The Customs Collection and Inspection Authority (ARCA) shocked the football world by filing a damning criminal complaint against the Argentine Football Association (AFA). The accusation is compelling: the alleged one Embezzlement of taxes in the amount of $7,593,903,512.23.

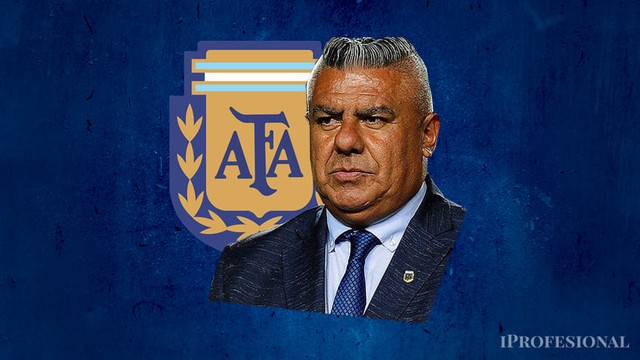

The financial committee is aimed directly at the highest authority of national football, chaired by Claudio “Chiqui” Tapia. According to the complaint The AFA withheld taxes and pension contributions the corresponding tax periods August and September 2025in addition to the pension contributions of December 2024 to September 2025.

The gravity of the case lies in one crucial detail: These funds were never deposited within the statutory thirty day period. This omission shapes the crimes found in the crime Articles 4 and 7, second paragraph of the penal tax regime of law 27.430.

The file that complicates the AFA

The letter is signed by Vanina Mariel VidalInterim Head of the Criminal Division of the ARCA Legal Department. The lawyers Matías Alejo Gentile Brezigar and Felicitas Achábal sponsored the legal lecture.

The complaint is precise in its figures. As a withholding agent, the AFA has failed to deposit into the treasury amounts well in excess of the threshold $100,000 monthly determined by criminal tax law regulations.

As of: December 10, 2025, Tax withholdings remained unpaid. However, at this time, those who correspond to social security were registered outside the legal deadline.

The numbers that endanger the fabric of football

The The large tax collection department provided devastating information. The total amount of unpaid tax withholdings in total $916,005,301.41.

This number is spread across several tax concepts. Including VAT, income tax and profits Article 79, all corresponding to the months August and September 2025.

But there is more. Withholdings of social security contributions that are withheld and paid after the statutory deadline have expired will increase $6,677,898,210.82. This amount covers the period between December 2024 and September 2025.

In this way, the penalty amount amounts to: $7,593,903,512.23 claimed by the tax office.

Claudio “Chiqui” Tapia at the center of the storm

The complaint becomes the focus of events Claudio “Chiqui” TapiaPresident of the AFA. His responsibility arises from his capacity as the company’s withholding tax agent and tax key administrator.

ARCA emphasizes that the AFA is registered as a civic association that “NCP Association Services”. A relevant fact: has no criminal record in the DGI criminal case monitoring system.

ARCA’s legal analysis is compelling. The reported behavior fits perfectly with the criminal offense of tax embezzlement. and social security resources.

ARCA prosecutors rely on solid precedent. You cite the case “Lambruschi” of the nation’s Supreme Courtwhich defines this crime as immediate bypass.

According to this doctrine, the crime is completed at the precise moment when bail should have been made. There are no gray areas: either the deposit is made on time or the crime is committed.

The text is categorical on one crucial point. The withheld funds “They do not represent own funds” which the company can freely dispose of to fulfill other obligations.

The delay in the deposit implies a improper financing on the part of the taxpayer. It’s other people’s money being used as if it were your own.

The fraud that complicates the panorama

ARCA argues that the subjective element of the offense is present. The fraud arose because AFA was fully aware of its status as a withholding agent and its obligation to deposit the funds.

Criminal liability lies with those who made the decision not to comply with tax obligations. The case law is clear: “Tax violations are only possible if the violations are identified by the bodies whose will represents the will of the company.”.

In terms of jurisdiction, the case corresponds to the National Economic Criminal Justice. The tax seat of AFA is the Autonomous City of Buenos Aires determines this place of jurisdiction.

The complaint ends with a consideration of the broader implications of the case. The behavior attributed to the AFA endangers the financial activities of the state.

The reasoning is straightforward: public spending depends on tax collection. If a company of AFA’s size intentionally avoids these obligations, has a big impact on the budget are necessary to fulfill the essential tasks of the state.

This tax scandal sets a precedent in the world of Argentine sports. The AFA, the highest authority in national football, is now facing criminal charges for tax embezzlement of more than $100,000 7,500 million pesos, with Claudio Tapia as the main person responsible of this multi-million dollar tax evasion.