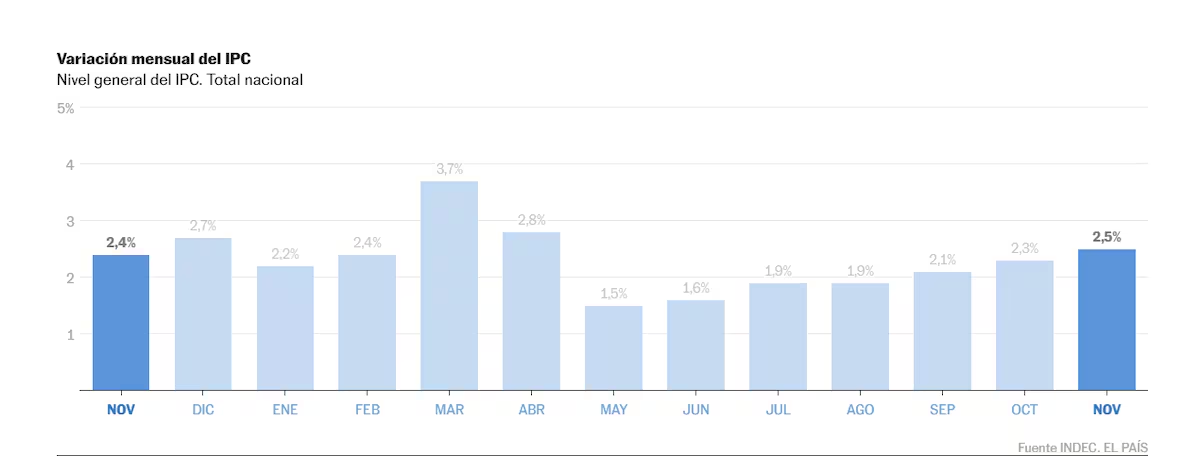

Inflation accelerated further in Argentina and reached 2.5% in November. The consumer price index thus recorded an increase of 0.2 points compared to the previous month and confirmed an upward trend: since Javier Milei came to power two years ago, the lowest inflation was reached last May (1.5%) and, from that moment on, it accelerated slightly but steadily. The inter-annual price change was 31.4% and so far in 2025 it has accumulated to 27.9%. Unlike previous months, this time there was no self-celebrating message from President Milei.

“The division with the highest increase during the month is that of housing, water, electricity, gas and other fuels (3.4%), followed by transport (3.0%),” said the Institute of Statistics and Censuses (Indec), in its report published Thursday. “The division with the greatest impact on regional monthly variation,” he added, “is food and non-alcoholic beverages” (2.8%).

The official inflation rate of 2.5% was higher than expected by the executive and most consultancies. Faced with the negative data, the Minister of Economy, Luis Caputo, highlighted that “after almost two years of management, and from 25.5% monthly in December 2023, inflation has been reduced to the lowest levels in eight years.

Rising food prices have also increased the income needed to avoid poverty and destitution – which affects 31% of Argentina’s population. According to Indec, the monthly change in the basic food basket in November was 4.1%, while that of the total basic basket (in addition to food, it includes clothing, transport, housing and other expenses) was 3.6%. In both cases, above inflation.

The main objective of Milei’s economic plan has been to stop the progression of inflation, after the index exceeded 200% per year during the last year of the mandate of Peronist Alberto Fernández (2019-2023). After the devaluation of the peso and the deregulation of the economy implemented by Milei when he took office, inflation rose in December 2023 to a monthly rate of 25.5%. By mid-2024, price increases began a downward trend, as the impact of fiscal adjustment, monetary compression, exchange rate peg and lower consumption were already being felt. The decline continued until March, when Milei’s plan suffered its first financial crisis of the year, overcome in April thanks to a $20 billion bailout from the International Monetary Fund (IMF). The second period of anxiety, in the weeks before the legislative elections last October, required a bailout from the US government of Donald Trump, carried out with a currency exchange for an additional $20 billion.

The relative economic calm achieved by Milei after winning 40% of the vote in the midterm elections has failed to translate into a further curb on inflation. The great challenge now facing the ultra president is that of recovering from the slowdown in the rise in prices, but at the same time reactivating economic activity and accumulating international reserves to face the enormous debt maturities.