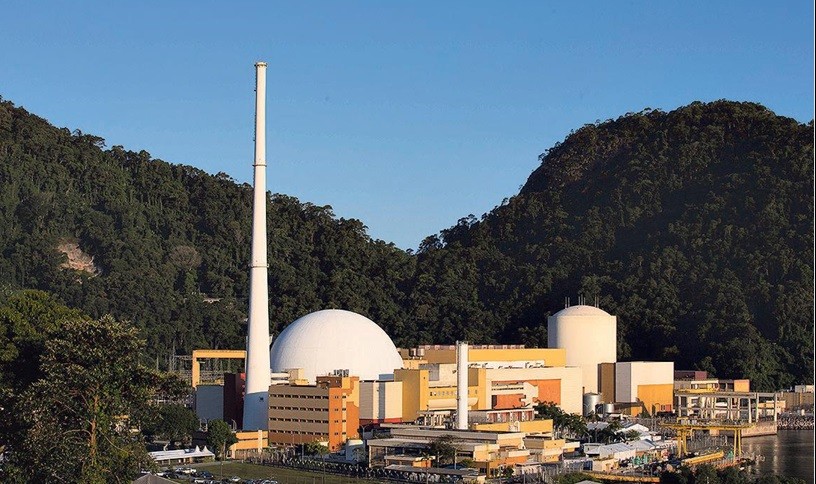

With the approval on Thursday by the Supreme Federal Court (STF) of an agreement between the Union and Axia (formerly Eletrobras), Eletronuclear, the public company that operates the Angra 1 and Angra 2 nuclear power plants, on the southern coast of Rio, is racing against time to raise 2.4 billion reais with its private partner, now Âmbar Energia. The goal is to complete the financing by February or March, the state-owned company’s interim president, Alexandre Caporal, told GLOBO.

- Negotiation: Correios extends agreement with employees on salaries and benefits until February

- Infrastructure: Government announces investment of 950 million reais to expand Rio port container terminal

This billion-dollar financing will help ease Eletronuclear’s cash flow, but is far from resolving its financial imbalances, according to the executive. In the medium term, Caporal defends the authorization for the public company to withdraw more resources from the fund it maintains to cover, in the future, the costs of dismantling nuclear power plants.

The 2.4 billion BRL will be financed by the issuance of debt securities and will be contributed by Axia or Âmbar Energia, operator of the electricity sector of J&F, holding of the Batista family, of the food industry JBS, which is in the process of buying the remaining share of the former Eletrobras in the public nuclear company.

— It is a very simple operation, because it involves a single shareholder and is private, it does not go to the market. The operation does not require B3 registration (the Brazilian Stock Exchange), it takes place between the parties, in compliance with the legislation of the CVM (Securities Commission, which regulates the capital market) — said Caporal, who took office less than a month ago.

He has been financial director since April 2024, appointed by the private partner, at the time the former Eletrobras.

In times of financial crisis, partly because the maintenance of the Angra 3 site, under construction for 40 years, costs around 1 billion reais annually, Eletronuclear requested, a few months ago, a contribution of 1.4 billion reais to the Treasury under the “risk of collapse”.

- Request: Eletronuclear asks the government for aid of 1.4 billion reais

According to Caporal, the billion-dollar financing will not resolve the financial crisis once and for all, as the new resources will be entirely allocated to work to extend the useful life of Angra 1 by another 20 years, a 3.5 billion reais project. The R$2.4 billion, released little by little, prevents Eletronuclear from devoting its liquidity to this investment, but does not resolve two other problems.

/i.s3.glbimg.com/v1/AUTH_da025474c0c44edd99332dddb09cabe8/internal_photos/bs/2025/e/F/nRsRfRTBmCtEYOhQQ3eg/carporal-divulgacao-eletronuclear.jpeg)

The first is the uncertainty around Angra 3. Started in the mid-1980s, the work has experienced successive delays, with economic crises and corruption scandals, such as those revealed by Lava-Jato.

An update of the BNDES economic-financial study on the resumption of the project estimates the amount necessary to complete the factory at 24 billion reais – in practice, it will be necessary to raise more than 30 billion reais to settle the debts to BNDES and Caixa. Giving up everything could cost between 22 and 26 billion reais in fines and debt settlement.

- Ancelmo Gois: Electronuclear goes to court to arrest “ghost” employee in flagrante delicto

The National Energy Policy Council (CNPE), made up of several ministries, discussed the resumption of Angra 3 in meetings earlier this year, but decided to postpone a decision on how to proceed.

The second problem is an operational restructuring, to have costs consistent with the current tariff for Angra 1 and 2. Even after a plan of voluntary redundancies (PDV), cost reductions and greater efficiency, costs were still 25% above the financial breakeven point this year. For 2026, they are expected to be 10% higher, Caporal said.

At the same time, Eletronuclear is awaiting a response from the National Electric Energy Agency (Aneel) in 2026 concerning a request for readjustment of tariffs, which would make it possible to balance the accounts.

For these two problems, Caporal believes that it is essential to use the resources deposited in the fund managed by Eletronuclear to finance the dismantling of atomic power plants. This fund, provided for by the regulation, has approximately 3 billion reais, which remains invested.

- Dividend gathering: Companies issue shares to strengthen their cash flow and distribute profits before the new IR

According to the acting president of Eletronuclear, it would be possible to withdraw 2 billion reais from the fund. Last year, the state-owned company made a withdrawal of 374 million reais, which was contested by the Federal Court of Accounts (TCU), but was ultimately approved. With this authorization, the public company withdrew 800 million reais from the fund between 2024 and 2025, Caporal said. Today he is asking for an additional 1 billion reais.

The topic is controversial because it concerns the safety and decontamination of factory sites decades from now. This also involves a challenge by Eletronuclear to the fact that the Federal Revenue imposes taxes on financial gains from the investment of the fund’s resources – but the regulations do not allow the funds of the fund itself to be used to pay taxes.

According to Caporal, the approval of the TCU would already allow the withdrawal, but the recently created National Nuclear Safety Authority (ANSN), which regulates the activity and will have the final say, is opposed to it. For the president of Eletronuclear, Brazilian rules on the operation of the fund intended to cover the dismantling of power plants are stricter than those of other countries, such as the United States.

According to technical calculations, it would be possible to make withdrawals of an amount sufficient to even avoid future contributions from the Treasury, Caporal argued. In an interview with GLOBO, Finance Minister Fernando Haddad said that Correios, in serious crisis, and Eletronuclear “are the two public companies that inspire the most care”, but the head of the economic team avoided talking about contributions to the operator of the nuclear power plants.

— We need a weekly cash flow analysis. And we continue to work hard to reduce costs — said Caporal, for whom authorizing withdrawals from the fund would be an “obvious” solution. — Are we going to bankrupt a company with 3 billion reais idle?