The foreign exchange market made its verdict the day after the central bank’s measures on the foreign exchange bands: the result was that the The price of the dollar rose this Tuesday by up to 1% in all segments. And also had an impact on future agreed operations for the exchange rate that takes new values into account.

In particular the price of The official retail dollar rose by 15 pesos for sale at Banco Nación, for sale at $1,480. Therefore, it only increases by 0.3% for the whole of December and by around 41% for the whole of 2025.

Now it is The Member of the European Parliament advanced 20 pesos this Tuesday and since the measure was announced on Monday, it increased by a total of 50 pesos to position itself in the $1,500 this Tuesday. Therefore, it increases by 1.6% per month and by 28% for the entire year. A similar cue occurred for blue.

It is recalled that the BCRA announced last Monday that from the first day of 2026 the The dollar’s fluctuating bands will initially stop moving at 1% per month adjusted for inflation two months ago (t-2), that is, in this case to the rhythm of the 2.5% CPI that occurred in Novemberaccording to INDEC.

The aim of this measure is to ensure that the variables of the economy move at the same pace and that there is no delay in the exchange rate. Therefore, the dollar is no longer the “anchor” of prices. In addition, the government announced that it would begin purchasing reserves and lowering banks’ reserve requirements..

In summary: heto the floating band, which is the area where the central bank does not intervene in the market, and that It currently sits between a cap of $1,519 and a floor of $921, will begin updating next month due to inflation.

Thus By the end of January, the band cap could rise to $1,564. with this new scheme beginning.

and for February The inflation measured this December would be applied, which according to the Survey of market expectations (REM), created by the BCRA itself among around 40 economists, a 2.1% consensus.

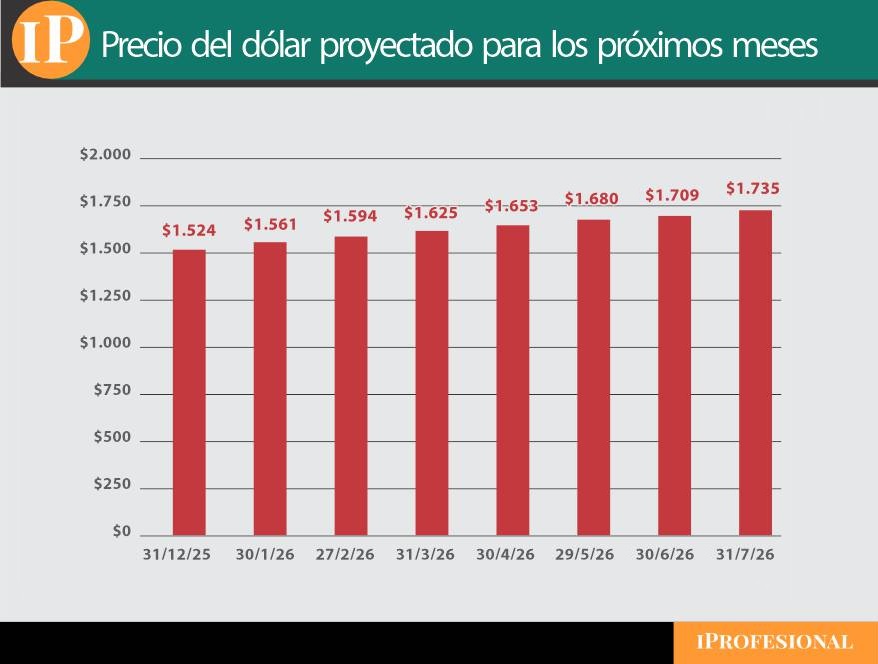

The “maximum price” the dollar will have in the coming months

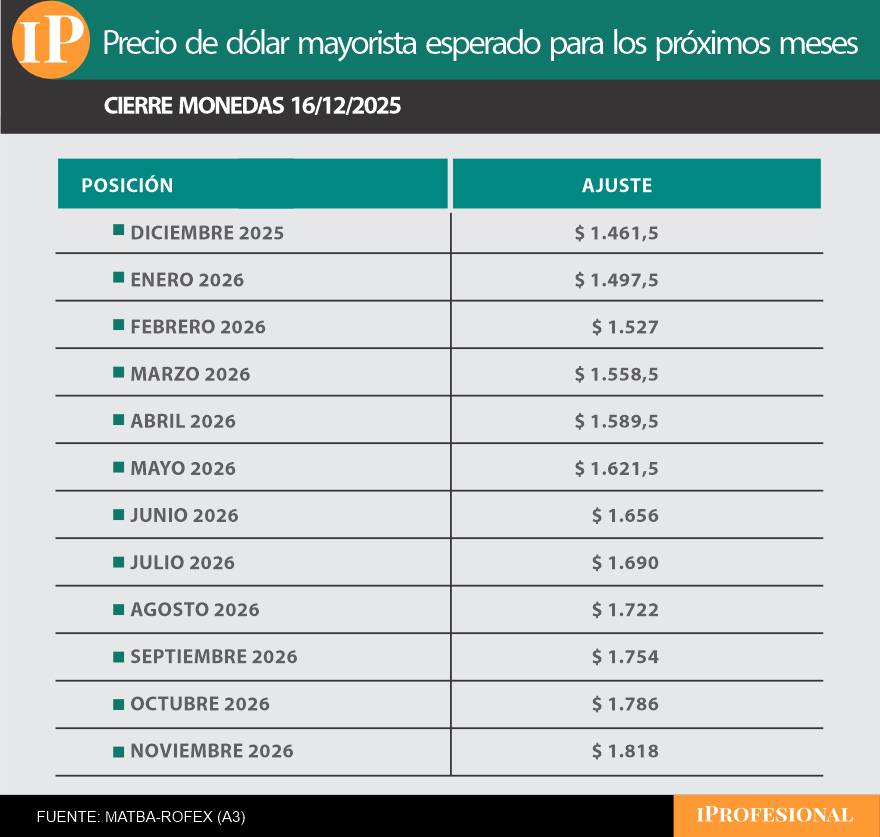

The dollar price agreed upon by investors in the futures market

Government announcements and the movement of Upward adjustment of the foreign exchange market They also affected the negotiated wholesale prices in dollars for the next few months.

It should be remembered that the New measures were announced by the central bank on Monday after the closure of foreign exchange marketsTherefore, the focus this Tuesday was on the operators’ reaction.

So, For Matba-Rofex (A3) futures and options, an exchange rate of $1,461.5 was negotiated at the end of December, an increase of 12 pesos compared to Monday’s trading session. Therefore, an increase of 0.7% is expected for the entire month..

For the The increases were repeated in the following months: for ends January The wholesale dollar is expected to be $1,497.5, an increase of 13.5 pesos compared to the previous day and a value that would be well below the new ceiling of the floating band, which with the inflation adjustment would be around $1,564.

In the meantime, At the end of February the price was 1,527 US dollars. an increase of 14.5 pesos compared to Monday.

And for the last period considered by the futures, namely November 2026, a wholesale exchange rate of $1,818 was traded this Tuesday for the end of the month, an increase of 29 pesos compared to the value traded on Monday.

Wholesale price in dollars expected by the market for the coming months.

In it Survey of market expectations (REM)a survey conducted by the central bank among around 40 economists is expected In December, the wholesale dollar reached $1,472.9while until the end of 2026, The forecasts of the economists surveyed by the BCRA position the US banknote in $1,720.

Another reference is the World Report FocusEconomicswhere more than 40 economists from domestic and foreign banks and consulting companies are interviewed where the wholesale price is forecast In December 2026, they agreed on a consensus that will reach $1,746. A figure that represents a decrease of 28 pesos compared to what was expected in the previous report for the same day.

Dollar price, according to economists

Before the central bank’s announcements last Monday, too Avoid a major exchange rate delay and be able to buy reservesSeveral economists had warned and hoped that the government would take measures to prevent the exchange rate differential from widening relative to inflation.

“I believe the government is taking action Make the economic program sustainable in the medium and long term. At the same time, it takes note of the criticism and the market’s wishes to validate new price levels. “As soon as the statement came out, the entire market reacted, bonds, stocks and the dollar rose,” he summarizes. Nahuel BernuesCFA, financial advisor and founder of Quaestus Consulting.

Additionally, Isaiah MariniEconomist at ONE618 (formerly Fondo Consultatio), believes that the New measures “prevent the band cap from being upgraded.” and in fact they would allow devaluation if the disinflation path resumes, provided that the adjustment is based on inflation from two months ago.”

In this sense it is Economists predict inflation will be between 20% and 25% next year.. According to economists, the real dollar could be “slightly higher” than the consumer price index in 2026.

“Declining inflation and interest rates as well as rising market confidence will boost the economy, although much will depend on the extent to which Milei can push through structural reforms. Success in this area could boost growth, while failure could trigger a new run on the peso.”warn the analysts surveyed by FocusEconomics.-