- Strategic turnaround

- Abundance with low prices

Against the backdrop of strong dollar commitments, the historic 2025/26 wheat campaign brings some relief to the economic team, which must more than cover maturities $7.7 billion in the first two months of 2026.

In response to the signals given by the government during the year and the reduction in the export duty rate (DEx). 9.5% for the 7.5%The industry responded in December larger exports; an increase in foreign exchange settlement great harvest the 2025/26 campaign.

Argentina faces extreme exchange rate pressure in early 2026. According to the economist’s forecasts Fabian MedinaIn the next two months, the demand for foreign exchange will increase $7.73 billiondriven by a combination of payments to bondholders, commitments to international organizations, the IMF and the seasonal outflow of tourism abroad.

In this “foreign exchange shortage” scenario, the contribution of wheat appears as a partial lifeline to the financial bridge that the team led by Luis Caputo must build until gross foreign exchange income around the end of March 2026.

Hand in hand with a production that goes beyond all brands 27.7 million tons (Mt)the Rosario Stock Exchange (BCR) reestimated deliveries for December 2.48 mtan absolute record that doubles the previous year’s volume and exceeds the previous high from 2021.

According to private sector estimates, the wheat complex will be able to liquidate as a whole between December and February 1500 million US dollars; The figure becomes predominant in the adjusted reserves panorama.

According to Medina, the Treasury would barely have time to get through the summer season 1500 million US dollars: for this reason, “we would be missing something U$s 6230 million”, Project.

Strategic turnaround

To achieve this flow, Argentina has sacrificed price for volume and recorded the most competitive FOB value in the world (US dollar). 198 – 205 us$/t); At this value, wheat sales in December would reach $500 million.

The report prepared by economists goes beyond the contribution to the central bank Matías Contardi, Franco Pennino and Emilce Terrémarks the “strategic” movements in the operational area.

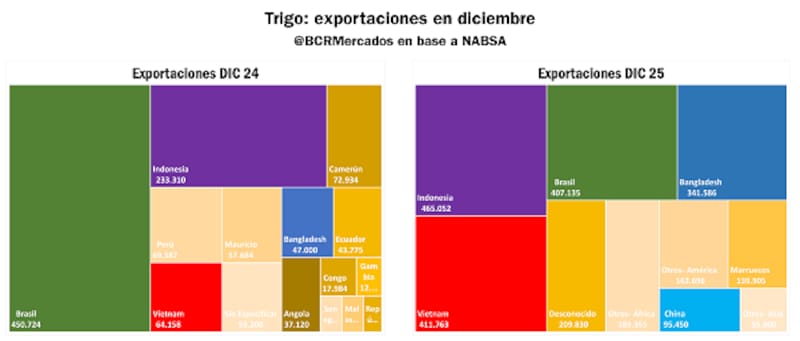

First of all, this “Turn to Asia” to destinations such as Indonesia, Vietnam and Bangladesh, which already account for half of monthly shipments.

On the side of ChinaThis month it was announced that Argentina was again buying Argentine wheat after three decades, attracted by local competitiveness compared to Australia.

At the same time, the report highlights the displacement of Brazil as the main buyer of wheat from Argentina. For the first time, distant destinations are outperforming Mercosur’s main partner, which fell to third place on the buyers podium.

Abundance with low prices

Despite export successes, the international market presents challenges. Seven of the eight main exporting countries (including Russia with 88.8 million t and the EU with 144 million t) had this excellent harvestswhich sets a “ceiling” on prices.

For Argentina, this global abundance means that foreign currency settlements will depend on the currency more than ever Speed and agility of shipmentssince price competitiveness is the only way to place historical surplus in an oversupplied world.

We would like to get to know you!

Register for free at El Cronista for an experience tailored to you.