Addressing investors, the vice president of the central bank said, Vladimir Werninghighlighted the post-election financial normalization and assured that the previous volatility was not related to the economic regime but to “politics”. In this sense, he referred to the non-purchase of reserves.

This was stated by the official during the presentation “Argentina 2025: Overcoming the black swan, the strength of the economic regime is confirmed: Impact, monetary response and financial normalization after the political-electoral shock on money demand” at the LarrainVial AMI International Investors Seminar.

“Financial normalization shows that this was the case a shock of political expectations that was not fulfilled (and there were no factors attributable to the economic regime),” said Werning, listing the changes observed after the October elections:

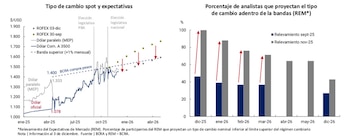

- Speculative demand for dollars and foreign exchange hedging is declining rapidly without any announcement of a change in the economic regime: there was a reversal in the dollarization of portfolios of $8.4 billion and a reduction in retail hoarding to $200 million per month

- Exchange rate expectations (both from the market and analysts) show an increase in the credibility of the exchange rate band regime. Only in April 2026 would the upper limit approach the $1,600 mark.

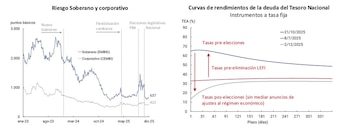

- The level and volatility of overnight interest rates and government bond yields fell below the levels prevailing in LEFIs.

- Confidence in Currency Competition: Savers who shifted their portfolios toward dollars did so by keeping their savings in the banking system

- There is a sudden end to the attitude of wait and see Companies and the immediate reopening of the corporate financing market

In this context, Werning assured investors: “It was the policy (… and not the reserve purchase policy): country risk was normalized after the election without any change in the reserve purchase policy.”

Likewise, he judged: “It was the policy (… and not the policy of abolishing LEFIs): interest rates were normalized after the election, without changes to the currency/exchange system.”

However, he said that “given risk aversion, money demand usually increases (cash is king) and the monetary response is expansionary. On the contrary, in 2025, Argentine monetary policy should have been restrictive because money demand fell (Dollar is king)”.

Werning admitted that “the BCRA has severely restricted liquidity (accepting currency by increasing reserve requirements) given the decline in money demand.”

It should be emphasized that the Copernican turn, which implied financial support from the USA, was not mentioned. These included the purchase of pesos or the sale of dollars by the North American Treasury and the exchange for $20,000 million, of which $2,510 million was “activated” in October.

In another part of his presentation, the BCRA Vice President outlined his outlook for next year. “In 2026, monetary policy will complement several favorable factors, while remonetization will ensure several economic objectives without conflict,” he indicated, adding that this will be determined by money demand.

When it comes to debt strategy, Werning’s roadmap for the coming year includes access to external markets.

On the other hand, Werning referred to the structural reforms and emphasized the support that had been received in the elections for their implementation. As a result, “the composition of Congress favors the approval of the projects.”

According to the official, these aim to improve institutionality, deregulate, rationalize and modernize the state, reduce costs, improve productivity and reduce informality:

- State budget 2026: After two years of extensions, the “law of laws” submitted to Congress is expected to be passed.

- Tax innocence: Reduced burden of tax compliance (simplification, appropriate controls, rationalization of the criminal tax system, simplified declarations) and source of repatriation of residents’ savings.

- National commitment to fiscal and monetary stability: Budgetary, fiscal and monetary rules to create balanced budgets and prohibit monetary financing.

- Work modernization: Reduction of compensation costs, establishment of a labor support fund to finance layoffs, dynamic salaries, hour banks, vacation sharing, restrictions on the right to strike, negotiations by companies on activities, simplification of labor and trade union relations.