While labor reform is being discussed, many companies have already taken measures in the employment sector. So far there are such things in Javier Milei’s management 419 fewer jobs per day and the closing of 20,134 companies. Given this scenario, the industry, which is one of the most affected sectors, is expecting one “difficult” summer with major lockdowns and redundancies.

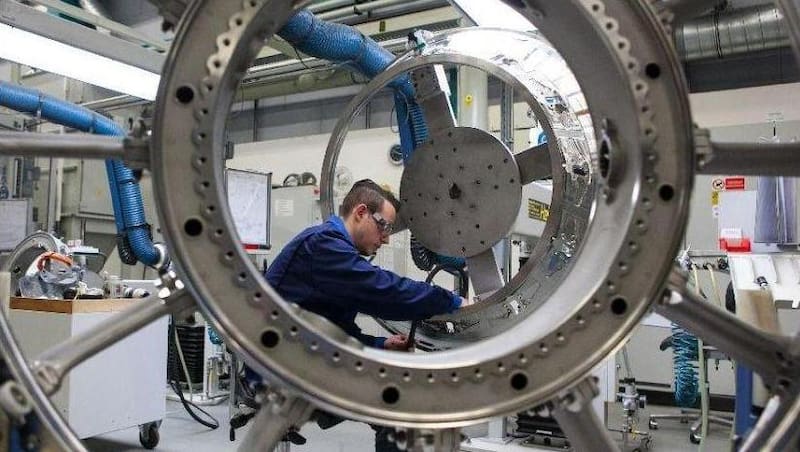

With a decrease compared to the previous year of 4.2% and a monthly contraction compared to October 0.5%The metallurgical industry recorded the lowest percentages in the historical data series in November and November Warnings are increasing, especially among SMEs.

The report from Adimraalso highlights that the installed capacity he withdrew 44.4% and there were no signs of a short-term trend reversal. “It’s been a year Deterioration of the metallurgical production structurewith an import level of over 70% year-on-year, i.e To emerge from this extremely worrying scenario, a comprehensive industrial policy is required. for Argentine SMEs.”

Given the closure of 20,134 companies from the vote November 2023 and September (from 512,357 to 492,223), reflecting the loss of 30 employers per day 280,984 positions Work (from 9,857,173 to 9,576,189), accordingly 420 registered employees less per day since the inauguration of La Libertad Avanza, according to the Center for Argentine Political Economy (CEPA).

The measures taken by the government of Javier Milei had a big influence heterogeneous to the economic actors. If the model is “winner” vs. “loser” it deepens for 2026, could jeopardize further jobs.

spend the summer

“Our employees are family,” confirmed an industrialist from Lanús, in the province of Buenos Aires, but assured that he would have to do so in January Staff laid off because the situation “cannot continue” as he fears that the “ball” of obligations is getting bigger and bigger.

“Nobody wants to say goodbye before the holidays”he explained, assuring that this was “the last resort” after a series of “anti-crisis” measures had been implemented.

The case is one of those that makes it to the executive suites of the USA Argentine Industrial Union (UIA), where the situation of the industry characterized by a “Slow activity, job losses and difficulty maintaining production in certain sectors”is axis.

At a meeting with Luis CaputoMinister of Economics, and Pablo LavigneMinister of Industry and Production, Martin RappalliniHead of the UIA, raised the industry’s concerns and shared possible measures will go through a “challenging” phase until 2026.

The data that arises from it Oversight of occupational risks (SRT) show that the industry is one of the sectors most affected by the decline in activity 2,122 fewer employers and 59,127 sick leaves, in the first 22 months of managing Milei.

The decline in consumption and the “abrupt” opening of imports, which was only necessary for metallurgical products in October $2,656 million which corresponds to an increase of 33.4% in tonsthey sketch a complex scenario.

The contradiction This affects a large part of the local business community, which celebrates the decisions of the Caputo-led cabinet and the deregulation of Federico Rumpfenegger “Juggle” to pay out bonuseswas reflected in the last meeting Propymes which was organized by Techint Group days ago.

After enthusiastically applauding the minister Patricia Bullrich Who uncovered this? Benefits that labor reform and then tax reform will bring in dialogue with Paolo Roccawho addressed the negative impact of incorporating Chinese products into value chains, Participants asked, “And in the meantime?”

Less staff and prayers for recovery

According to the latest survey by UIA Study Centerin November, the 21% of companies confirmed that they have already reduced their workforce. In addition, given the decline in production, an increase in Use of other adjustment measures such as reducing shifts and suspensions.

Domestic demand has consolidated Main concernmentioned by 40% of companies, while a 47.4% saw their billings decline.

William friendPresident of the Argentine Chamber of Electronics, Electromechanical and Lighting Industries (Cadieel) explained that companies in the sector are “expectant” Avoid making relevant decisions They are waiting for a positive demand response, which they trust will happen soon.

With reference to employmentIn the face of an uncertain scenario, caution prevails in the economy. According to Cadieel, expectations for the third quarter of the year fell: 78% plan to retain their workforce and a 22% expect their work team to be downsized.

The impact of trade liberalization in a recession scenario is remarkable. An example of this phenomenon is that one of the largest courier companies tapping into the boom in overseas purchases increased its square footage fourfold last year not a single new job created. In contrast, job losses are increasing across the entire industrial chain 150,000 jobs over a total of more than 300,000 in almost 2 years.

Accordingly Daniel RosatoHeads of Industriales Pymes de Argentina (IPA), are the sectors most affected Metal processing and industries related to the textile and footwear industry, affected by the increase in imports. Instead this Electric intensive, less dependent on permanent staff, show greater resilience.

Although the government and business leaders expect labor reform to be a driver of job creation, negative phenomena have emerged. On the one hand, higher number of layoffs as part of flexibility and at the same time Postponement of new hires in the sectors with the best dynamics.

Anti-crisis strategy

The survival strategies of SMEs are drastic: Some embark on conversion and importation, others shrink, and one group begins to plan emigrationBe Paraguay It is the preferred destination due to the low tax burden and the advantages of the “maquila law”. The transition from factory to importer means a significant loss of local jobs. Reduction from 50 to 10 jobs per companyvarious business people agree.

Elio Del RePresident of Adimra, agreed on the “very complicated” perspective and pointed out that “the amount of staff employed does not correspond to the demand.” At the same time, he made it clear that “layoffs contradict the industrial logic of job creation.” The average seniority in metallurgy is 15 years said and marked that It requires skilled labor and training, which takes time and effort.

That’s why, despite the accumulated red numbers, the industrialists still remain They delay the dismissal of employees However, he did not rule out that the decision would be made hastily after the end-of-year celebrations If there is no industrial policy that stimulates domestic consumption, the recovery in demand will only lead to a “decline” in imports.

Another sector in crisis is toywhere manufacturers are expected to make adjustments at the end of the Three Kings season. So far, the operation has seen a 20% reduction in labor costs under the current government. Although no immediate mass layoffs have been identified, there has been a decline 1,600 direct and indirect positions due to non-renewal of retirements or resignationsand the end of outsourcing various processes. At the same time, 300 toy stores gave up street sales and switched to the online channel.

The activities most affected by competition from imported goods, such as: Clothing, shoes, food And household appliances They assume that there will be layoffs in the industry “spiralize” after the holidays and focus on Buenos Aires Province.

The definition is crucial, the suburbs are home to all kinds of industries and it is precisely those not associated with the “hot” sectors such as agriculture, energy and mining that are in crisis due to the decline in consumption.

These activities associated with mass consumption are “The Wedding Duck” and they identify with those who are “Payment of adjustment.”

Even the ones that have links Dead cow They claim that the purchase agreements for the next two years are compatible with the national oil company They distributed 85% to suppliers in China.

This panorama also influences the activity of Cargo transportation. Cristian SanzPresident of the Argentine Federation of Road Transport Companies (FADEEAC), assured: “Everything indicates that the economy will continue to be characterized by strong heterogeneity in 2026.”

As in 2025, the sector’s performance varies significantly depending on the sector and geographical area, he clarified.

“The panorama is much more complex in terms of movement Food and consumer goods for the household, such as: B. white goods“, he said, pointing out that “we see few signs of recovery in these segments, to which is added the decline of national manufacturing companies against the background of a strong opening of imports.”