Credit card usage rose 2.9% in pesos last month, reaching $22.6 billion in total spending. according to a report from First Capital Group, an Argentine financial services company.

This monthly increase corresponds to a real increase of 0.6% in November when adjusted for inflation. Aside from that, This represents an increase of 20.8% compared to November last year.

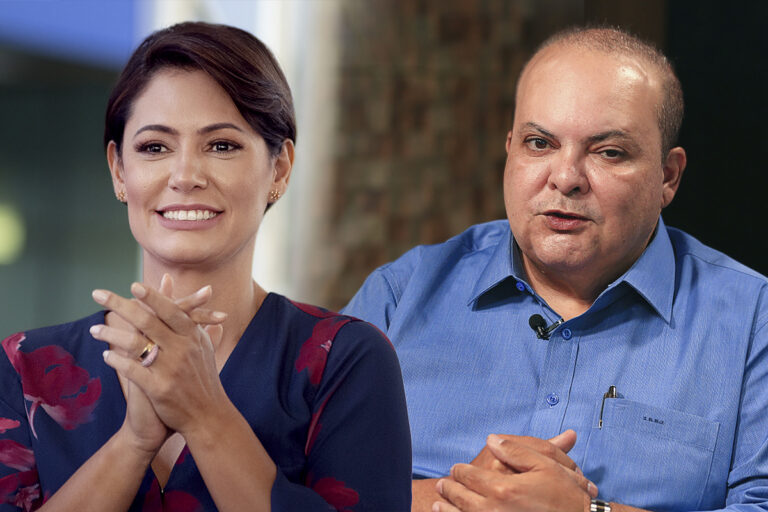

Accordingly Guillermo Barbero, partner at First Capital Group, “The behavior of this line has remained erratic over the last 12 months, fluctuating between significant increases and other more moderate increases. In addition, the increasing insolvency prevents the normal use of the card by defaulting customers. However, thanks to the management of credit institutions, a normalization process is expected.”

Credit card financing in dollars increased balances by 1.1% per month. representing a global increase of up to $623 million. This corresponds to an increase of 20.7% year-on-year. over $516 million.

Despite these increases, Barbero pointed out that “the report highlights that current levels are still below the peaks recorded in the first half of the year.”

Beyond the surge in card spending, other consumer credit lines are showing signs of slowing, another report from the same company said. First Capital Group points to a decline in the number of personal loans In real terms they fell by 0.7% for the second month in a row.

Regarding this trend, Barbero pointed out that “for the second month in a row, we observed a decline in real terms in this business, which was one of the most dynamic in the last 18 months and contributed the largest volume of absolute nominal growth last year: $9.7 trillion. The shadow of increasing defaults in recent months has reduced supply and also affected the speed of rate cuts, delaying the return to values more consistent with current inflation.”

Following this trend, Real auto loans fell 2.1% monthly. However, this corresponded to an annual increase of 51.6%.

To explain this trend, Barbero explained that “there is a decline in real portfolio values and we have also observed a strong stagnation in nominal billings. The weak performance of the automotive market, measured both by the transfer of zero-kilometer vehicles and used vehicles, explains such a poor financing month.”