There’s only a little time left to take the photo End of the yearwhich defines who must submit and pay the annual declaration Personal wealth tax 2025. Although the affidavits expire in June next year, i.e. December 31st It defines the assets that are taxed and those that are exempt from tax..

There are two types of statements:

- Those that must be presented by those who are registered for the tax and by those who must pay it despite not being so;

- Employees in a dependent relationship to the extent that the gross salaries received this year exceeded the amount of 196,963,134 US dollars.

While price indices spread (CPI)resulting in an estimated annual variation of 31.31%, which requires official ratification ARKthe following is determined non-taxable minimum amounts:

- The general floor that must be exceeded for payment is $384,728,044 for total assets

- The taxpayer’s minimum home value would be $1,346,548,155. If this value is exceeded, the excess must be stated in the affidavit.

ARCA must publish the resolution with the Car reviews and offers. As for them hold dollars The official offer, buyer type, dated December 31st must be taken into account.

Those not shown in the photo are those taxpayers who chose to pay the relevant tax five years earlier.

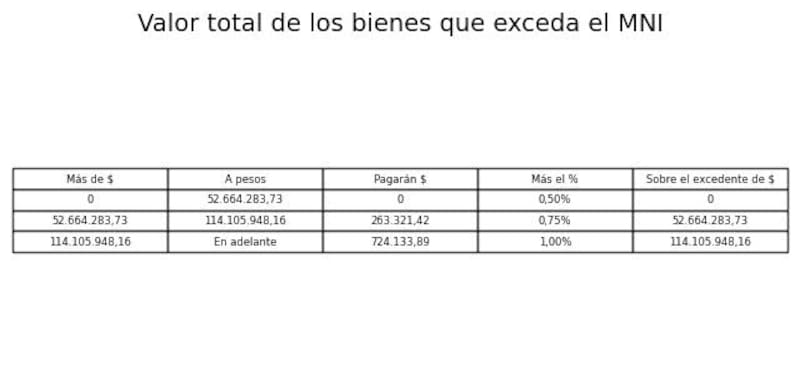

The Scales of progressive tariffswhich, according to the law, will be reduced by 27,743 this year compared to the previous year, would look like this:

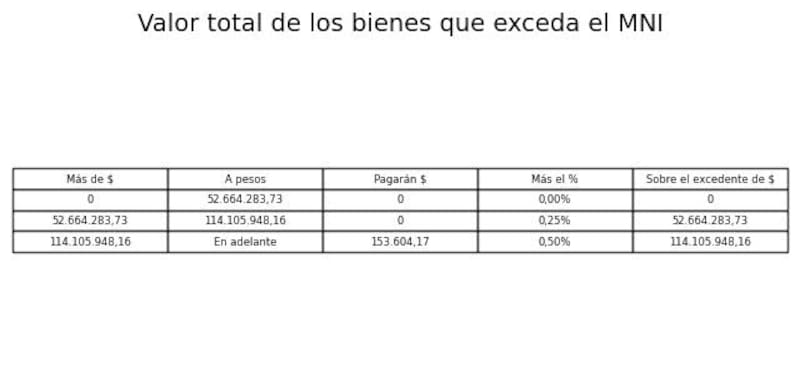

For the Taxpayers who have registered as compliantthe aliquot tables look like this:

Personal assets: everything you need to know about taxes

Personal property is a tax It applies to assets located at home and abroad in the estate. until December 31st of each year.

If the total value of the taxed asset for each tax period exceeds the established minimum amount from which the tax is levied, you must register with ARCA and submit an affidavit specifying the amount to be deposited by the due dates established for the month of June.

This amount results from applying a tax rate to the value of your assets that is higher than the minimum tax-free tax rate.

To whom does the personal wealth tax apply?

- Domestic residents and undivided inheritances for assets located at home and abroad.

- Persons resident abroad and undivided inheritances located there for assets located domestically.

- Undivided inheritances are taxed on their assets from December 31 of each year, provided that this date is deemed to be valid in the period between the death of the person for whom the undivided inheritance begins and the declaration of heirs or the date of declaration of the will fulfilling the same purpose.

Which assets are taxed under personal wealth tax?

- The estate based at home and abroad.

- The real rights to goods based at home and abroad.

- The Ships and airplanes Domestic and foreign registration.

- The automobile patented or registered at home and abroad.

- The personal property registered in the country.

- The personal property of the apartment or temporary residence if the apartment or place of residence was in Germany. The program automatically calculates a 5% guess on the encumbered asset.

- The personal property of the personif he had his residence in Germany or stayed there.

- The other personal property and property who were in the country as of December 31st of each year, even if their situation was not permanent.

- He Money and cash deposits who were in the country as of December 31st of each year.

- The Titles, shares, quotas or social investments and other securities Representatives of the share capital or equivalent capital issued by public or private entities if they have their registered office at home or abroad. Company interests do not apply because they must be registered by the company as the representative responsible.

- The Assets of companies or sole proprietorships located in the country.

- The virtual or digital currencies, crypto assets or similar.

- The Creditsif the debtor has his actual place of residence in Germany.

- The Property rights of a scientific, literary or artistic nature, those of trademarks or trademarks and the like, patents, drawings, models and reserved and remaining designs of industrial or intangible property, as well as the derivatives thereof and the respective licenses, if the holder of the right or, if applicable, of the license was resident in the country as of December 31 of each year.

- The movable property and livestock (able to move independently) and located outside the country’s territory.

- The Deposits in foreign banking institutions.

- The Negotiable securities issued by a company which borrows significant long-term capital from the public and divides its debts to each investor into equivalent securities, called notes and bonds, issued by corporations or companies based abroad.

- The cIncome whose debtors are resident abroad.

Which assets are exempt from personal wealth tax?

- The assets of the Members of foreign diplomatic and consular missionsand their employees and family members, to the extent and with the limitations established by applicable international conventions.

- The Capitalization accounts, which are included in the capitalization system, and individual accounts, which correspond to private pension insurance plans of companies subject to the control of the National Insurance Superintendency.

- The social contributions of the Cooperatives.

- The intangible assets (Keys, trademarks, patents, franchises and other similar assets).

- The Goods covered by the franchises of Law 19,640 (Tierra del Fuego).

- The rural property whose owners are natural persons and undivided heirs, regardless of their destination or affection.

- The Titles, bonds and other securities issued by the Nation, Provinces, Municipalities and the Autonomous City of Buenos Aires and CEDROS.

- The Deposits in Argentine and foreign currency in institutions included in the regulation of the Banking Law, for a fixed period, in a savings account, in special savings accounts or in other forms of raising funds in accordance with the provisions of the BCRA.

- The negotiable bonds issued in local currencyas long as they comply with the requirements of Law 23.576.

- The Instruments issued in national currency to promote productive investmentestablished by the national executive.

- The Shares in investment funds as well as participation certificates and securities Representatives of fiduciary debts of financial trusts placed through a public offering approved by the National Securities Commission, the principal assets of which consist of at least 75% tax-exempt assets and deposits.

- The Properties to be rented out as a residence, with properly registered contractsif the value of each property does not exceed the minimum non-taxable value corresponding to a living space.

We would like to get to know you!

Register for free at El Cronista for an experience tailored to you.