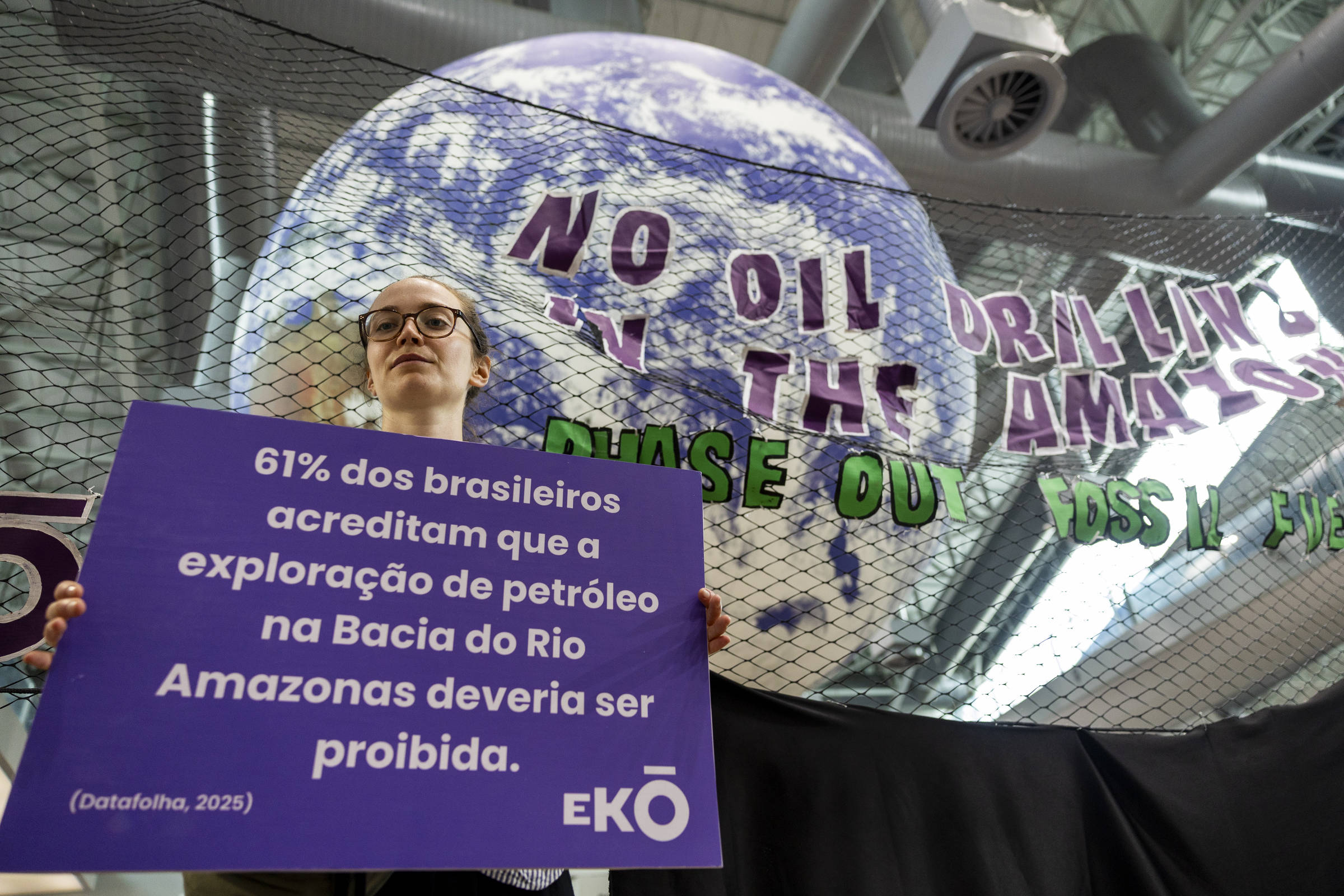

With the work of COP30 in Belém having concluded, all analyzes converge to highlight the coordinated effort of oil-producing countries – notably Saudi Arabia and Russia – to veto any global initiative aimed at gradually abandoning the use of fossil fuels. The success of this strategy was evident: the term “fossil fuels” did not even appear in the final declaration of the meeting.

There is no doubt that this represents a defeat in the fight against global warming. The question I intend to address is whether this “defeat” really represents a long-term victory for the oil and gas sector.

In searching for the answer, I remembered Theodore Levitt’s article “Myopia in Marketing” — required reading by GV in the 1970s — and my own experience in the banking industry.

Around 1910, Levitt says, a Boston millionaire—a loving father, but probably unconvinced of his children’s financial capabilities—decided that his entire fortune would remain invested in shares of electric streetcar companies, thereby condemning his heirs to poverty. Levitt uses this anecdote to support his thesis: Companies fail not because of the obsolescence of their products, but because they poorly define the market in which they operate, focusing on what they produce and not on the needs of their customers. This happened with American railroads, which saw themselves in the “rail business” and not in the transportation business.

The idea is simple but powerful. Throughout my banking career, largely focused on serving large corporations, I have always tried to focus on being close to customers and understanding their needs, letting products emerge as an answer and not a starting point. As requirements changed, so did the solutions.

In my later years as an executive, now also responsible for retail, I encountered the difficulty of applying Levitt’s teachings when it required profound change. For established companies (incumbents), it takes time to distinguish between the real threat and the passing fad. An innovation does not emerge or establish itself as a superior solution overnight: it must go through a period of testing, learning, distrust and loss.

The delay, often visible in the reaction, is not only the result of the natural aversion that we all have to change – “Lusitana is the one who likes change”, said a friend – but above all of the feeling of comfort offered by the belief in the so-called “barriers to entry”, which exist in all areas of business… until they cease to exist.

In 1900, for the railway companies, the tracks between the main cities appeared like an insurmountable barrier. After all, who would build a new railway on a route that is already served?

The equivalent of rails in retail banking was the branch network. For decades, expansion was achieved through the opening of units: a vast network made it possible to serve a wider audience, gain scale and offer products at a competitive cost. For a new entrant, it would be almost impossible to compete without acquiring an existing bank.

Until it doesn’t.

Digital banks have emerged, reaching a significant portion of customers, especially younger ones, without the need for branches, at a much lower cost and offering a service that delights their audience. At that time, doubts still remained about the viability of the model. Could they become profitable? Would they know how to manage the complexity of credit? Could they evolve beyond single-product platforms and offer a wide range of services?

The temptation to wait and see is great, but that would be a big mistake. Whatever the success of the new competitors, the undeniable fact was the emergence of a form of service that met the expectations of many customers. This was enough to justify the commitment to integrate new learning and adapt the business model.

I remember a sentence I read at the time: “Incumbent companies must find innovation before innovators find the market.” »

Finding innovation is not just about coming up with a new product. This involves promoting internal transformation: evolving systems, reviewing the role of agencies, changing the organization of work and, ultimately, the company’s own culture. An arduous and long process, which requires leaders to have the humility to place themselves as apprentices.

Fortunately, in the almost five years since I left my management role, the bank where I worked and on whose board of directors I sit today has intensified its transformation, improved its services and achieved a notable improvement in customer satisfaction indicators, the result of combining the virtues of the traditional and digital models. More relevant than the results is the clarity from leaders that much remains to be done and that the challenges of evolution are ongoing.

My intention in reporting this experience is to draw parallels between the challenges facing railroads in 1900, traditional banks over the past 15 years, and those facing the energy sector today.

The enormous reduction in the costs of solar and wind energy, new “cheaper” forms of storage and the exponential expansion of the supply of these sources present the fossil sector with the same dilemma. Believing to rely on their oil reserves as a barrier to entry, many managers do not realize that their business is not oil, but energy.

Answering the initial question, I would say that the “victory” of postponing the transition represents, in the long term, a defeat for the fossil sector itself. By resisting the changes that are already shaping the future of energy, its leaders are only slowing down the transformation process on which its relevance will depend.

The decision to start prospecting today for wells whose oil will only arrive on the market in 12 or 15 years corresponds, in my opinion, to the choice of a bank to extend its network of agencies in the midst of the digital revolution (I would not invest in that bank!). COP30 showed that external pressure can be contained; What cannot be contained are the changing needs of “customers” – countries, businesses and societies that already demand cheaper, cleaner and safer energy. It is in this market, and not in that of additional barrels, that the future lies.

PRESENT LINK: Did you like this text? Subscribers can access seven free accesses from any link per day. Just click on the blue F below.