The government-sponsored labor reform provides for a reduction 3% on employer contributions and also lowers the rate of Income tax that companies pay maximum 31.5%among other things, cuts Steer which significantly reduce business costs.

Within this framework, the specific analysis of the fiscal costs of the project that the Executive sent to the Senate this week Argentine Institute of Financial Analysis (IARAF) In particular, he examined which national taxes would be abolished if the proposed approval were adopted.

Labor reform: which national taxes will be abolished if the project is approved?

“Given the recent delivery of Project to modernize the world of work from the national government to the Senate, which includes the Elimination from certain national taxesIt is interesting to compare the changes that would occur in the 2025 Tax Vademecum released in May. “Specifically, it is about what the Vademecum would look like if the bill were adopted,” says the IARAF report.

And he clarifies that “the IARAF Tax Vademecum is not a mere list of all taxes existing throughout Argentina, but but a list of the different types of taxes identified according to the different taxable events recorded.”.

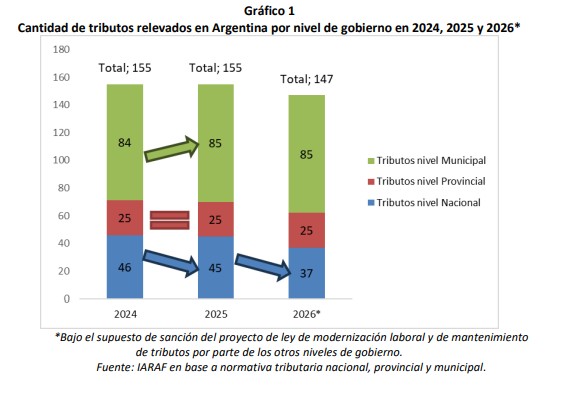

This is specifically mentioned in relation to the draft law that the government submitted to the Senate “Proposes the abolition of 8 national taxes.” “In fact, at the national level, if the bill is adopted, There would still be 37 different taxes remaining, a proportional decrease of 18% of the inventory. Therefore, if in 2026 the other levels of government maintain the same level of taxes, Total taxes would be reduced from 155 to 147.

Based on the analysis of the 2025 tax legislation, IARAF determined the existence of 155 different tax types across the country. These taxes include Taxes, fees, contributions and duties. At the national level there were according to their criteria 45 taxes.

And he examined which eight taxes will be abolished if the Work Modernization Act is passed as presented:

- Tax on cinema tickets

- Tax on recorded videograms

- Tax on audiovisual communication services

- Tax on luxury items

- Tax on motor vehicles, motorcycles and boats

- Tax on recreational or sport boats and aircraft

- Insurance tax

- Tax on cell phones and satellite phones

National taxes will rise from 45 to 37 if the labor reform is adopted

Which taxes are levied the most at the national level?

Based on the labor reform project and the possible abolition of the above taxes, The IARAF analyzed the current tax situation and checked the weight of the most important taxes.

“Looking at the years 2024, 2025 and 2026 with the passage of the bill, it appears that the non-extension of the PAIS tax this year brought a reduction to which the 8 specific taxes that the national government proposes to abolish. In this way, compared to 2024, national taxes collected increased from 46 to 45, provincial taxes remained at 25, and Council taxes rose from 84 to 85” he remarked.

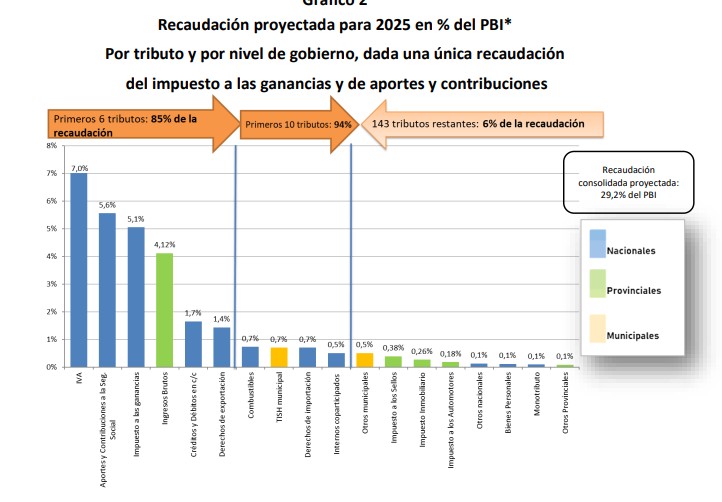

“Regardless of the variety of taxes identified, effective collection by all levels of government in Argentina focuses on relatively few taxes,” he added.

The weight of various taxes in the collection of the state

And he explained: “Considering the forecast for 2025 VAT, contributions and social security contributions, profits of individuals and companiesProvincial tax on gross income, tax on bank debits and credits and export rights would generate 85% of Argentina’s consolidated tax revenues.”

“If you add the fuel tax to the six taxes mentioned, the municipal safety and hygiene tax (TISH), import duties and domestic taxes shared, It is clear that 94% of Argentina’s consolidated revenues are concentrated in ten taxes. Eight of these are national, one provincial and one municipal,” the report concludes.

Specifically, the possible adoption of the labor reform, as the government has announced, will bring with it a reduction in some taxes. Although its weight in the survey is not high, the ruling party points out that lower costs for companies will lead to greater formal job creation.