Despite rising above 2% for three months, inflation is in significantly lower values than in previous years and this has a direct impact on consumer habits: Large purchases at the beginning of the month in supermarkets are reduced and local businesses become more important.

Another key factor in this sense is a purchasing power that is not recovering and that is leading consumers to become more “rational” and make smaller purchases, experts say.

This phenomenon is reflected in various indicators, both private and from INDEC itself, which show a decline in sales in supermarkets and self-service hypermarkets compared to better performance in neighborhood or nearby businesses.

Changing habits: Supermarket mega purchases are reduced and neighborhood businesses win

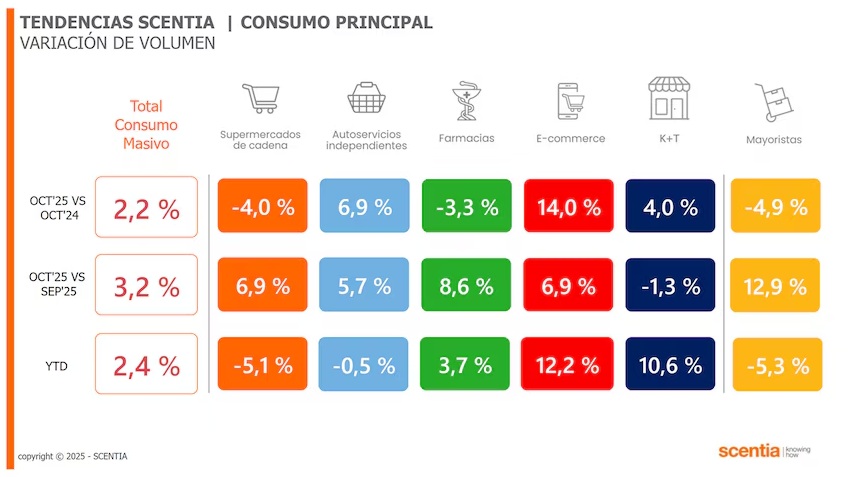

This emerges from the consulting firm’s latest monthly survey Scentia Due to mass consumption, overall sales increased in October 2.2% year-on-year And 3.2% compared to Septemberwhich confirms the trend of moderate recovery that has been observed since the middle of the year.

However, behind the total, a very heterogeneous map appears: Supermarket chains and wholesalers are still unable to recover compared to the previous yearwhile the Independent self-service, kiosks, warehouses and e-commerce are solidifying leadership positions within consumer preferred channels.

The momentum aligns with warnings from retailers and analysts in 2024: With incomes still lagging inflation and habits accelerating, People are increasingly resorting to shopping locally.

Data from consulting firm Scentia on mass consumption

Lower inflation makes planning purchases of groceries and other staple consumer goods more predictable many people who used to “run to the supermarket” to stock up and protect themselves against price jumpsthey stopped doing that in the last few months.

This phenomenon also reacts to the Loss of purchasing power. “ANDIt’s something similar to what happened in 2002, after the crisis, when people flocked to neighborhood stores. It’s a normal phenomenon: people appeal to extreme rationality and make very small purchases. And even though the supermarket is almost 15% cheaper than the neighborhood stores, they prefer to go there more often to buy one, two or at most three things,” he said iProfessional Osvaldo del RioDirector of Scentia.

Heterogeneous consumption: How each distribution channel develops

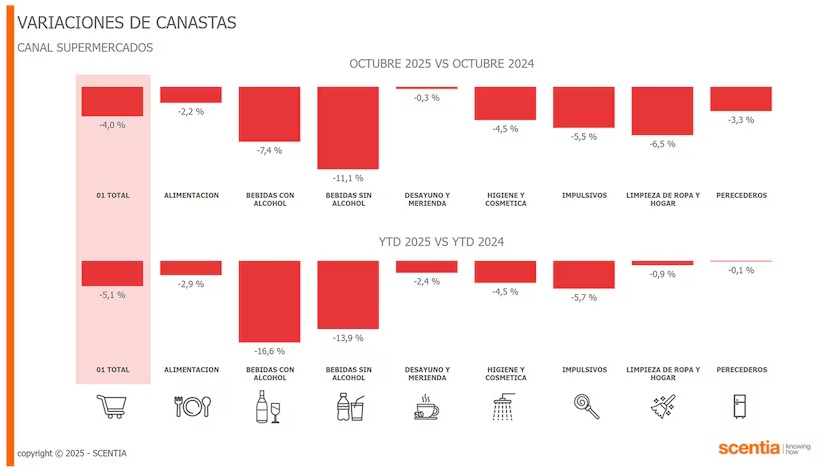

In supermarkets, all items recorded declines compared to the previous year

According to the latest Scentia report with data from October (November will be announced in the coming days) in the case of Supermarket chainsthe balance was negative again: Autumn 4% compared to the same month of 2024 and cumulatively -5.1% in the first ten months of the year. The wholesaler repeated the trend with a decline of 4.9% year-on-year And -5.3% accumulated. Both segments continue to be the segments that suffered the largest declines in all baskets analyzed.

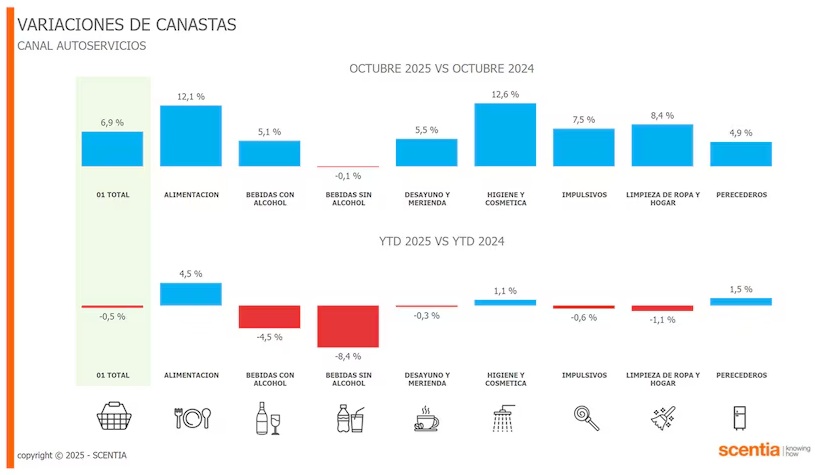

On the contrary, that independent self-service maintained a cheaper way: they grew 6.9% year-on-year and they locked up the accumulated money -0.5%which shows a much smaller drop than that of the modern canal. The PharmaciesIn the meantime, they marked -3.3% year-on-yeareven though they have a positive sum +3.7%a sign of the momentum the healthcare category continues to have.

He E-commerce once again stood out among the most dynamic segments: it was making progress 14% year-on-year and a very solid one 12.2% overalldriven by the growth of the digital channel from chains, pharmacies, perfumeries and purely online platforms. The Kiosks and shops showed an increase of 4% year-on-year And 10.6% cumulativealthough with a slight decrease compared to September.

Neighborhood stores saw positive trends for many items in October

Which products sold the most and which sold the least?

Looking at all channels together, almost all categories traded higher in October except for two: The non-alcoholic drinkswhat went down 5.1%and the Household cleaners, who withdrew 0.6%. During the year, the non-alcoholic beverage category experienced the only overall decline -2.5% between January and October.

In it modern canal -Supermarket chains-, the photo is more critical. All categories experienced volume declines, with a sharp decline in non-alcoholic beverages (-11.1% YoY And -13.9% cumulative). Those too alcoholic drinks suffered a setback of 7.4% in October and 16.6% in the first ten months. Breakfast and snack foods and perishables cushioned the decline with more moderate declines: 0.3% And 3.3%respectively.

In the independent self-servicethe panorama was almost reversed: all baskets remained positive, with the exception of soft drinks, which declined 0.1%. However, in the cumulative annual result, more items appear in negative territory – mainly beverages – which ultimately results in the overall result -0.5%.

Among the Wholesale supermarketsOctober left a complex scenario. However, non-alcoholic drinks recovered 0.9%the remaining categories closed lower. And in the ten months of the year they are all in the red Hygiene and cosmetics leads losses with a decline 11.1%.

The Scentia report confirms a pattern repeated in other private studies that fully impacts big chains’ plans: Aside from lower inflation, The Argentine consumer wants to reduce spending per ticket. prioritizes proximity, promotions and small purchases and switches to channels where it perceives a better price or greater flexibility.

The partial recomposition of revenues is still not enough to reactivate the modern channel homogeneously, while neighborhood formats, digital commerce and traditional points of sale – kiosks and shops – continue to gain ground. A trend that analysts say could continue in the coming months as consumption continues to focus on more segmented and fewer “full cart” purchases.