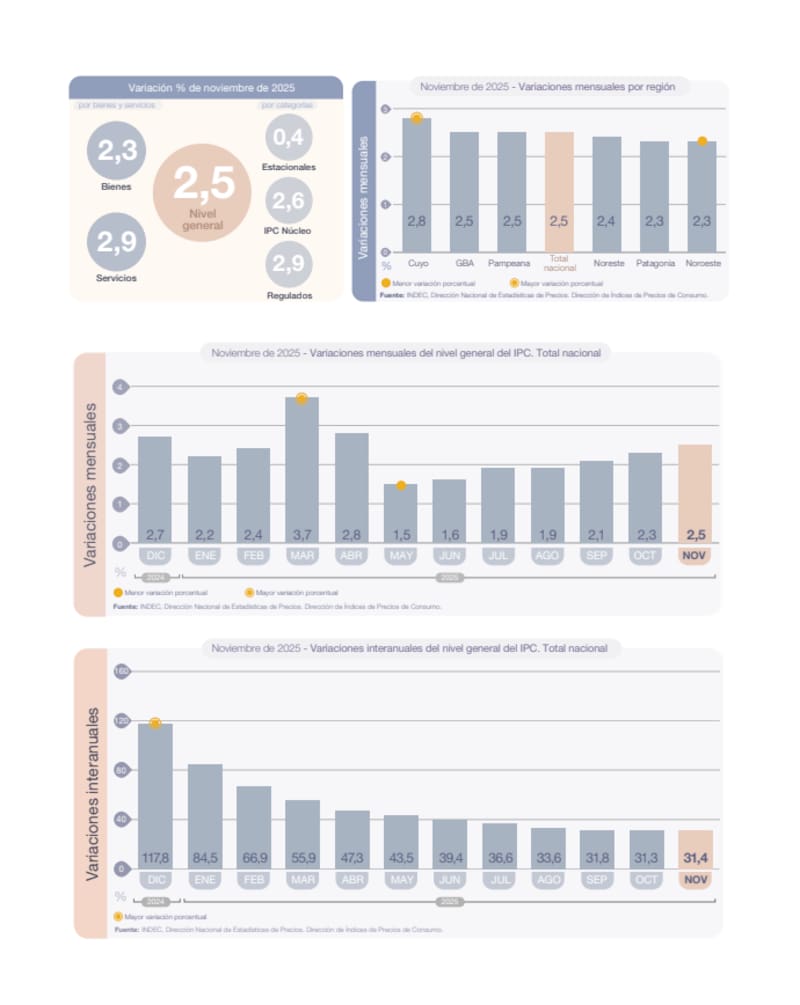

The INDEC reported that the consumer price index rose 2.5% in November, rose 27.9% for the year and has an annual variation of 31.4%.

Housing, water, electricity, gas and other fuels increased by 3.4%, transportation by 3.0% and food and non-alcoholic beverages by 2.8%. In the category table, Regulated was reported as the Driver of the Month (+2.9%), above Core CPI (+2.6%) and Seasonal (+0.4%).

Regulated vs. core: the pulse of the month

The mix of regulated rates and services boosted the measurement: housing and household fuels explained part of the increase with gains of 3.4%, and the regulated category outperformed the core. In parallel, the core moved 2.6%, a record that broke the previous slowdown. The Center for Argentine Political Economy (CEPA), a tink tank of Kirchnerian origins, summarized the table: “Core inflation data showed a higher value in November than last year: it was 2.6%.”

Energy and water prices: the political seasonality of prices

According to CEPA, residential areas in the AMBA faced average gas and electric adjustments of about 3.8% and AYSA water adjustments of 1%. This regulated trident highlighted the CPI of the month and fueled discussion of official disinflation.

Transport and fuel: the resistance of the bag

Transportation increased 3.0% nationwide. CEPA said premium petrol rose 11.5% and diesel 10.3% in November, while AMBA saw a 4.1% increase in public transport and metro was at the same level. “The introduction of micro-pricing prevents the average YPF price increase in the country from being known in real time,” the report said.

Food: meat, fruits and a rearrangement with nuances

The “Food and Beverages” category grew by 2.8% and showed heterogeneity: increases in meat and fruit were accompanied by decreases in some vegetables. In GBA, roasts rose 13.0% and apples rose 19.2%, while tomatoes fell 26.5%. CEPA attributed the pressure to the “increase in wholesale meat prices,” with increases of 19.3% and 16.7% for oxen and bullocks, as well as increases for fruit (+11.4%), vegetables (+3.7%), chicken (+5.6%) and pork (+3.9%).

Communication, health, education: variations with regulatory logic

Communication improved by 2.7%, with companies making adjustments of up to 3.0%. Health insurance was rated at 2.4%, prepaid between 2.1% and 2.9% and medication at 2.1%. Education rose 2.2%, with school fees in AMBA ranging between 2.1% and 2.8%, amid deregulation of private enrollment since November.

Various goods and services, leisure and restaurants: the rest of the board

Miscellaneous goods and services accounted for 2.5%, driven by personal hygiene, while leisure and culture accounted for 2.4% and restaurants and hotels accounted for 2.5%. The scenario suggests that consumption will not rise sharply, as CEPA warns when explaining the role of the “salary cap” and pent-up demand as a price anchor.

Regional map: Where it hit hardest Monthly variation showed spread: Patagonia and Cuyo were at the high end of the range at 2.8%, while the Northeast closed at 2.3%. Greater exposure to housing and transportation prices explains some of the difference, with Patagonia Housing up 4.7%.

Course 2025: the zigzag of disinflation

With the November data, the monthly sequence forms an arc with a low in May (1.5%) and a high in the last month (2.5%), after passing through June (1.6%), July (1.9%), August (1.9%), September (2.1%) and October (2.3%). The interannual indicator fell steadily throughout the year, but rose to 31.4% in November. The CEPA highlights the change: “Annual inflation increased its value by 0.1 percentage points compared to the previous month.”

Official narrative and market signals

The government defended forcefully Disinflation as an axis, but the Recovery after three months Cause for questions. The combination of managed tariffs, fuel, food with specific shocks and moderate consumption did not prevent the index from exceeding October. CEPA emphasized that “the government maintains the anchors associated with cost/demand: the exchange rate and the decline/non-recovery of wages.”

Products that marked the monkey’s pulse

The twenty with the highest increase included roasts (+13.0%), buttocks (+10.2%), minced meat (+9.5%), rump (+9.4%), lemon (+30.4%), apple (+19.2%), potatoes (+13.5%) and onions (+12.9%), while tomatoes in GBA fell by 26.5%. In the hygiene sector, cotton (+4.3%) and bleach (+3.2%) were added.

Trend or episode? The keys for December

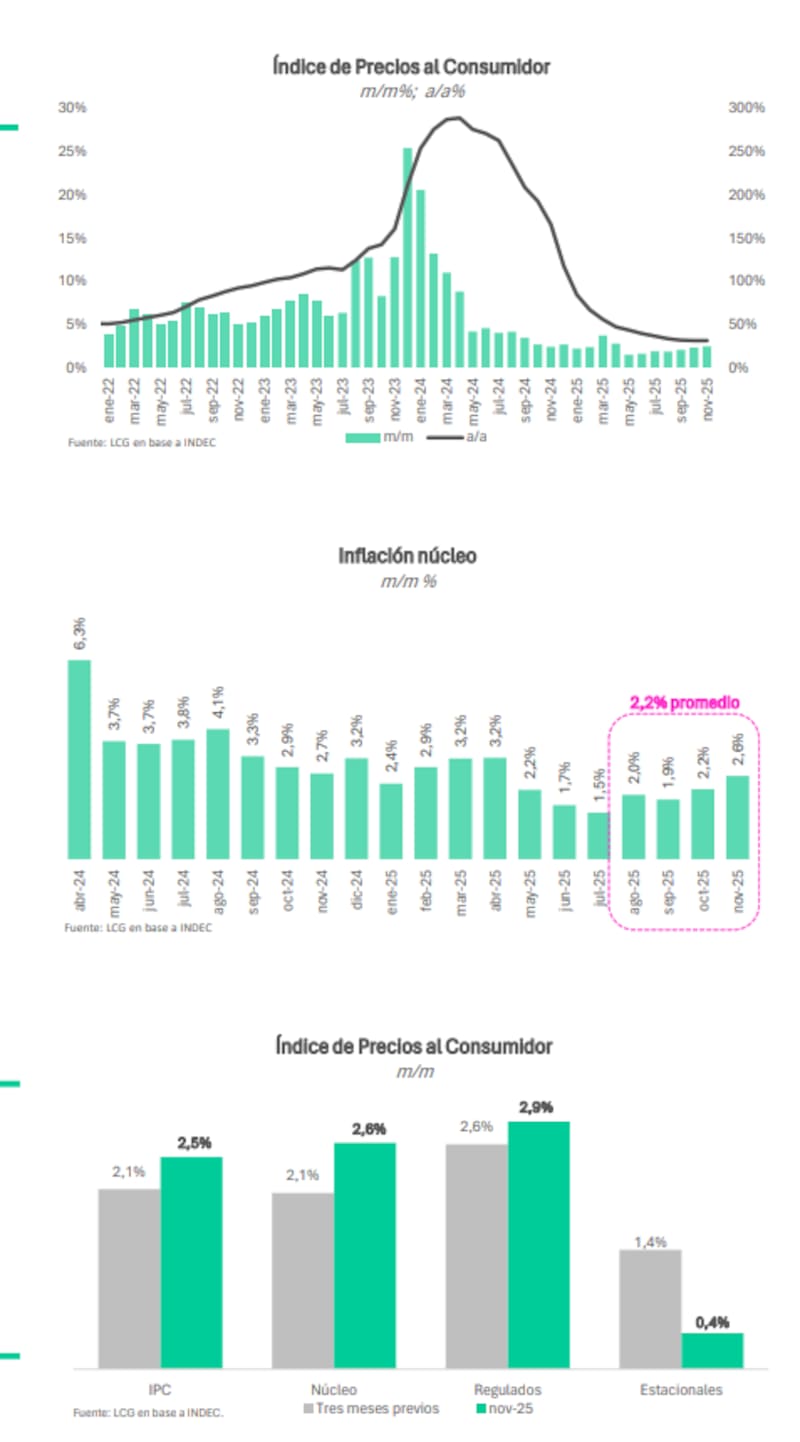

According to consulting firm LCG: “Retail inflation accelerated by 0.2 percentage points compared to October: 2.5% monthly“, and emphasized that the increase was explained “This is mainly due to the increase in core inflation: it rose by 0.4 percentage points within a month“The analysis showed that after the lower limit in May (1.5%) “General inflation accelerated every month” and that inertia continues to be a relevant factor even when activity stagnates, which “hinders convergence at lower levels“.

LCG agrees that the Regulated grew above average (+2.9%) and that the Seasonal they became slower (+0.4%), reinforcing the idea that The regulated component remains crucial in inflation dynamics.

The advisor emphasized: “For the third consecutive month, the item with the largest relative weight in the index, food and beverages, recorded a noticeable acceleration, rising 2.8% monthly in November“, driven by meat, in line with expectations in the previous survey. In contrast Dress it barely rose 0.5%,”This may be explained by the fact that it is one of the points most affected by trade liberalization“.

As for the future scenario, LCG assumes that “It is difficult for inflation levels to quickly approach below 1% in the short term“, even with weak activity and stabilized exchange rate expectations. The consultancy warned that sluggishness continues and that interest rate adjustments and the removal of subsidies envisaged in the 2026 budget could increase pressure. Annual inflation was estimated for 2026 20% measured in December.

“After bottoming out in May 2025 (1.5% month-on-month), overall inflation accelerated each month. Core inflation reached this low point in July and then returned to levels around 2%. This shows that inertia continues to be an important factor, making convergence to lower inflation levels difficult even with stagnant activity.“, Details LCG.

CEPA, for its part, assumes this a month with high seasonality due to festive consumption and doubts about the continuity of “quasi-freezing in regulated markets”. It points to an increase in prepaid bills (2.1%-2.5%), possible telecom adjustments (up to 3.0%) and pressure from meat and fruits/vegetables in the first weeks of December. The exchange rate showed relative stability. The dilemma in the official narrative is whether the anchors (salaries and dollars) will sustain the index as interest rates continue to rise.