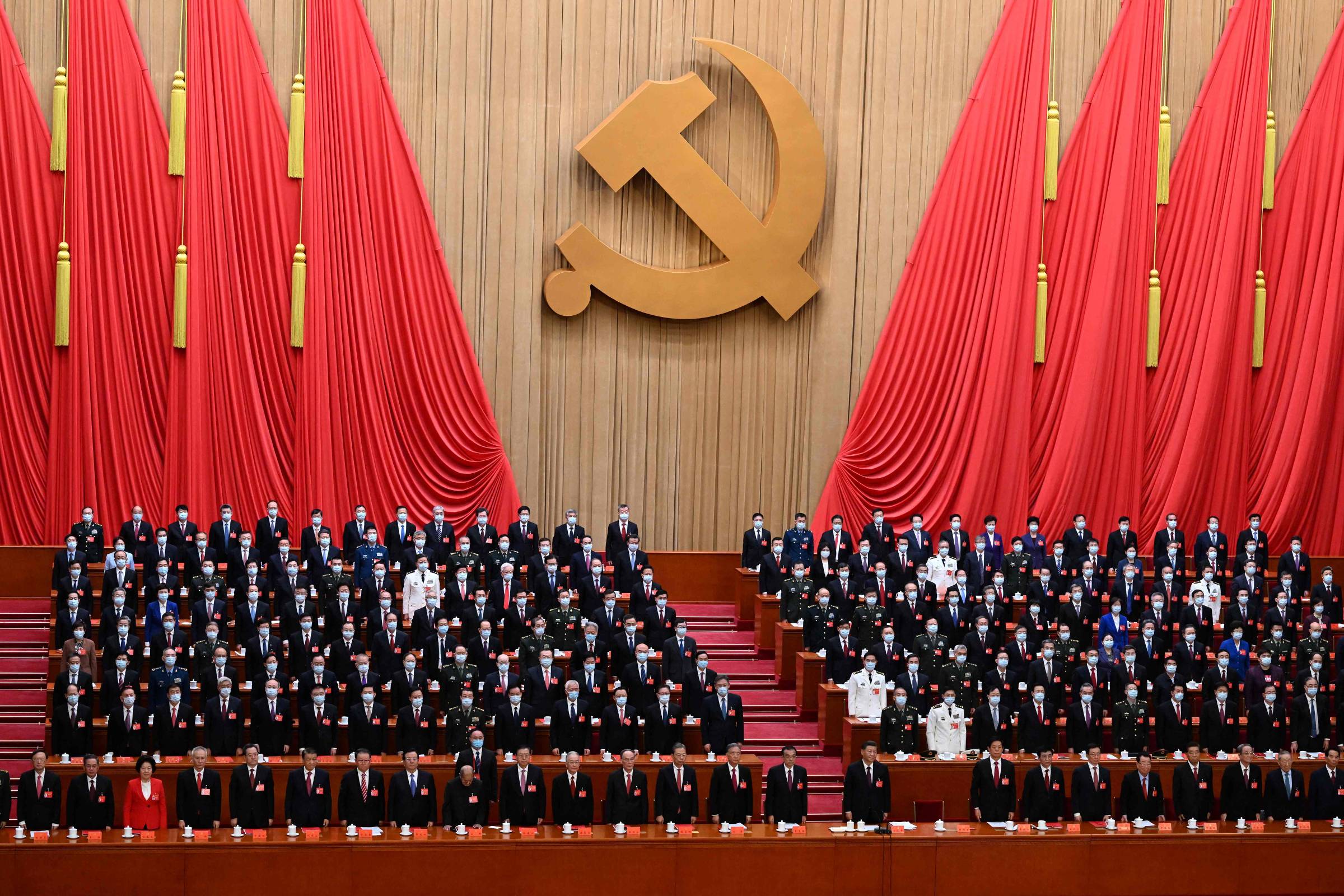

Last week, I argued in this space that 2026 is likely to consolidate a systemic Sino-US rivalry. The time has therefore come to discuss China’s domestic scenario, an aspect of analyzes of the current situation generally ignored due to the opacity of the political system.

If all goes as planned, 2026 will be the silent year that will pave the way for a much more explosive 2027. This is when the 15th Five-Year Plan (2026-2030) will come into force, whose results and responses to the problems of economic and political cohesion will be fundamental on the path that will lead us to the 21st Congress of the Communist Party in 2027 – when the mandates of all senior officials will be renewed, including that of the party’s general secretary.

This will be the time when provincial leaders will seek to stand out, implementing the directives decided in Beijing and eager to publish exultant figures in search of having something to show in the fierce competition for prestigious positions in the party hierarchy. The central question is how to achieve this at a time when Xi Jinping appears increasingly willing to accept structural economic limitations previously seen as transitory.

Within the system, these limitations are already widely recognized. In November, for example, industrial production rose almost 5%, while retail sales rose just over 1%. The dissociation between supply and consumption is no longer cyclical and has become a recurring element in economic activity reports. It should be noted that household confidence remains contained and that growth depends more and more on public investments and exports.

The management of the housing crisis makes this logic even more obvious. Gone are the days when cases like the defaults of billionaire developer Evergrande, considered for many years too big to fail, left Beijing’s policymakers with their hair on end. Little by little, society understood that the problem was not going to disappear out of nowhere and that it was no longer treated as an exception.

Local governments are now launching targeted credit programs and stock purchases from these near-bankrupt companies, no longer to revive the market, but to prevent buyer protests and avoid a fiscal collapse. The emphasis is no longer placed on reactivating an exhausted economic engine, but on controlling the social risks linked to its slowdown.

There is also no sign of a shift towards consumption. The leadership opposes reforms aimed at increasing disposable income or strengthening the welfare state (measures internally seen as fiscally risky and politically demobilizing), especially at a time when the party seeks to avoid the formation of new social expectations.

Instead, the core of the strategy remains investment in so-called “new productive forces,” jargon that is repeated exhaustively in the five-year plan and which highlights a redoubled emphasis on semiconductors, biotechnology, energy production and transmission, artificial intelligence and advanced manufacturing.

Next year, the challenge is therefore not to restore dynamism, but to maintain control in an unfavorable international environment and with increasingly narrow domestic margins.

The model may guarantee short-term stability, but how the party manages the cost – with political centralization, low consumption and targeted growth reducing the capacity to adapt precisely when internal pressures build – will set the tone for the sensitivity of these changes.

PRESENT LINK: Did you like this text? Subscribers can access seven free accesses from any link per day. Just click on the blue F below.