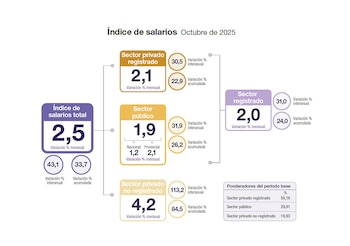

Last October the Index of Wages recorded a monthly increase of 2.5%a variation that was 0.2 percentage points above inflation for the period (23%). However, the aggregated data hides different behaviors between different segments of the labor market.

According to the official report, the monthly increase in the overall index was explained by increases in 2.1% in the registered private sector, 1.9% in the public sector And 4.2% in the unregistered private sector. This means that, on average, registered workers suffered losses relative to inflation in the tenth month of the year. The disadvantage was 0.2 percentage points for private employees and 0.4 points for public sector employees.

So the advantage of the general wage index can be summarized in what happened to the informal wage indexes. However, in this regard, it is important to clarify that the data on informal wages has a lag of five months, so the 4.2% reported by Indec is actually comparable to May, when the consumer price index rose by 1.5%.

According to the report, the wage index recorded a year-on-year increase in October 43.1% in the face of an increase CPI of 31.3% . This result was a result of gains 30.5% in the registered private sector, 31.9% in the public sector And 113.2% in the unregistered private sector. In this way, informal workers had an annual salary fluctuation that was more than three times that of formal workers and government employees.

The same pattern can also be observed in the cumulative measurement for the year. Between January and October 2025, the overall wage index increased 33.7%. During this period, salaries in the registered private sector increased 22.9%those in the public sector increased 26.2% and those in the unregistered private sector saw an increase of 84.5%. This last value once again stood out as the highest of the group and was decisive for the performance of the accident major.

In any case, two points must be taken into account when analyzing what is happening in the formal private sector. On the one hand, we must remember that informal salaries are significantly lower than those in the private sector and reflect several years of severe deterioration. On the other hand, as already mentioned, it must be taken into account that the data on informal income is five months behind, as Indec itself explains in its methodological part.

The comparison between the CPI and salaries allows us to get an accurate idea of whether workers have gained or lost purchasing power, but there is another comparison that allows us to take a look at what is happening at a socioeconomic level. Crossing the income data with that of the Total Base Basket (CBT) and the Staple Food Basket (CBA) You can get an indication of what is happening to the levels of poverty and need.

It should be remembered that households with incomes above a CBA but below a CBT are technically considered “poor”, while households with salaries below a CBA are considered “destitute”. So if salaries rise faster than both baskets, it can be concluded that the pressure on poverty rates is lower. On the contrary, if basic needs grow faster than salaries, poverty and need can be expected to increase.

What happened on this occasion? According to data published by Indec, in October both the CBA and CBT rose by 3.1%, which follows Basic goods rose faster than income.