Beer consumption habits are changing and the major Spanish companies in the sector are aware of this. Companies such as Mahou San Miguel, Damm or Estrella Galicia have embarked on exploring new business avenues to continue their growth with other product categories ranging from coffee to bottled water, soft drinks and energy drinks. A range of brands with which, in addition, they have more negotiating power with bars and restaurants.

Behind this transformation are the numbers, a change in the consumption and spending model of customers. A few months ago, the Mahou San Miguel group already recognized that beer sales were not experiencing their best moment due to “several factors”, as its general director, Alberto Rodríguez-Toquero, explains. Among them, “the geopolitical uncertainty that we are experiencing, the increase in accommodation and transport expenses which impact consumption outside the home,” he assured. However, if beer has not progressed – in the case of Mahou San Miguel, consumption decreased by 2% – bottled water increased by 4%. “Solán de Cabras is the brand whose value is growing the most,” Rodríguez-Toquero acknowledged about his brand.

This decline is borne by the entire sector. For example, the association that brings together all local businesses, Cerveceros de España, stated in its latest annual report that in 2024 (latest data published) “the per capita consumption of Spaniards was 52.8 liters, compared to 55.5 liters the previous year, which represents a drop of 4.9%”. “This reduction reflects a more contained consumption model on the part of the Spanish population, which maintains moderation as a central characteristic and also places us as one of the countries in Europe with the lowest per capita consumption,” affirms Cerveceros.

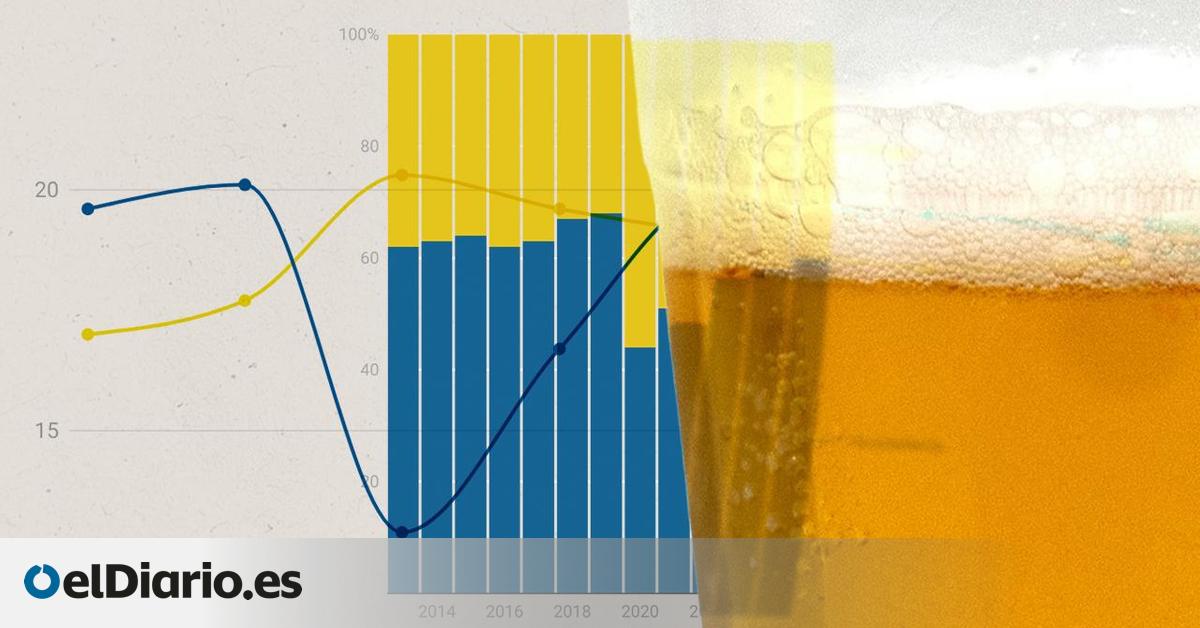

The following graph shows the evolution of sales in millions of hectoliters and the decline within the Horeca sector, which includes the entire hospitality industry, from bars to restaurants.

Brewers emphasize that consumption is not taking off, even if tourism, one of the drivers of beer spending, is having its best moment. “Among the factors that explain the decline in national consumption are inflation, which continues to affect purchasing power; global economic uncertainties, which encourage the control of social spending; and greater planning of exits,” he lists. “To these elements is also added the climatic factor”, because heatwaves impact the reception terraces. Added to this is the fact that younger generations are drinking less. “They are at the origin of a significant cultural change in relation to alcohol. More than half of young adults say they have reduced their consumption of alcoholic beverages, and a growing percentage have not consumed alcohol in the last month,” he indicates, based on various studies.

The following graph shows the distribution of beer sales between households (what is purchased in stores, hypermarkets and supermarkets) compared to the hospitality sector, which includes bars, restaurants and hotels.

What companies did they enter?

With this shift in preferences, breweries must reinvent themselves. This is what all the major companies present in Spain do, although to varying degrees. Heineken – owner of Cruzcampo and Águila – is focusing more on beer, although it is also diversifying, with products such as Ladrón de Manzanas cider. Meanwhile, other companies have further accelerated this increase in product range. Damm, for example, is in the tonic category with Fever Tree; milk with Letona or Cacaolat; in soft drinks, with Nestea; and owns outlets, such as the Rodilla sandwich chain, which, like Damm, are controlled by the Carceller family. María Carceller is the CEO of Rodilla, while her brother Demetrio is executive chairman of the Damm Group.

For its part, Mahou San Miguel bought water from Solán de Cabras ten years ago. In addition, it launched into energy drinks under the Refeel brand; in others based on wine, Los Cachis; and from January 2026, it will market Café 170º. “Our decision to go beyond beer responds to changing consumption habits,” explains Mahou. Also bet on other alcohol-based products, such as vermouth.

Something similar also happens with Hijos de Rivera, the parent company of Estrella Galicia, which has in its brand portfolio waters such as Cabreiroá, Agua de Cuevas, Fontarel and Auara; Maeloc ciders and Ponte da Boga or Quinta Couselo wines. The Galician company claims to have accelerated this diversification process last year, with the launch of Amara Brava Spritz, the entry into spirits activities such as Vanángard gin or Mucho energy drinks.

More negotiation capacity

This diversification also gives breweries more negotiating power when selling their brands to bars and restaurants. In other words, they can present all their products and market them as a complete package, according to hotel industry sources. Companies assume that with more products they gain muscle. “We sought to strengthen the company throughout the value chain: from starting our own malt houses to logistics. This gives us greater autonomy and response capacity in the market,” explains Damm, adding that it also offers “personalized solutions for each customer”.

In this process of broadening the field of action. Mahou San Miguel also launched a digital platform, called Nexho, which centralizes orders, training, information, technological solutions and management tools for hotel operations, he lists. He also points out that new businesses have their own rhythm. “Our new bets – coffee or energy drinks – are still in their early stages. » The objective, he specifies, is that “all of our innovations, both in beer and in new categories, represent 10% of our total turnover in 2030”, therefore “open to new market opportunities”. In addition, it ensures that all non-alcoholic categories – including water – already represent 30% of its activity.

“Every company has its own rhythm,” says Damm. “The commitment to soft drinks has allowed us more accelerated growth, while in catering we are committed to a more gradual and consolidated expansion”, such as the purchase of A Padaria Portuguesa in the Portuguese market, carried out through Rodilla. But they don’t want to lose their roots either. “We are and continue to be a brewery, this is our origin and what defines us. But we look to the future,” concludes Damm.