- What does the investment in Gualcamayo included in the RIGI look like?

Almost a year after presenting its proposal to join the Large Investment Incentive Regime (RIGI) Minas Argentinas has received approval for its $665 million Deep Carbonates project at the Gualcamayo minefrom San Juan.

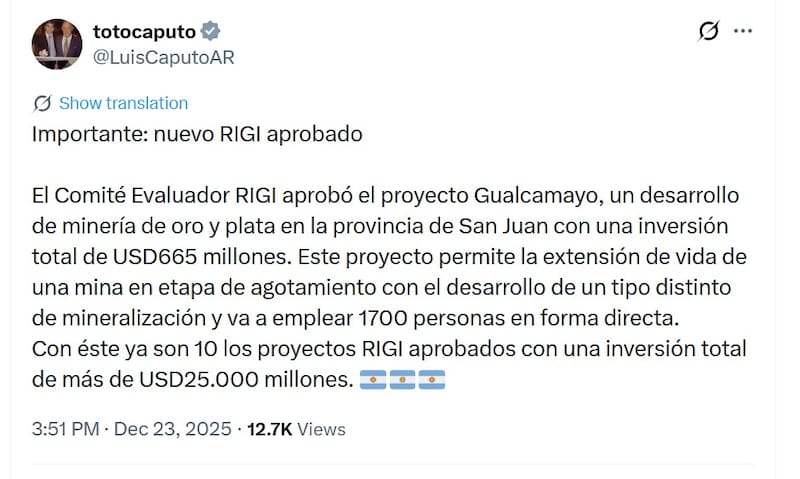

It was the Minister of Economy Luis Caputo who made the announcement on his social networks, adding to the specific dates of the project that this authorization “allows the extension of the life of a mine in the exhaustion phase with the development of a different type of mineralization.” will directly employ 1,700 people. This means that ten RIGI projects with a total investment of more than $25 billion have now been approved.”

Out of Minas Argentinas, a company of the Aisa GroupIt was explained in detail that the National Government Assessment Committee had issued one positive statement for the Deep Carbonates Project (DCP) presented under the RIGI, a step before the publication of the resolution corresponding to the ambitious project that will transform the Gualcamayo mine “into a productive center with a forecast of at least three decades”.

Like all projects that have managed to be included in the RIGI, the company considers it to be an important milestone for Argentine mining “by providing regulatory predictability and legal certainty for large-scale investments.”

What does the investment in Gualcamayo included in the RIGI look like?

The approved plan provides for an investment of more than $660 millionOf this, $50 million will be allocated to geological exploration.

The central axis of the project is the development and exploitation of the Deep Carbonates Project (DCP), a deposit that currently contains: more than 3.5 million ounces of gold in resourcescertified to the NI 43-101 standard and the JORC Code, of which 2.45 million ounces are already categorized as reserves.

The Gualcamayo mining district contains a total of more than 5 million ounces of gold resourcesof which 3.2 million are in the category of proven and probable reserves, according to the latest report under international certification dated April 2025.

The Company is currently preparing an updated report on its mining resources and reserves 20% increase expected compared to the previous report.

In parallel, Minas Argentinas is promoting a short- and long-term district exploration program. At the moment, Only about 4% of the property has been explored in depthThis shows that a significant portion of Gualcamayo’s geological potential remains to be discovered.

The aim is to promote a comprehensive understanding of the district, expand the resource base and lay the foundation for several decades of mining development, with a technical, responsible and long-term perspective.

Pre-feasibility studies are already advanced. Work on the technical and technical feasibility of the project will begin immediately. As far as the impact on the world of work is concerned, it is expected that gradually the construction phase, expected at the end of 2027create between 1,000 and 1,500 jobs. With the start of production, which is planned for the end of 2029, around 600 permanent direct jobs will be consolidated.

The project includes the Development of a state-of-the-art underground minea new processing plant and essentially the incorporation of a pressure oxidation plant (POX) with modern technology that allows the processing of complex minerals, releasing the gold contained in the mineral and enabling efficient extraction.

This POX facility will be one of the first in South America one of the few systems of this type in operation worldwide.

In addition, the plan provides Construction of a 50 MW photovoltaic park to cover the company’s electricity needs.

Gualcamayo was in the closure phase just two years ago. Since Aisa Group’s inception in 2023, the Company has continued operations, settled debts with suppliers, made progress in recategorizing resources and reserves, and reactivated exploration work that today supports a long-term development plan.

Juan José Retamero, owner of Aisa Groupnoted: “The incorporation of the PCP into the RIGI underlines the true dimension of this investment. The axis of the project is the construction of a pressure oxidation plant, a highly complex technology that allows the processing of refractory minerals and will be one of the few plants of this type in the world and the first of its kind in South America.”

And he added: “The project includes a strong component of training and qualification of Argentine professionals and technicians who must operate, maintain and optimize industrial processes at the highest level. This specialized human capital is a strategic asset for the country and one of the most important impacts of the RIGI.”

The Gualcamayo mine has accomplished a lot throughout its history Contributions of more than $33 million to the trust fund for Jáchalin addition to $66 million in royalties.