. 13,500 million to extend the subscription period to 35 years Which is taken into account in calculating the pension.

Short term adjustments

The OECD’s concerns about the situation in Spain are also short-lived. In recent years, it has been strongly recommended that the Government of Spain take advantage of the strong progress of the economy in order to… Accelerating the pace of reducing financial imbalances And creating what is called a “financial cushion” to address future crises.

Although the government prides itself on pursuing a prudent and responsible fiscal policy, it has never fully convinced the body that has repeated that recommendation year after year. Its latest report reiterated this issue, but with some additional caveats. The first looks to the long term and warns that “under current policies, the debt-to-GDP ratio will increase significantly from 2040 as a result of the costs of an aging population.” The second is more worrying because it affects the short-term, that is, the fiscal policy that this government or its successor will have to address in the coming years, according to the document distributed by the Organization for Economic Cooperation and Development on Wednesday. It will force Spain to “halt the increase in pension spending, reduce inefficient spending and improve tax revenues.” If they want, they will achieve the goals of reducing public debt and deficits that the government committed to Brussels.

The executive authority committed to the Commission that Spain would reduce its public deficit to 0.8% of GDP and its public debt to 90.6% by 2031, and that it would do so by adjusting the development of its public spending according to a sequence consistent with the commitments. The European Commission has already questioned Last Tuesday. However, the OECD report warns that as of today there are no measures on the horizon to support achieving these goals, and that under current standards they will not be achievable, unless the country makes a drastic adjustment.

These concerns did not prevent Corman from describing the performance of the Spanish economy in recent years as “impressive” or from acknowledging that GDP will rise by 2.9% this year and 2.2% next year.