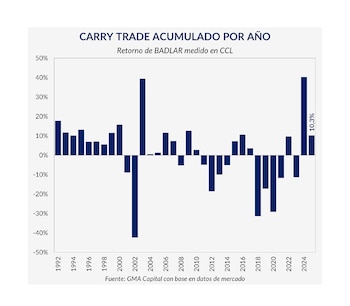

In 2025 He Carry trade achieved a total return of 10.3% in Dollar Cash with Settlement (CCL) despite the pronounced volatility of the Argentine financial markets and the instability of the exchange rate. The analysis published by GMA Capitalthe consulting company of Nery Persichinirevealed that the investment strategy based on taking advantage of short local interest rates once again delivered positive results after an exceptional 2024, when this type of operation produced a return of 40 percent. However, in 2025, unlike last year, the strategy of betting on profits in dollars with prices in pesos was exclusively for the brave.

The report from GMA Capital emphasized that the Dollar-linked bonds With an increase of 24.6%, measured at the cash settlement exchange rate (CCL), they led the return ranking in 2025. This result contrasted with the performance in 2024, when these stocks were among the least profitable alternatives on the market. Completing the podium were global bonds at 16.6% and CER bonds at 15.3%, both driven by the decline in sovereign risk over the year.

On the contrary, that S&P Merval With a decline of 3.5% in dollar terms, it landed last in the investment rankings. According to the consulting firm’s analysis, “the stock index aims to end the year with a decline of 3.5% in dollar terms, placing it in last place.” The dynamics of local assets were characterized by sharp fluctuations, which did not allow investors to find a stable haven in the Argentine stock market.

The evolution of dollar returns on key local assets such as AL30, TO26, S&P Merval and TAMAR Index reflected the extreme volatility of the year. The report pointed out that “star investments like the AL30 fell 20% over the year despite landing in notable spots.” Argentine stocks experienced moments of sharp correction, particularly after the elections in Buenos Aires province, when they lost up to 50% of their value in dollar terms before partially regaining lost ground.

Long-term peso bonds such as TO26 also suffered severe attacks, mainly due to the rise in interest rates triggered by the disarmament of the LEFI and election uncertainty. The document from GMA Capital He emphasized that “the TO26 title serves as evidence: from a TNA of 30% before the LEFI disarmament, it reached a peak of 65% before explicit US support, losing 30% in hard currency.”

The year was marked by three important milestones: the start of phase 3, the so-called Liberation Daythe departure of LEFI and a highly intense electoral calendar. Each of these factors had a direct impact on investment sentiment and asset pricing. The adviser emphasized that “local dynamics were marked by three inevitable milestones: the start of Phase 3 (coinciding with Liberation Day), the withdrawal of the LEFIs and the intense electoral calendar.”

Not all peso instruments were equally affected. Short-term investments such as fixed maturities and mutual funds money marketThey withstood turbulence better, especially between August and October. According to the report, “The key to emerging unscathed was selectivity and precise timing. Sudden interest rate fluctuations, while detrimental to long-term securities, were ultimately a tailwind for accrual instruments.”

The phenomenon was particularly striking in the months before the elections, when fixed terms captured real interest rates that reached 40% per year. The strategy of Carry tradebased on the use of short-term interest rates, allowed investors to achieve a higher return than much traditional assets, but without reaching the extraordinary levels of 2024. According to GMA Capital, “This maneuver did not mark two years in positive territory since the 2016-2017 biennium.”

Analysis of cumulative returns as of December 23, 2025 shows that the USD-L Bonares achieved a gain of 24.6% in dollar terms, followed by Global USD and the CER bonds. Instruments denominated in pesos, such as Private Badlar and the UVA fixed conditionsalso achieved increases, although to a lesser extent and with clear differences depending on the time horizon and sensitivity to interest rate changes.

On your part, an analysis of the stock exchange company IOL explained that the strategy of Carry trade remains attractive, although dependent on exchange rate stability and the deepening of the disinflation process. The consulting firm observes a scenario with interest rate compression, greater liquidity and negative short-term real interest rates, accompanied by a sustained disinflation process and an adjusted exchange rate system. According to the report, the government will focus its efforts on accumulating reserves and will not allow the peso to appreciate. The expectation of IOL indicates a reduction in exchange rate volatility in the first half of the year, supported by foreign exchange flows from the gross harvest and financial balance as well as by the reduction in country risk. The report claims that the exchange rate would move within a multilateral real exchange rate band between 95 and 105 points. IOL represents a constructive vision regarding Carry tradeHowever, warns that the strategy suits aggressive profiles and recommends limiting its weight in portfolios. The advisory firm favors positioning in LECAPs in the short term and sees value in tactical trading in the BONCAPs through 2027, with high implied interest rates if inflation is lower than expected.