THE PepsiCo Inc. reached an agreement with the activist investor Elliott Investment Management has reduce its product line in the United States by 20% and lower prices, in addition to reducing its workforce. The moves represent an early agreement with Elliott, as the maker of Mountain Dew and Doritos seeks to revive growth and win back investors.

Elliott amassed a roughly $4 billion stake earlier this year and has demanded changes, citing an overly complex brand portfolio and a declining share of the beverage market.

The company also provided an updated outlook for next year.forecasting organic revenue growth of 2% to 4% in fiscal 2026, compared to the average analyst estimate of nearly 2.7%. Organic growth, a key metric for investors, excludes things like acquisitions and currency volatility.

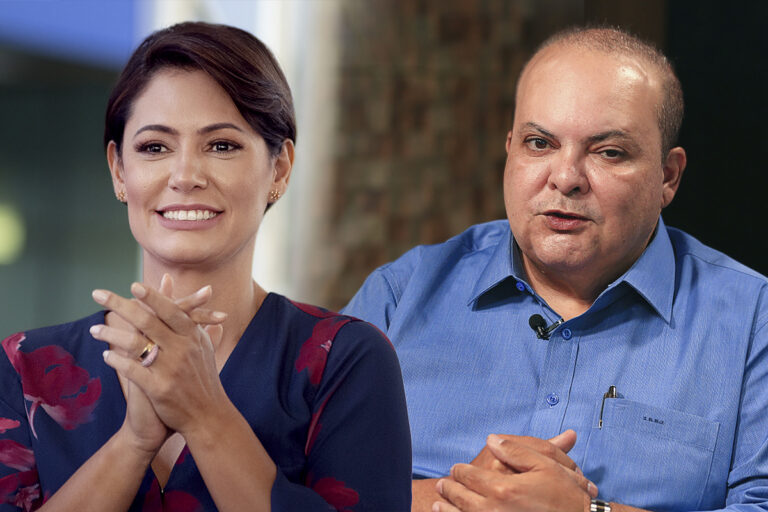

“The message you have to take away from this case is that we are not continuing with business as usual,” he said. Steve Schmitt, CFO of PepsiCo, during a conference call with analysts this Tuesday (9).

PepsiCo shares changed little this Tuesday at 11:32 a.m. in New York. Shares have accumulated a 4.2% decline over the year through Monday’s close, compared to the 16% rise in S&P 500 Index.

THE the executive director of PepsiCo, Ramon Laguarta, declared that the company plans to use savings generated from increased productivity to reduce prices of its main brandswhich he believes should translate into higher sales volumes.

“We have the opportunity to reinvest in value in a more substantial way,” Laguarta told analysts, noting that PepsiCo had already tested lower prices. “That gives us great confidence that the volume will come.”

Laguarta reiterated the company’s plans to launch new products with more fiber and protein, as well as those that eliminate artificial ingredients and reduce sugar levels. Analysts said some fundamental pillars of PepsiCo’s strategy were already defined before Elliott’s involvement in the company.

“Our impression is that Elliott’s involvement created a greater sense of urgency for the company to implement its strategy, but the strategy did not change in a revolutionary way,” the analyst wrote. Robert Moscow, of the TD Cowenin a note.

Marc Steinberg, partner at Elliottsaid the plan “will result in greater revenue and profit growth,” according to a PepsiCo release. He added that Elliott will continue to collaborate with PepsiCo.

Employees ordered to stay at home

On another frontPepsiCo asked employees in several North American offices, including its headquarters in Purchase, New York, as well as Chicago and Plano, Texas, to work remotely this week. In recent years, companies have frequently asked employees to work from home ahead of layoff announcements.

“We will be making structural changes to our business that will affect certain business functions,” he said. Jennifer Wells, Director of Human Resources North Americain a message to employees on Sunday, which was seen by Bloomberg News.

Laguarta said the company is taking steps to reduce costs, improve productivity and modernize its production line, so it can invest in other areas of the business. PepsiCo executives had already discussed “staffing adequacy” – a common corporate euphemism for layoffs – before the company hired Elliott.

In November, PepsiCo announced the closure of Frito-Lay facilities in Orlando, Florida, leading to the dismissal of more than 450 people. At the time, the company said the layoffs were “driven by business needs.”

PepsiCo did not specify which products it would stop selling. Laguarta said the company saw “sequential improvement in Frito-Lay North America throughout the year.”

Laguarta told analysts that PepsiCo was not considering a “complete restructuring” of its North American beverage operations, “as we do not believe this will improve market performance or maximize shareholder value.” He said the company is testing a model in which it would further integrate its food and beverage lines into Texas and take a “differentiated approach” when analyzing the market across the country.

Elliott had urged PepsiCo to review its current system, in which it uses a network of independent bottlers but also operates numerous bottling companies of its own.

Lay’s Potato Chips, Doritos and Cheetos

In the months since Elliott’s stake was announced, Laguarta said the company has moved quickly to update its portfolio and reduce costs. The company reformulated the Lay’s range of chipsnotably by reformulating barbecue flavors to replace artificial colors with natural colors. Laguarta also launched a new range of Doritos and Cheetos without synthetic colors and announced it would expand its options with more protein and fiber.

The deal did not guarantee Elliott a seat on PepsiCo’s board, but Steinberg said Elliott welcomed PepsiCo’s “commitment to board renewal.” In November, Schmitt, a former executive at Walmart Inc., joined PepsiCo as CFO, replacing Jamie Caulfieldwho retired.