In two years of management Javier Milei There was a “sincerity” of the exchange rate that lifted the dollar above the inflation rate and significantly improved the real exchange rate – a pure exchange rate and therefore a partial measure of the competitiveness of the economy – which was reflected in two consecutive years of trade surpluses in the balance of goods.

Although it was based on a very low exchange rate (80 out of 100 theoretical equilibrium points on December 10, 2023), the The realignment of the dollar was associated with monetary expansion new and is now closer to this equilibrium zone. Although the exchange rate was at times used by the current government as an inflationary “anchor”, after the partial exit from the “stock” in April and with the rise of the dollar near the elections – when it challenged the cap on the bands – it took advantage of a clear advantage over inflation to make it clear that today real wages are the real anchor of retail prices – complemented by greater openness to imports – more than the exchange rate or the level of the currency base, as some monetary union theorists believe Monetary base argument. Orthodoxy by ensuring that “weights are missing” in the economy.

In two years of reign Advances in freedomHe Wholesale dollar rose 293.8%from US$364.41 (Notice A3500 dated December 7, 2023) to US$1,435, while the financial “counting with settlement” (which is carried out outside the “stocks” and is therefore a more objective price than the official price) increased by 47.7% from 1,019.15 to 1,505 pesos.

During the same period, cumulative inflation was about 266%, while the expansion of the Monetary base increased by 293.1%from $10.1 billion to $39.7 billion on December 2, 2025. With this data, the Inflation would have a remaining increase of about 27 points coincide with the rise of the official dollar and monetary expansion, a comparison that perhaps explains why it is so difficult to reduce the monthly CPI below 2 percent.

The increase in the official dollar almost matched the pace of monetary expansion, a ratio that justifies the stable presence of the currency – at least from a monetary point of view and without the “distorting” factor of electoral risk – and a level close to equilibrium in the index of Multilateral real exchange rate which the central bank measures, 95 points on a 100 point basis.

“In a baseline scenario where the exchange rate bands are maintained, we see some decoupling from inflation expectations. The indifference between the different curves occurs at inflation rates that appear high relative to the possible movements of the exchange rate within the bands. If we take the current price as a base and bring it up to the upper limit of the band, we are left with an average depreciation rate of 1.3% for the coming months, with balanced inflation between fixed rate and CER of monthly 1.8% Given international inflation, this represents an appreciation of the real exchange rate by 3 to 4 points,” he analyzed. MegaQM.

“Looking ahead to 2026, the capital inflow through the financial account would then allow a recomposition of reserves at a pace more in line with the growth and remonetization of the economy, without causing price and exchange rate frictions. It is true that the lack of reserves places the economy in a situation of fragility, which makes it vulnerable to any type of shock, whether external or internal. However, today both contexts seem to speak in favor of the prospects of success of a gradual strategy in recomposition “Reserves,” he added José Maria SeguraChief Economist of PwC Argentina.

“If we continue with what we submitted to the 2026 budget and assume that the monetary base remains constant relative to GDP, the base would grow by 25% in nominal terms and that would allow us to buy about $7,000 million without having to sterilize. If money demand recovers 2 percentage points of GDP, which of course it should, we could buy $7,000 million more without having to sterilize,” said the Minister of Economy, Luis Caputo.

“We will not change the exchange rate scheme and continue to fluctuate between the bands for the reasons that I have explained many times: Argentina continues to be a country with political volatility, the band systems have been effective in most of the stabilization processes and the market has a certain volume that we cannot force,” Caputo added.

In this context, the official strategy envisages an increase in demand for pesos in the coming months, a logical trend if economic growth is confirmed, a greater supply of dollars through private sales – after an intensive dollarization of pre-election portfolios – and important income from the capital account, either from private and sub-sovereign debt placements and foreign direct investments.

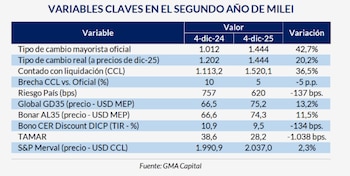

A report from GMA Capital He specified that last year alone “the official exchange rate increased by 43%, but the most important thing was the narrowing of the gap with the ‘Liqui Cash’, which shrank by five percentage points.”

“The market also awaits new certainties on how this management will reactivate dollar generation for maturities. The route, according to BCRA President Santiago Bausili, would be through the treasury account,” GMA Capital added.