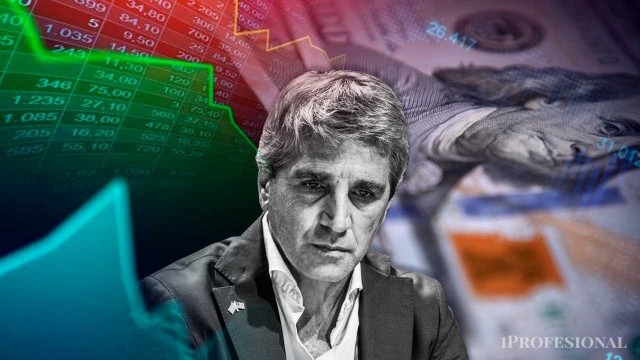

The Minister Luis Caputo taken a further step towards “normalization” of the market. Although the result of the Bonar 2029 tender caused some criticism due to the expectations raised in the previous hours, the city’s heavyweights are celebrating the first issue of a government bond in dollars in almost eight years: beyond the amount and the rate, this is a sign that they are “gradually” rolling out the maturities in foreign currency, as all “normal” countries do.

It is not only seen as an impetus for an early return international debt market, with the granting of foreign legal titles and longer terms and volumes, but it can also be part of the chain that ultimately leads to the transaction Release of controls on the foreign exchange market already those Capital movementswhose main victims continue to be companies, not so much individuals.

In addition, the rate of 9.26% at which the new Bonar 2029 The product that came to market performed slightly above expectations, in any case they celebrate that it underperformed its peers. The same applies to the amount: in the previous hours there had been speculation with higher numbers, but the $1,000 million raised was within the range of Caputo’s expected target and is considered a good number for a test of the market.

Key path to finally disarming the dollar trap

Leonardo Chialva, partner at Delphos Investment, already confirms this iProfessional that, as in football, this first broadcast was just a warm-up exercise for the start of the game: the game, played with titles of foreign legislation, would take place in the first two months of next year. To do this, the government must first obtain budget approval in Congress and approval from lawmakers to proceed with placing foreign debt.

According to Chialva, the government must move on Internships in New York to guarantee the conversion of debt into dollars and then to lift restrictions on the foreign exchange market and capital movements. The premise is not to reverse the order “so that it doesn’t end up like Macri.” The risk is that a possible upheaval like in 2018 triggers the departure of major players and destroys everything else with market freedom.

Outlier director Gabriel Caamaño previously stands out iProfessional What usually happens in Argentina is the opposite: first they release controls and then they go out to raise dollars on international markets. At least that’s what happened with Carlos Menem in the 90s and with Mauricio Macri in 2016. But now Javier Milei is “trying something different”: You need to proceed with debt restructuring before you finish lifting market restrictions.

Caamaño estimates that the exit from the international debt market will begin with the issuance of Global titleswill take place in the first half of next year. But it will depend on the decision of Caputo, which could continue to raise funds through placements like this or “REPO” operations until the controls are completely eliminated. In addition, he emphasizes, it will depend on how the external front develops, which usually influences decisions.

Currently, From January 1, 2026, a new section of exchange controls will be published This still affects companies: Multinational corporations can once again transfer their profits abroad without restrictions. This is flexibility that the government expected in April when it unveiled the exchange rate band system, lifted restrictions on individuals and announced the agreement with the IMF. Key point: There will be no BCRA regulations, but the validity of the ban will simply expire and the monetary authority will not introduce new restrictions.

At that time, the executive had distinguished two debt universes for the decline in profits: the shares accumulated by the end of 2024 and the profit flow generated in 2025. In the first case, the central bank offered the Bopreal, a dollar bond that met with little acceptance. On the other hand, 2025 profits can be automatically transferred abroad after the current ban expires, without the need for a new BCRA rule.

The possible impact on reserves is controversial in the market. Consultants who work with multinational companies believe that amount would not be significant relative to savers’ monthly dollar demand, which saw a slowdown in November for the first time since restrictions on people were lifted. In any case, the disarmament of stocks will not be complete: The restriction on the purchase of foreign currency by companies for hoarding purposes remains in place. The end of this measure will depend on whether the government manages to raise more dollars.

Test passed, with local investors at the helm

Chialva estimates that the participants in the tender were mainly local investors (positively from his point of view). He reiterates that there is a “battle” with foreign funds that want to finance Argentina, but at a higher interest rate than Caputo’s team is willing to accept. Classic fight, nothing more and nothing less. However, he believes that the country’s macroeconomic order and Trump’s support for Milei could force them to lend at lower interest rates.

Pedro Siaba Serrate, PPI research director, stands out earlier iProfessional that local investors who would have led the tender have little incentive to rotate. For this reason, he believes they will likely keep the new Bonar 2029 in their portfolio, at least in the short term, without rotation or aggressive negotiations. In addition, there is no chance that the return will quickly approach the Bonares curve and be over 10% on average.

Caamaño maintains that the result of the call is positive, even if the cutoff rate is slightly higher than the minister expected, namely less than 9%. He considers this because of the signal that Caputo wanted and was able to send to investors: a progressive progress towards “Normalization”. In this case it is an attempt to return to the international voluntary debt market, but without first dismantling the remaining layers of the exchange rate.

Accordingly Javier TimermanAdcap partner, the market “opens up little by little and closes suddenly.” For this reason, starting work on small issues like this at more “comfortable” interest rates for investors is the only way Build trusta process that takes a while. On social media, he distinguished himself from critics of the tender’s outcome, who argued that the cut-off rate was higher than what local companies and provinces had spent on debt in recent weeks, namely less than 9%.