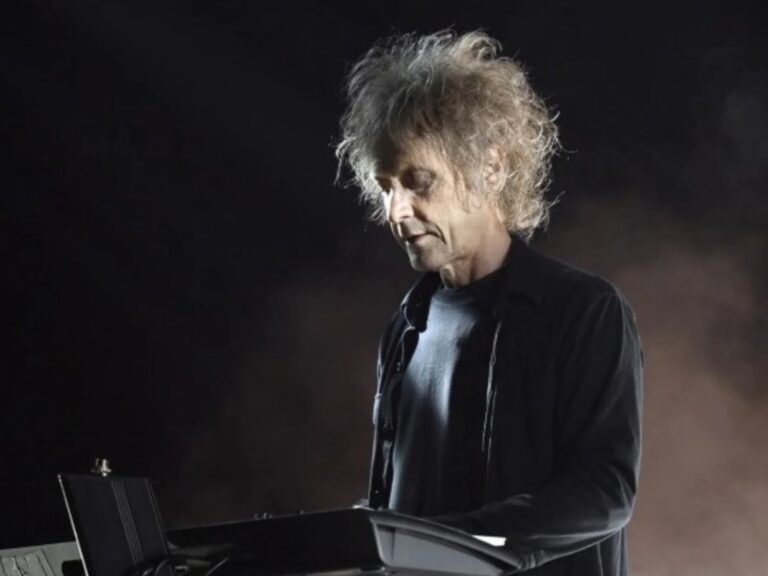

The economist, Luis Palma Stockspoke to Canal E and analyzed Argentina’s macroeconomic scenario, the behavior of the dollar, central bank reserves and country risk. He also warned of market volatility and stressed that compliance with current guidelines is crucial to maintaining financial stability.

“There is a lot of volatility in the forecasts,” explained Luis Palma Cané. In this sense, he explained that his calculations are based on the assumption of continuity in the economic course: “What we have.” obviously deviates from the budget and it’s pretty close to the compilation that Latin Focus does very well.”

The true inflation number for 2026

Regarding inflation, he differentiated the official forecasts: “I believe that the issue of inflation, all these figures are based on that.” Current policies are being followed and structural reforms are being undertaken“In that scenario, he expected inflation to happen for us.” It will be more than 10% of the budget“, and specified: “I would say that I should go.” between 20% and 30%“.

Regarding the dollar, Cané warned of the different forecasts. “The budget sets a level for December next year smaller than the current1,425 versus 1,450,” he noted, but clarified that private polls show a different trend: “The median is heavily corrected and consequently.” There are predictions of around 1,700 to 2,100“.

Dollar estimates for the end of 2026

He continued that the exchange rate will depend on the management of reserves: “We believe we will rely on that.” how reserves and the exchange rate are managed“In the same vein, he stated: “I think we can think about a dollar by the end of next year.” between around 1,700 and 2,000“.

Regarding country risk, the interviewee explained that the key will be on the external front: “From our perspective, the key point is country risk It will go through all of these numbers.However, he added: “It is also very important the issuance of reserves and the possibility of taking on debt in foreign markets.

At the same time, he emphasized that reducing country risk depends on the final solution to the reserve problem: “It will come to the point where we solve it once and for all.” the question of reservations“Whether we buy through issuance or not through issuance.”