The presentation of the “work modernization” bill by the government of Javier Milei brought this into focus again tax burden that comes before that Apartment rental and its impact on the Profitability of real estate investments. The study also compares it to profitability, which a fixed term.

The proposed changes include the Exemption from income tax for income from the rental of real estate intended for residential purposes.

A report from Argentine Institute of Financial Analysis (IARAF) analyzed how the tax structure affects rents today and what changes would occur if profit elimination were approved for this type of income.

The official aim of the measure is to improve the profitability of the sector, promote investment and increase the supply of rental housing.

What tax burden does a renter pay today?

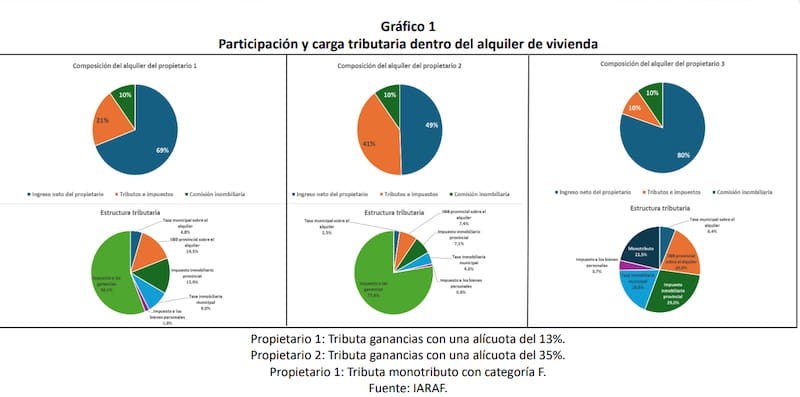

The study is based on three witness cases from owners who each own five houses a monthly rent of $550,000 per unit and a property value of $70,000. In all cases, the intervention of a real estate agent is assumed, who charges a commission of 10%.

The first case corresponds to an owner registered in Profits who pays taxes effective rate of 13%. Secondly, to a taxpayer with other income who is affected by the tax return Marginal rate of 35%. Thirdly, to an owner who only receives rental income and is registered in the mono-tax system.

According to IARAF, in the first case the total tax burden – plus national, provincial and municipal taxes – amounts to 20.8% of the rental value. In the second case, the tax burden increases to 40.6%, mainly due to the impact of income tax. With the Monotributista, the tax burden is reduced to 10% of income.

In the first two profiles Profits explain the majority of the tax burden: 56% of the total in the first case and 77% in the second. In the mono-tax system, however, the state property tax and the tax component of the simplified system itself predominate.

How high is the profitability of a rental?

With the values adopted in the report, The annual gross rental yield is 6.46% in dollars. Discounted once Real estate commissionprofitability drops to 5.8%. After deducting taxes, the annual net return is 4.47% for the owner who pays a 13% profit tax and just 3.19% for those struggling with the 35% tax rate. He Monotributiston the other hand, achieves a net profitability of 5.17%.

What changes if the result is eliminated?

If the income tax exemption for residential rentals is approved, the overall tax burden for owners registered in the general system would be significantly reduced. According to IARAF in this scenario Taxes would only account for 9.1% of the rental valuewhile the owner would keep 80.9% of the income, compared to less than 50% in some current cases.

With the reform The annual net rental return would be approximately 5.22%. both for self-employed people and those who are currently paying the maximum profit rate. In the case of the monotributists, there would be no relevant changes as they would continue to pay the simplified scheme unless they decide to switch to the general scheme.

Rent vs. fixed term in dollars

The report also compares fixed term real estate investments in dollar terms. In the current situation a Annual income of 5.25% for a limited periodtaxed at a rate of 35% of profits, gives a net return of 3.41%, similar to that of a rental achieved at the maximum rate.

However, if the rental income exemption is approved, The profitability of the property would be more than 50% higher than the fixed term that continues to pay taxes. In a scenario where both instruments were tax-exempt, the returns would again be the same, with a corresponding increase in net income in both cases.

We would like to get to know you!

Register for free at El Cronista for an experience tailored to you.