He new exchange system The reorganization of the map of expectations for the dollar for 2026 announced by the Central Bank (BCRA). Since January 1, the Floor and roof swimming band will stop adjusting to a fixed rate of 1% and start changing in pace month to month Inflation reported by INDEC with a two-month lag (T-2).

The decision implies a significant change in the way the dollar price is forecast and forces us to recalibrate scenarios.

This is what the official announcement suggests, according to the President of the Monetary Authority, Santiago Bausili give predictability, Reduce discretion and anchor expectations in a context where the government seeks to consolidate disinflation and initiate a period of remonetization of the economy in 2026.

What changes with the new banding scheme?

From January it will be official dollar It will move within a range, the growth of which depends on the inflation data. This has two direct consequences:

- The upper limit of the band is estimated in real terms, which increases the tolerance margin for possible volatility episodes.

- The soil completely loses its relevance. Since the central bank will initiate purchases within the band, the “floor” is just a testimonial number.

On the latter, the BCRA announced that it will accompany the new regime with a pre-announced reserve purchase program aligned with the development of money demand. The base case calls for purchases of up to $10 billion in 2026, with the possibility of increasing to $17 billion if monetization accelerates without the need for aggressive sterilization.

What dollar price does the market begin to discount?

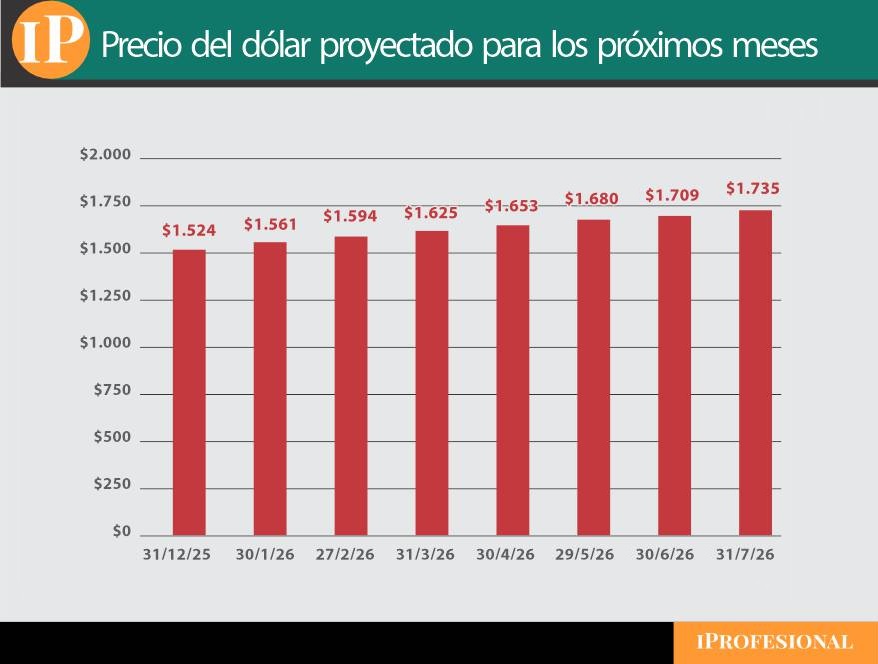

The forecasts circulating in the city, which correspond to the assumptions of the REM, show a faster route to the exchange rate cap. The implied range continues to widen through the end of 2025 and through much of 2026. Month by month the number would be something like:

- December: $1,524

- January: $1,561

- February: $1,594

- March: $1,625

- April: $1,653

- May: $1,680

- June: $1,709

- July: $1,735

“Maximum price” of the dollar

REM: Consensus of Calm

He Market expectations survey -REM- accompanies the official narrative of gradual disinflation, Monthly inflation is approaching low single-digit levels. In this scenario, sharp jumps in the dollar are not needed to maintain competitiveness, especially if the fiscal anchor remains firm.

However, the consultants emphasize that the regulation means no exchange delaybut a regime that seeks Reduce indexing and disable expectations of discretionary devaluation. The dollar ceases to be the price that corrects imbalances and begins to function as such Equilibrium variable within a stricter monetary framework.

The Role of Peso Demand and Reserves

One of the pillars of the new program is that Recovery of money demand. The BCRA recognizes that the monetary base is still at historically low levels and aims to increase it from 4.2% to 4.8% of GDP in 2026 without creating inflationary pressures

In this context, the accumulation of reserves is no longer an isolated goal, but becomes the main emission channel. Every additional peso demanded by the economy is supported Foreign exchange purchaseswhich strengthens the credibility of the system.

From a more critical perspective: Aldo Abram, The executive director of the Libertad y Progreso Foundation assessed the BCRA’s turnaround positively, although he set limits.

According to Abram, “It is good news that a mechanism for purchasing reserves is transparent and stipulates that any increase in demand for pesos will be punished with the issuance of foreign exchange purchases.” For the economist, the new system reduces discretion and improves the signal to the market.

However, he warned that the current context presented a problem Window of opportunity that shouldn’t be wasted. “First, the current increase in the preference for hoarding in pesos should be used to eliminate the distortions that have arisen with the increase in reserve requirements and the rigidities in the integration of monthly requirements,” he said.

In this sense, he emphasized that the requirements and restrictions applied during the emergency They should not be permanentas they affect the normal functioning of the financial system. “They should only be used with caution. Once this situation is over, these distortions must be eliminated,” he concluded.

Where can the dollar go in this new regime?

Under the current rules, the base scenario that the consulting firms devalue is that of a stable dollar within the band, with gradual and gentle movements as long as three conditions are respected:

- Sustainable budget discipline

- Falling inflation

- Real recovery in peso demand

The risk lies not so much in the size of the dollar, but in possible political or financial shocks which push the exchange rate to the upper limit of the corridor. Then, The headquarters would have room to intervene, but without changing the general framework of the program.

Less specific forecasts

The change in bandwidths redefines the discussion. Before it was easier, everyone who trusted the tapes predicted 1% growth and that was it. Now the calculation is dynamic and forces inflation forecasts – subject to the errors typical of each estimate.

For this reason the question no longer arises “How much will the dollar be worth?”But “What range will it be in?” The REM and the consultancies show that the market is starting to internalize this logic.

The BCRA’s challenge will be to maintain the system’s credibility as the economy begins to demand more pesos and the dollar no longer serves as an automatic safe haven.

Much of the success – or attrition – of the new monetary system will take place there.