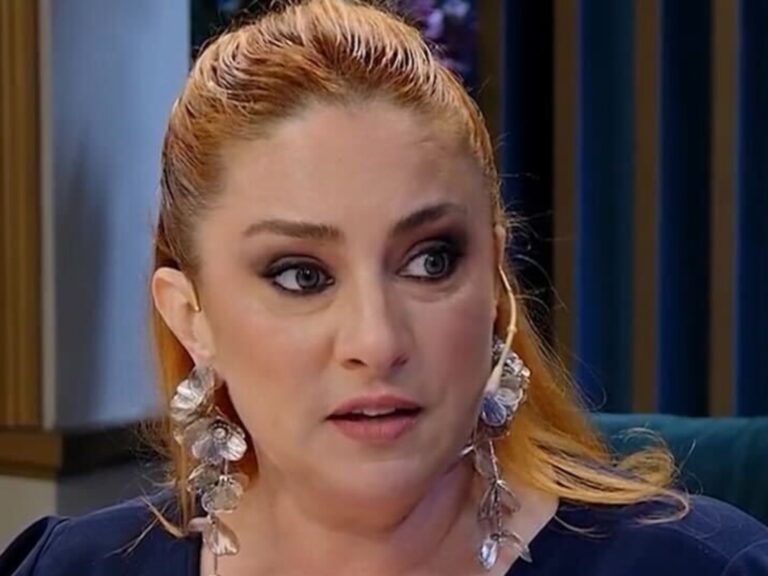

33% of young Argentines choose networks or content creators as a source to learn about money on social networks. According to the report “The value of learning”, produced by Santander together with IPSOS, 86% say they did not receive financial education at school. They surveyed people between the ages of 16 and 24 in ten countries around the world, including Argentina.

The study, conducted in Europe and America and based on 20,000 consultations, also shows that only 20% of adults have ever taken a formal financial education course, despite 95% recognizing its benefits.

In the country, 91% of the population believes that schools and parents should ensure financial education, but almost 30% use social networks to learn about money. In Argentina, this number doubles compared to older people, as young people are better informed but are also more at risk: seven out of ten have been victims of attempted digital scams and almost one in four have actually fallen into online scams.

In Argentina, almost 86% of respondents answered that they had no financial education in school, which is one of the highest levels in the study compared to other countries in the world. But 84% of those who haven’t taken a finance course say they wish they had.

The study uncovers a global paradox: 61% of people claim to be financially literate, but only 11% feel truly informed. When measuring fundamental concepts, the gap between perception and reality becomes clear: in Argentina, only 27% correctly answered a question about inflation.

95% of respondents recognize the benefits of financial education: 64% believe it helps them make better decisions, 59% believe it helps them better manage money and debt, and 40% believe it reduces financial stress. But the hurdles remain: 44% cite costs and 31% lack of time as the main reasons for foregoing training.