The retail payments system has continued to see significant expansion and greater digitalization in recent months, with one piece of information standing out in the latest report from the Central Bank (BCRA): the continued growth of Purchases in dollars with a debit cardsomething the government enabled earlier this year to encourage that Bimonetarism. This happened mainly through the e-commerce channel.

The official survey analyzes the state and evolution of payment methods. The information covers November 2025 – and October for some segments – and confirms relevant changes in consumer habits and daily financial transactions.

As stated by the BCRA, “the month of analysis is November 2025, with the exception of withdrawals, credit cards, debit cards and transport cards whose information corresponds to October 2025 (latest available data)”, while the prepaid card data refers to September.

Remittances: Strong increase in shipments in pesos

In November the Send money in pesos through instant “push” transfers recorded year-on-year growth of 20.3% in quantities. They were counted in total 666.3 million transactions for $70.1 billionwhich implied an increase 20.3% in quantities and from 18.2% in real amounts compared to the same month last year. Furthermore, the 73% of the missions had a CVU as the origin and/or destinationreflecting the growing importance of digital wallets.

However, in foreign currency 1.8 million operationswith an increase over the previous year of 2.7%so overall $2,638.8 millionalbeit with a drop-in 14.2% year-on-year in the native currency.

On the side of Cash income in pesos (“pull”)they were completed 39.2 million transfers for $3.5 billionwhich represented a decline 3.4% in quantitiesbut an increase of 10.2% in real amounts in an interannual perspective.

QR payments: expanding interoperability

The Payments by bank transfer (PCT), interoperable via QR summed up 76.9 million operations in pesoswith a growth of 29.1% year-on-yearfrom $1.6 billionwhich meant an advance In real terms it is 37%.

The report details that the 98.4% of PCTs started with QR codesequivalent to 75.8 million payments (+35.9% year-on-year) from $1.6 billion (+45.8% year-on-year, real). Of the total is the 52.6% were made from sight accounts (CBU). and the 47.4% from payment accounts (CVU). In the case of companies, this is 57.8% of accreditations were made on payment accounts and **42.2% on sight accounts.

Currently there is 84 interoperable digital wallets and 61 PCT acceptors are registered with the BCRA. The operation started with random keys or tokens They only represented that 1.6%with 1.2 million paymentsa fall from 68.7% year-on-yearfrom $38.5 billion (-59.9% real).

Payment accounts and investment funds: weight still limited

In October of total 61.7 million payment accounts, 14.6 million had a balanceso overall $0.6 billion. In return the Balances invested in investment funds they reached the $5.6 billion. Together, both concepts represented this 6.3% of total private sector peso deposits. In parallel, the register of payment service providers currently exists 205 PSCP.

In November there was 11.3 million direct debitswith a drop 6.8% year-on-yearfrom $1.7 billion (-1.9% year-on-year, real). The Effectiveness rate was located in 45.1%.

As for them Checksthey compensated 4.7 million documents (physical and electronic) from $18.6 billion. He ECHEQ declared 60.1% of the quantities (2.8 million electronic checks) and the 82.5% of the amountsequivalent to $15.3 billion. The Rejections due to “insufficient funds” They represented the 2.2% in quantities and the 1.7% in amounts on the total compensation.

Cards: Loans exceed debit cards and dollar purchases increase

One of the most notable points of the report is the development of Cardswhere the The loan utilization once again exceeded the target load. In October the Debit cards registered 177 million transactions for $4.7 billionwith falls from 13.3% year-on-year in both volumes and real amounts.

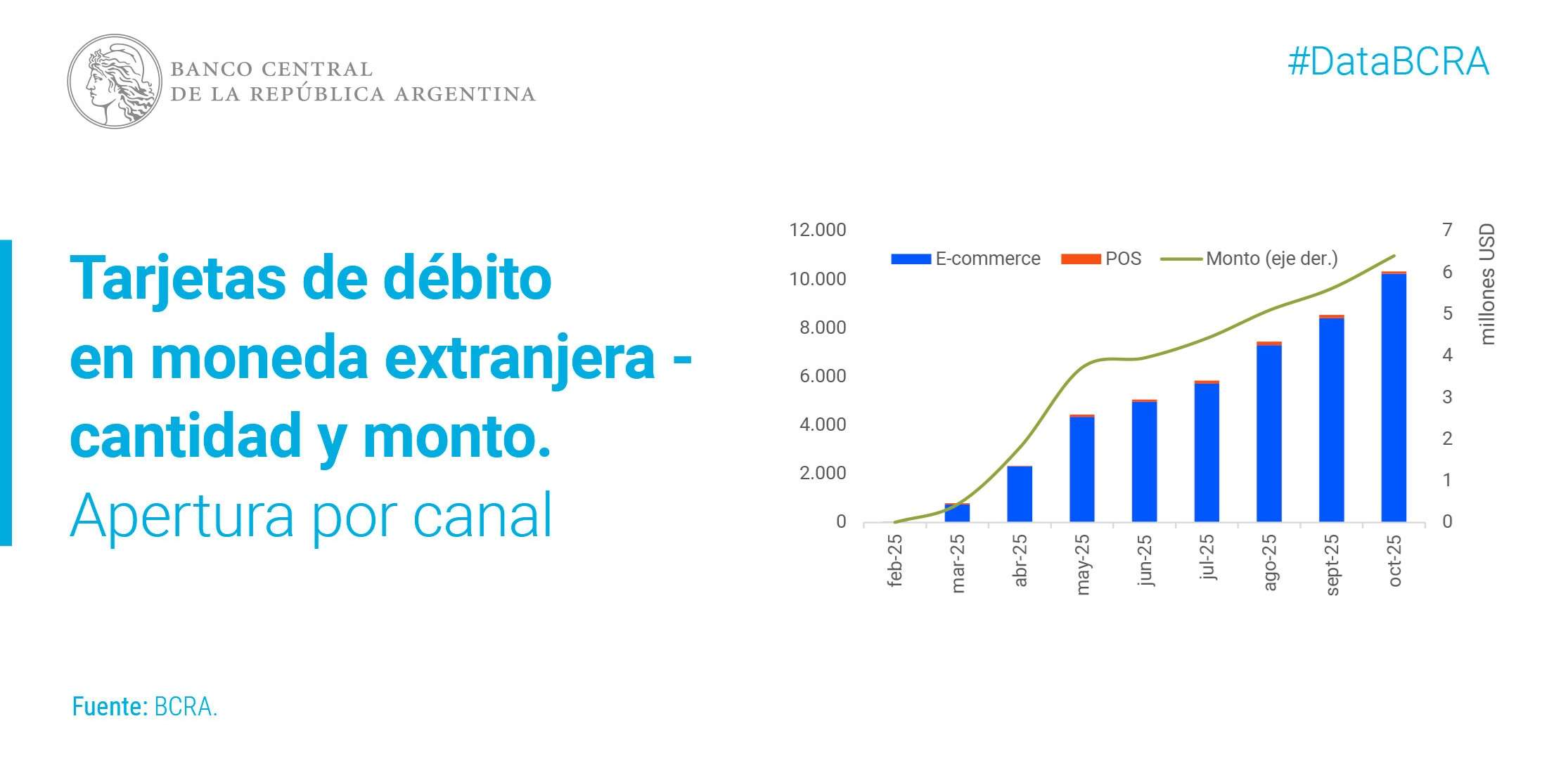

However, a different dynamic was observed in foreign currencies: in October 10.3 thousand transactions in dollars for $6.4 millionof which the 99% were transacted via e-commerce.

As a result, in the accumulated in-between February (start of operations) and October 2025were counted 44,810 operations in dollarsso overall $31.4 millionwhich confirms the sustained advance of this means of payment for consumption abroad or dollarization.

The evolution of dollar payments using debit cards, according to BCRA

In the case of Credit cardsYear-on-year increases were recorded 7.4% in quantities and from 1.8% in real amountswith 188.9 million payments for $10 billion. The main channels were POS and QRthe the concentrated 39.2%followed by E-commerce (37%) and automatic debit (14.2%). He Interoperable QR explained that 4.7% of the total of credit transactions, while the Modality of a payment represented the 90.7% of the quantities and the 73.8% of the amounts.

Transport, invoices and statements

There were such in transport in October 385.5 million trips with the SUBE cardwith a drop 3.7% year-on-yearfrom $0.17 billionalbeit with real growth of 23%. In November the Rides paid with QR they added 19.1 millionfrom $19.1 billion.

Regarding the Electronic MiPyME invoiceHe 85.7% of transactions were carried out in pesoswith 73.6 thousand bills entered into the open circulatory system, e.g $1.4 billion.

Finally, in relation to ExtractionsHe 89% were processed through ATMs. They signed up in October 49.8 million extractions in the 17,507 ATMs availablefrom $4.1 billionwith an average of 2,846 withdrawals per ATM and a average amount of 81.6 thousand US dollars. To this they added 3.7 million non-bank withdrawals using debit cards from $0.2 billion (average 60.4 thousand US dollars) and 2.2 million from PSPCP intrapayment accounts from $0.1 billionwith an average of 55.7 thousand US dollars.