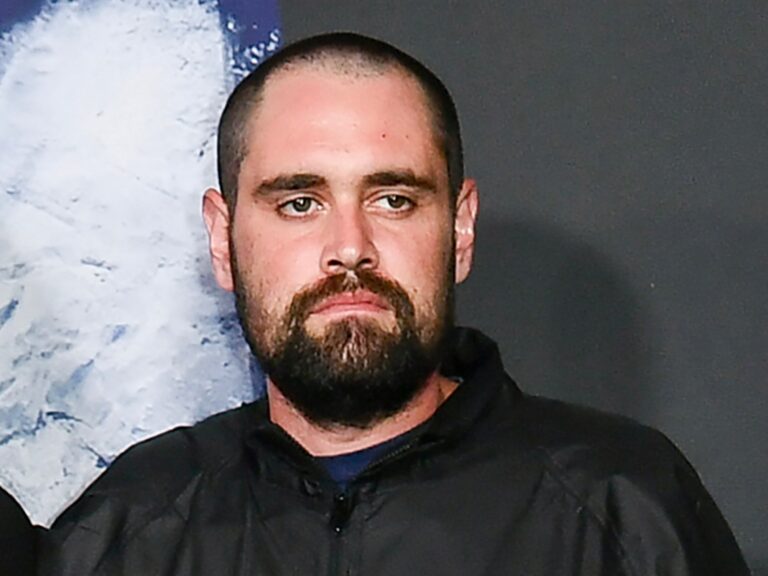

Sebastian WeisgrisVulnerable families have passed, said an economist and specialist in social inclusion and monitoring at UNICEF Argentina From 48% in 2024 to 31% this year. In conversation with Fontificia modeby Net TV and Radio profile (AM 1190) explained that although the lower sectors are showing recovery thanks to “stabilizing inflation” and improving unrecorded income, the middle sectors are “supporting consumption with debt.”

Sebastian Weisgrais is an economist and specialist in social inclusion and monitoring at UNICEF Argentina. He has been associated with UNICEF for more than a decade, where he plays a key role in monitoring and evaluating the situation of children and adolescents. He is an expert in analyzing the social situation of children in Argentina, using economic and social data to advocate for better public policies and greater protection for children and adolescents in the country.

UNICEF confirmed that child poverty has decreased in Argentina

Authoritarians don’t like this

The practice of professional and critical journalism is an essential pillar of democracy. This is why it bothers those who believe they are the bearers of the truth.

We consult with you on the report on poverty reduction measured by UNICEF as well as warnings that although poverty is falling, the middle class is poorer. There is always a debate about how to measure poverty and how to measure relative poverty.

In fact, at UNICEF we have conducted a series of surveys since 2020 to report on the economic context and income in families with boys and girls. This poll shows that it is consistent with the scenario that actually occurred last year Reducing poverty, mainly in sectors with the greatest vulnerability.

There may be three central statements. The first of them concerns A Improvement in the most vulnerable sectors. The indicator that we measure and that concerns us relates to families who cannot meet their current expenses, which are the basic expenses necessary to support a child. This data fell from 48% In 2024 31% In 2025. This is the lowest level since 2022. This has allowed more families to meet childhood expenses and regain access to basic consumption. Families who stopped buying food due to lack of money also improved: it decreased from 52% to 29%. It is a positive trend. Obviously, let’s think about it 30% of families with boys and girls restrict food consumption due to lack of money. There are still challenges.

The second question relates to these challenges that you mentioned regarding the middle sectors. The middle sectors are not affected in this way. The improvement in income is not felt and debts grow. Households with formal debts are on the rise 31%This is the highest level since 2020, and if informal loans from virtual or family wallets are added, this rises to 45%. This means that the lack of resources makes debt the middle class’s solution and increases the use of credit cards to buy food.

I lived in Brazil, and they used a word that caught my attention, which was “overlook.” It would be like people who cannot pay, in a society completely dependent on banks, unlike Argentina. Are we on the way to that, to the entire society being banked, either because even those who receive benefits for the poor do so through a banking system or virtual wallets, and finally this facilitates debt at the same time?

Yes. In terms of policy effectiveness, we are on this path. Both subsidies and transfers today are 100% remitted to banks. This allows, in a way, access to greater resources, such as loans. What actually happens is that it hits in a different way. It hits the most vulnerable sector in one way and the middle sectors in another. The basic problem we have is that there are three elements. on the one hand, There is an improvement in the income of the undocumented. These incomes increase much more than inflation. Income protection through Universal Child Allowance (AUH) Recently, priority has been given primarily to stabilizing inflation. When you have high levels of inflation, it erodes the incomes of those who cannot protect themselves or index their salaries. So, it hits the poorest families, but when the situation stabilizes, as it is now, the first to feel relief are those families. Reshaping fixed income, such as fixed income, improves the purchasing power of the most vulnerable sectors.

This does not happen in the middle sectors, that is, it does not reach the same extent. Transfers and subsidies cushion shocks, however The official salary is adjusted with a certain lag compared to the previous inflationThey are also families who pay rent, transportation, health and education. Expenditures do not directly benefit from compensatory programmes. So they support consumption with debt. Perhaps this is the key to explaining these two cases.

Less savings and leisure, more second brands: the new x-ray of the ‘middle class’ looking at itself

When you say that some indicators decreased “certain indicators decreased from 50% to 30%,” did they decrease compared to when?

We have conducted this survey from 2020 to the present. It ended in August 2025. However, I think you have to look at this trend.

And August 2023?

As it decreases. In August 2023, it was still at 33 or 34%, the lowest number since 2022. It seems to put us in a pre-pandemic situation.

Did he get back to normal before Miley?

In some indicators it decreased to before the following. There are some indicators that improve sooner.

This 33% is what I’ve had since 2020. 48% was produced by Milei.

The devaluation that led to poverty and caused eight million boys and girls to live in poverty, which was the highest peak, is after the devaluation in 2024. After this year, there is a recovery, and a recovery almost before the devaluation.

Therefore, the lower sectors regained the position before the depreciation of the Miley, and the middle sectors became poorer.

Yes, the middle sectors are the poorest. I mentioned a danger to you. Three factors explain this: stable inflation, which we hope will continue; The salary position, which does not occur in the same way between registered and unregistered, between formal and informal, is part of the basic information, which is discussed in the 2026 budget, which is Automatic transfer of universal child allowance.

Automatic mobility, which the executive authority is considering removing, That would cause increases to start being discretionary. So, even in the context of low inflation, keeping the anti-inflation rules updated in the previous month, as is in place, would allow the AU to continue fulfilling its raison d’être, which is to protect those who need it most. Hopefully, at some point it won’t be needed, but keep in mind that, If it were not for AUH, today we would have another million children living in poverty. The preventive ability of this policy is remarkable. Therefore, I believe that, under this scenario of fiscal consolidation, maintaining allocation mobility would be highly desirable.

TV/ff