December brought unexpected relief for those who use the subway every day. This is not a rate freeze or government support, but rather an unprecedented war between banks and digital wallets that are returning 100% of the trip value. The result is simple: If you pay with the right card or app, you get past the turnstile without paying a cent.

The classic SUBE faded into the background. Today the real difference lies in this What medium do you use to support the reader?not how much credit you have. Almost all financial institutions have jumped on this wave of benefits, but what determines whether you really get free travel all month are these Refund Limitswhich vary depending on the bank.

The photo of the market shows three clearly marked tiers: an elite group that covers most trips, an equally competitive intermediate segment and a general train that guarantees free mobility for a significant part of the month. The right choice can represent Free travel for whole days.

And best of all: all actions work dailywith no restrictions on schedules or specific days. If you have the plastic or the specified app, the subway may cost you $0 every day of the month.

The “$15,000 Club”: the three giants who rule the underground

At the top of the ranking is the strongest trio of the month: Banco Galicia, Mercado Pago and Mastercardthe only companies that offer a refund $15,000 monthly for subway rides. This is the maximum available and is sufficient to cover virtually all labor mobility in December.

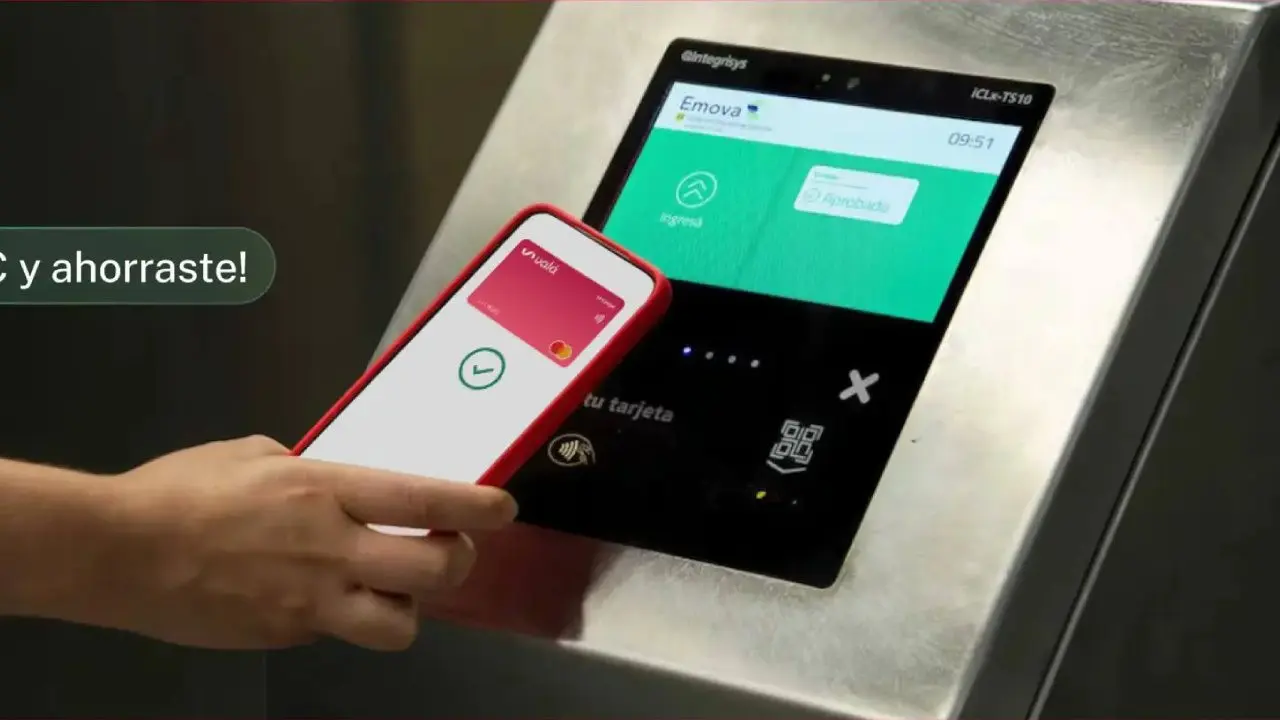

Galician bank demands payment no contacteither with the contactless debit card or with the mobile phone NFC. The process is identical to using the SUBE: you support and pass. The difference is that the bank will refund 100% of the trip value up to $15,000. For customers from Galicia it is the most direct and convenient option.

Payment market corresponds to the offer but with a different modality. You have to pay here exclusively with QR. The user has to open the app, scan the turnstile code and only then cross. It is an additional step but allows for the same maximum benefit. Due to its size in the AMBA, it is one of the most used promotions.

The third pillar of the “elite club” is MasterCardwhich provides a network advantage regardless of the issuing bank. If your Mastercard card is contactless or loaded with Google Pay or Apple Pay, you can get a refund of up to $15,000, regardless of bank. It is the ideal alternative for users who are not customers in Galicia or who have already exhausted their limit at Mercado Pago.

Banco Nación and the mandatory QR: the challenger that takes its place

Appears in the second step National Bankwhich is positioned with a refund of 100% and a monthly limit of $12,000. It can’t compete with the top performers, but it far outperforms most of the market and offers dozens of free rides.

The technical condition is crucial: payment must also be made QR use BNA+ or associated wallets like MODE. This requires the app to be open before you arrive at the turnstile, especially during peak hours, but it allows for significant savings that extend over much of the month.

The $12,000 cap was designed for frequent subway users. With this amount, an average worker can travel virtually every two weeks for free and a student can cover all of their monthly consumption without paying.

The fact that Banco Nación is introducing the QR as an exclusive method shows a profound change in public banking: it is leaving behind the traditional physical card and pushing its users towards a digital ecosystem aligned with the new validators of the Buenos Aires metro.

The $10,000 train: a safety net to finish the month for free

The largest corporate group offers a monthly refund of $10,000enough to cover between 20 and 25 free rides. In this quantity there are Santander, ICBC, Supervielle, Banco Comafi, Brubank and Banco Ciudad.

The methodology is the same for everyone: NFC or contactless payment. The passenger supports the card or mobile phone and the fare is automatically deducted, which is then 100% refunded until the limit is reached.

The benefit is completed with the network VISAwhich provides a generic limit of $10,000 Pay contactless, regardless of the issuing bank. For many users, it acts as an ideal “wild card” to continue traveling for free when the highest limits have already been exhausted.

The perfect strategy for December is simple:

- First exhaust the limit of $15,000 (Galicia, Mercado Pago or Mastercard).

- Then go to $12,000 from Banco Nacion.

- Complete the month with the options $10,000 of the general train.

With minimal planning, this is entirely possible Not having to pay a single subway ride for the entire month of December.

Technology on the platform: NFC vs. QR, the key to making the discount work

If you want to travel for free, you have to use the right technology. The new roles have two systems: a NFC/contactless reader and a QR reader. Each bank explicitly states which method it uses and which method it uses lose the refund.

He NFC It is the fastest option. All you need is your contactless card or your mobile phone with Google Wallet or Apple Pay activated. They lean on the reader and pass in less than a second. It is the system of Galicia, Santander, ICBC, Supervielle, Comafi, Brubank, Ciudad, Mastercard and Visa.

He QRselected by Mercado Pago and Banco Nación, requires opening the app, selecting “Pay with QR,” scanning the reel screen and then proceeding. It’s not as fast as NFC, but it’s the only way to reach the limits of those two units.

The conclusion is simple: December is the month in which the SUBE is temporarily decommissioned. If you have NFC or QR enabled, the subway can be completely free. All you need is the right card, the right payment method and most importantly the right order to take advantage of every limit.