There is complete agreement on that number Claudio Tapiawith nine years at the helm AvaIt would not have been possible to survive without the brilliant performances of Lionel Messi and the Argentine national team, which won the World Cup and two Copas America in those years.

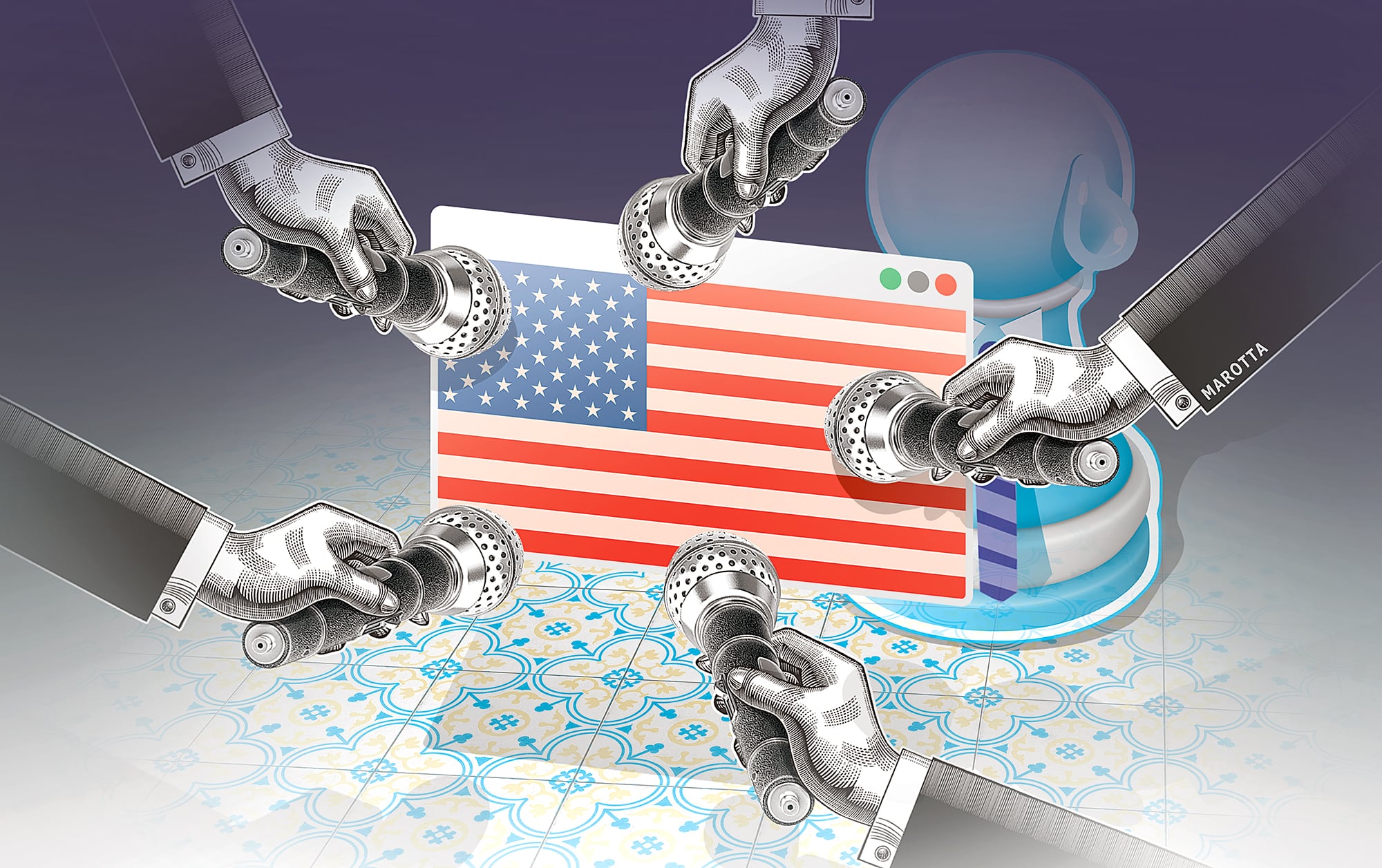

Regarding economic policy, those who maintain a critical view of the Treasury Palace’s decisions wonder – while maintaining personal distance – if something similar will not happen with a Luis Caputo administration at the helm of the economy, which has been largely strengthened and revived thanks to the US Treasury bailout and the results of the elections held on October 26th. It is an amusing and perhaps exaggerated comparison: as if, for the economic team, Donald Trump and Scott Besant were the salvation that Messi and Depo Martinez were dreaming of. Czech Tapia.

What is palpable here is that, five weeks after the decisive electoral setback that enabled Javier Miley to begin the second part of his first term, objections to economic policy from business and serious economists have resurfaced. Doubts recur about the exchange rate regime, the value of the dollar, the accumulation of reserves, unrealized obligations with the International Monetary Fund, debt repayment, the depth of openness to imports, the level of activity, and job creation.

Added to this mix is the governability test that will be conducted from December 10 in Congress with the budget law and the reforms announced in labor and tax affairs. In particular, what margin will the economic team continue to maintain to maintain fiscal adjustment amid the political pressures that the allied Conservatives are trying to impose, and not so much, to provide votes on each of the official initiatives.

If the promised reforms go far, they will have the real depth of reducing the cost of producing, selling, exporting and employing workers in Argentina. As a precaution, in case circumstances force us to be more generous to allied Conservatives, a pre-emptive adjustment has begun: state staff cuts will continue and electricity, gas and transport prices will rise sharply to reduce the subsidy bill that was eased in the election year.

Regarding the long-awaited tax relief, the Minister of Economy himself was honest last week: rural deductions will not be significantly reduced, and the tax on checks could be reduced “if the economy grows at a rate of 8% per year.”

In addition to Becent, Messi and Depo, there are always taxes and fees to save the score no matter the cost. Notes on the management of Luis Caputo, which had become widespread after the September defeat in the Buenos Aires provincial elections and which were exacerbated by the financial flow that deepened after that result, practically disappeared thanks to the October 26 victory.

The Trump administration’s support to avoid an exchange rate collapse was crucial before and after those midterm elections, making the economy minister and the central bank head the main beneficiaries of the confirmed outpouring of optimism in the business world. There is no doubt that the president, his sister Kareena and the Minister of Economy were the big winners in the October elections.

The question that remains unanswered is whether Javier Miley’s resounding victory was thanks to or in spite of economic policy. In the economic world, opinions are divided. For many, the post-election relief was not about what was voted on, but rather what was not voted on.

Naturally, the official team conveys natural praise for its performance, considering that it won because of the economic model and, above all, because it succeeded in significantly reducing inflation. The stock exchange’s management had so much to do with this outcome that the whole thing was certified. It was not the monetary and disbursement plan that failed and had to be rescued by the US Treasury, but rather the measures adopted were so correct that they could not be jeopardized by circumstantial political confusion and thus the Trump administration’s decision to ensure that aid arrived in time.

Whatever the case, the recovery in markets and confidence in the government has been exceptional. Country risk fell from 1,500 to 650 points and Argentine stock prices rose, although they are still losing so far this year. The approval rate measured by Bulíarquia and Di Tella University rose by 17.5% in November, which had already jumped by 8% in October.

The government is sticking to very positive sectoral data, celebrating the boom in investments in the energy, mining and services sectors, which, despite the decline in domestic manufacturing sales due to competition from imports, maintains average activity indicators in positive territory. To defend an exchange system that is questioned by negative reserves that do not grow, shares in companies and floating bands that do not update, Luis Caputo again challenged his critics by ensuring that the model verifies export records in dollars as they are.

This is half the truth, as the minister forgot to mention that Argentina’s main exports are generally of a primary nature, such as agriculture, mining and hydrocarbons, and are made regardless of the value of the exchange rate. Another call seems to be the call for manufacturing exports. “The truth is that Bessent was Martinez’s lottery in Qatar,” economist Rodolfo Santangelo said sarcastically over the weekend, regarding the US Treasury Secretary’s performance regarding the fate of the official representatives.

It summarizes the point of view of many specialists who believe that not everything is solved in macroeconomics, and that the Trump administration was forced for some reason, and not just political reasons, to intervene to save the situation. The debate that has resumed, after the great relief and restoration of confidence brought by the October 26 elections, is about whether Argentina’s macroeconomics are really as organized as the ruling party puts things forward. In any case, the problem is microeconomics.

Industrialists who decide to stop production and devote themselves to importing consider that the overall economy is still far from being organized. Credit remains expensive at rates ranging between 50% and 80% for working capital, inflation remains at 25/30% annually, taxes that hit the productive and commercial chain exceed 50%, and the exchange system maintains restrictions on the entry and exit of capital. With a model that always prevents the solution of a complex reality: today’s negative reserves are more than $15,000 million if the dollars lent by the IMF, the United States, China and other components outside the purchase of foreign currencies by the Treasury or the BCRA are not taken into account.

Objection is growing from economists who insist that the government should benefit from optimism and support from the United States to lift exchange restrictions once and for all, buying reserves with the fiscal surplus at a rate of 800/1000 million per month, and that the level of the exchange rate is effectively determined by the market, without shares, with all actors intervening in buying and selling currencies, including the government to get out of the negative zone in the external accounts.

At the same time, a less stringent approach should be applied when establishing the monetary system that allows for the normalization of the peso supply and interest rates. If you want to maintain a floating exchange range chart, it should not be as fictitious as it is now, and should be located in the middle of the road, respecting the real market value of the dollar.

Maintaining exchange rate lags while deepening openness to imports is a risky path in terms of activity and employment. On the other hand, there is complete agreement to shed light on the financial system, despite talk about the exchange system and the monetary and financial system.

The government’s surplus represents a major achievement that all observers highlight. But here too the economic team will have to overcome the policy test. Until now, and still in the election year, to sustain the fiscal battle, the team accompanying Luis Caputo has been led by the president that any economy minister or treasury secretary would ask for if he faced an Aladdin lamp: Milley who was tougher on fiscal matters than his ministers, as well as with the foreign policy suited to receiving unlimited aid from the United States. Now you need your own wristband and wallet to pass the promised laws.

With the budget law, the conservatives are playing their own game. If agreements to distribute more funds are not reached with the regions, tax reform, not to mention labor market modernization, is at risk, as the conservatives remain oblivious to this dispute. Diego Santelli has already been warned in his multiple meetings with provincial leaders. At this point, the Interior Minister still does not have the answers from his economics counterpart. “I need to know what we can offer moving forward,” say those close to the head of the political portfolio.

Behind this position, the fate of the political strategists blessed by Karina Miley, the Menem family and Manuel Adorni also hangs in the balance. In addition to Besant, Messi and Aldepo, Economiya will need a lot of support from the president to overcome the shooting.