The payment of the second part of the additional annual salary (SAC) or half a Christmas bonus in December 2025 brings with it some important changes compared to the same period last year.

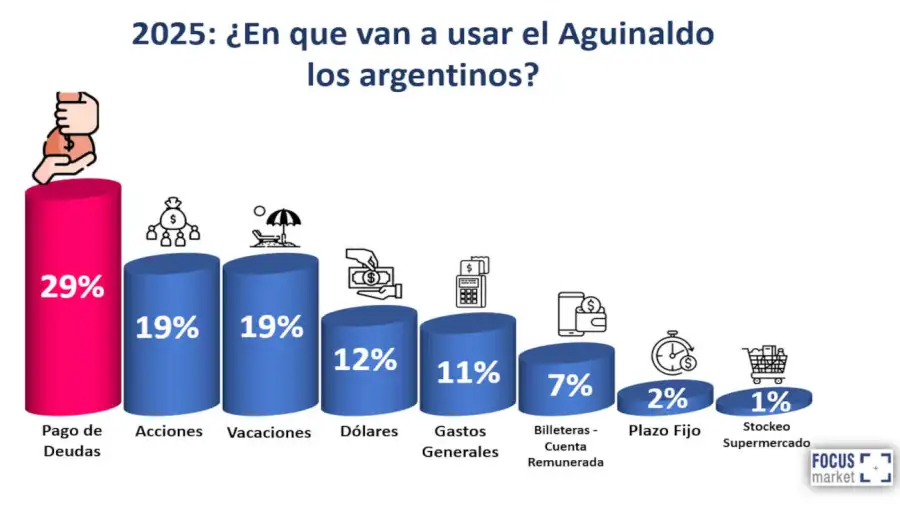

The trend has changed “conservative and defensive,” loudly Study of Focus market carried out in 3,875 cases. The data shows a sharp shift from spending on leisure and investments to meeting basic needs and paying off debt.

The report assumes that there are 10,051,200 people in the conditions to receive this benefit (according to SIPA data), distributed between the private sector (6.2 million), the public sector (3.4 million) and private households (440,900). However, for the vast majority, the intended use of these funds is already at risk.

According to UBA, the purchasing power of the minimum wage fell by 35% in the Milei era

Debt settlement

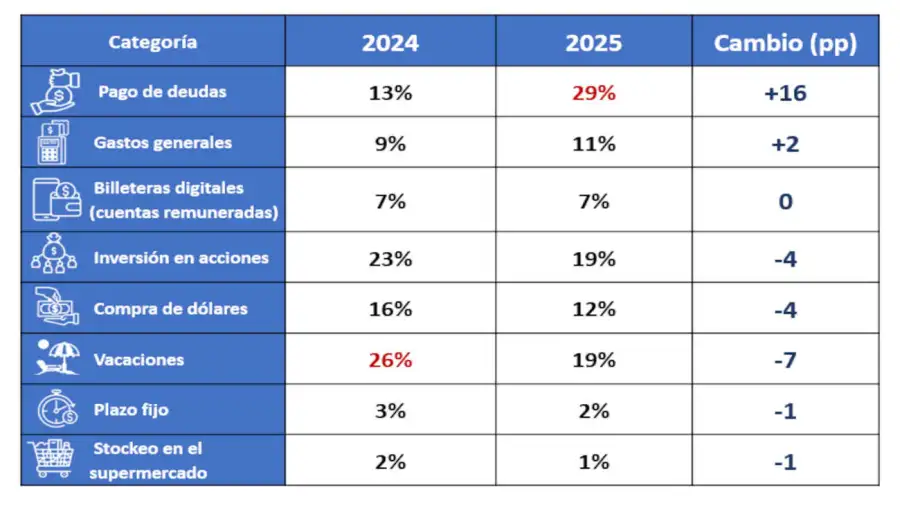

The study’s most revealing data is the jump in priority Debt settlementwhat happened from 13% to 29%. If the increase in general expenditure is added, the overall increase in the use of funds for commitments is 18 percentage points.

“The increase in debt repayment from 13% to 29% is the most telling date in the survey: The bonus was no longer an “extra” and became a patch which many middle class families will use to close out the month,” he explained Damian Di PaceDirector of Focus Market.

This behavior is a response to a scenario in which real wages do not fully recover, although the macroeconomy shows signs of order. Credit cards, according to the analyst, continue to be the “oxygen” of homesand the bonus is relieving that pressure.

Less vacation and lower investments

The downside of paying off debt is the decline in enjoyable consumption and financial investments. In the vacation area, the intention to allocate the bonus to tourism failed 26% to 19%. This indicates economic uncertainty or shorter work breaks.

Aside from that, Investments in the stock market also fell from 23% to 19%This reflects a preference for liquidity or safer assets in the face of volatility.

The end of the “occupation”

The survey highlights an interesting phenomenon related to macroeconomic stability: people are no longer running to the supermarket to stock up on goods. He Supermarket inventories fell to 1%while dollar buying fell from 16% to 12%.

Di Pace analyzes this behavior as a sign of normalization: “People no longer feel the need to run to the supermarket to stock up. before prices rise or block pesos for 30 days because real interest rates are negative. “It is the first bonus in years in which expected inflation has been below the interest rate.”

In this sense it is fixed deadlines You can hardly believe it 2% the intention of use and the digital wallets Stay stable in a 7%. Low inflation expectations and a dovish dollar reduce the urgency to seek refuge in foreign currencies or physical goods.

The report concludes that despite macroeconomic improvements, purchasing power faces ongoing challenges. The trend is consistent with INDEC data mentioned in the report, which indicates that in 2025 the 37.4% of families had to use savings for daily expenses.

LM CP