The 2025 automobile market showed significant progress in imported cars. This happened because, following the restrictions imposed by the management of Alberto Fernández, the change in the economic model promoted by Javier Milei is one of its pillars, the economic opening.

The effects of the new rules of the game can be clearly felt in this area. In the last two years it went from a Market with a sales share of 70% on average of 0 km nationwideby 2023, to a reverse scenario where itVehicles arriving from abroad already account for 60% of sales.

There has been a lot of talk about evolving brands Chinese. Undoubtedly they are the protagonists of these months, but we must take into account that in Argentina we are experiencing things at an accelerated pace that were happening more slowly in other neighboring countries.

For the same reason, the import restrictions between 2020 and 2023 will result in some changes that also occurred in other markets, such as the exit of automobile companies It is being produced with a delay in an Asian country.

Most often imported

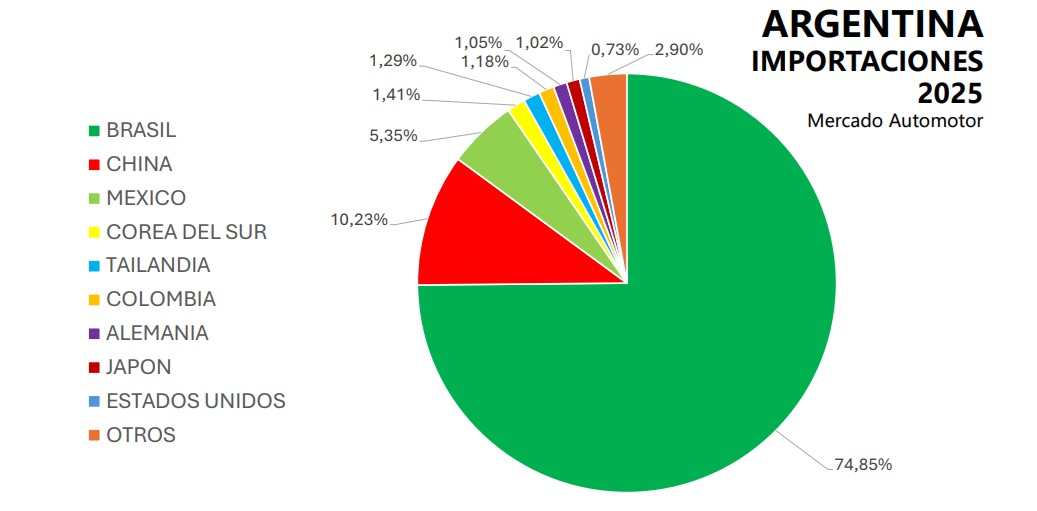

Brazil, Argentina’s most important trading partner, took first place. Of the sector’s total imports, 74.8% come from the neighboring country.

As for the Chinese, while there has been a flood of these companies in 2025, they have not yet reached significant volume levels, apart from being the second import-sourced market 10% of income from 0 km from the country. This pushed Mexican cars into third place.

Imports, according to Sioma, an ACARA organization.

According to the latest data from ACARA, 49% of cars sold in the year were of Brazilian origin and only 40% came from local factories. The rest is spread across a dozen countries.

The Toyota Yaris is the best-selling car and is manufactured in Brazil.

In 2024, 0 km coming from Brazil accounted for 36%, while those produced in the country accounted for 56% of sales.

Growth of patents

Although in this scenario car registrations increase by 48% compared to last year, this does not mean that more domestically manufactured cars will be sold.

He The main beneficiary of this improvement in internal operations is Brazil, as the market expansion is based on the imported 0 km.

Based on the latest data collected in Argentina between January and November 2024 392,450 vehicles were patented. If 56% were “made in Argentina”, the volume of national 0 km amounted to 219,772 units. 141,282 factories in Brazil have now left. Until last year, more Argentine cars were sold in the local market than Brazilian cars.

Fiat Cronos is manufactured in Argentina and is also in the top ten in sales.

On the other hand, 587,000 units were patented in the first 11 months of 2025. 40% were national. That’s 234,800 vehicles, just 15,000 vehicles more than in 2024 (6.8% increase) with a market growth of 48 percent.

Of this volume (little will change with the December patents) are the 49% are Brazilian, equals 287,630 units. This way, Brazil will sell 146,000 more cars this year than in 2024, a growth of over 100%.

Undoubtedly, President Lula da Silva celebrates the recovery of the Argentine market in the Milei era.

Brazil benefits from Argentine policies

Aside from the good news for the Brazilian government, these are the ones who are most sore The factories in this country benefit from this. 90% of car imports are processed through the terminals grouped into ADEFA, the local equivalent of Brazil’s ANFAVEA.

That is, Argentine factories are the main importers of cars. There are six companies that sell the models they produce in the country, but they complete the range with a large number of Brazilian models.

The other 10% of imports come from the Chamber that brings together dealers of brands not established in the country (CIDOA), concentrating about 20 brands.

Brazil is expected to continue exporting thousands of units to Argentina in 2026 as a market expected to grow compared to 2025.