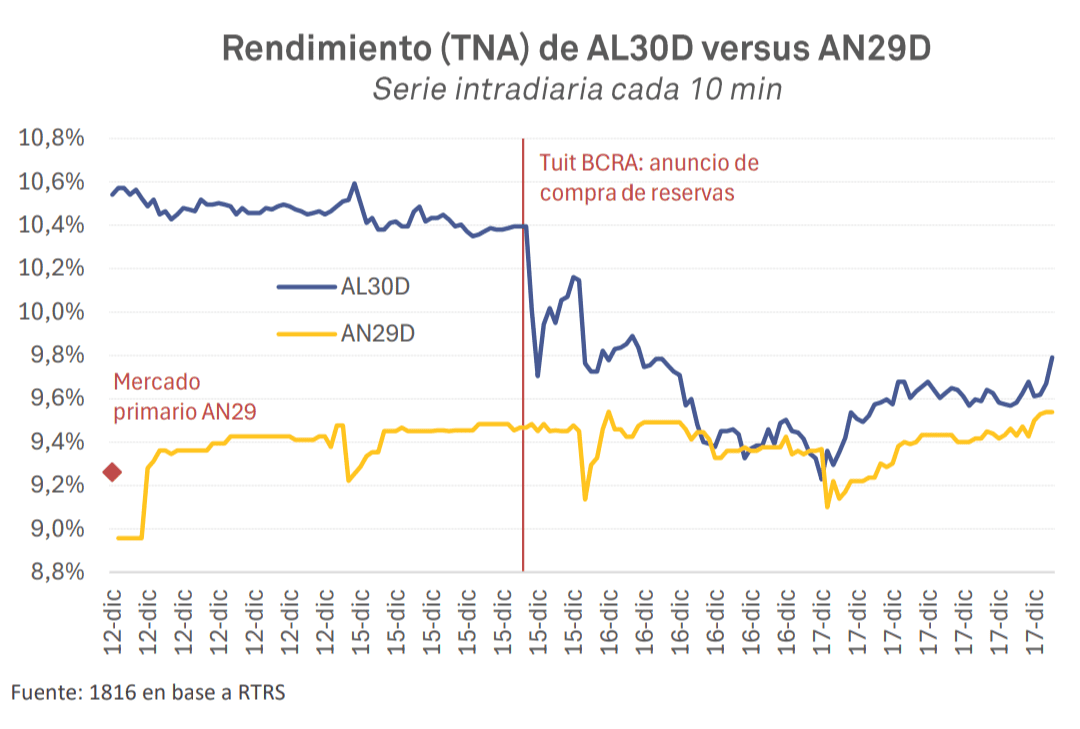

The brand new dollar debt security, the Bonar 2029 (AN29)already has a performance that is close to that of the other competitors. The narrowing of the difference between the new and the classics was mainly due to an improvement in the performance of the latter: driven by good news, the prices of government bonds in dollars rose in recent days, thereby depressing yields, which led to the country risk falling below 600 points.

At the same time, there was a slight deterioration in the new bonds. The instrument used last week by the minister Luis Caputo The yield, which raised $ 1,000 million, rose from 9.26% at launch to just over 9.5%, just below the 9.8% that classic securities such as the AL30 achieve today, one of the most representative of the domestic market, which is also part of the short section of the maturity curve.

Since we find ourselves in a similar situation, the question in the market is which of the bonds has the greatest upside potential for new income brand new AN29 and the remainder of the notes in dollars in accordance with local law. Those consulted by analysts iProfessional They have different preferences, so there is no unanimous winner, but the truth is that it depends on the goal that each investor sets for himself when positioning.

The new dollar bonus or the classics?

Gustavo NeffaPartner of Research for Traders, emphasizes that AN29 works with a Bullet (pays the entire capital at the end), so the Length of time It is very high (3.5), with “good coupon payments” (6.5%), but you have to wait until expiration in 2029 to get back the money you invested. On the other hand, other bonds such as the AL30 pay 8% annually, 4% semi-annual capital and a coupon of 0.75%, which is little but “increases the capital”.

Neffa prefers some of the classics, like the AL30, over the AN29. However, keep in mind that for those who prefer vouchers and have some patience, positioning yourself with others would be ideal government securities in dollars, such as AL35 and AE38, which have better values today.

The financial advisor Jose Ignacio Banor claims that the Length of timewhich is almost twice as high in the AN29 compared to the AL30 due to its structure, is a “measure of volatility”. Therefore, a reduction in country risk should benefit the former more than the latter. However, there is also a tendency towards pre-existing Bonars, especially those with longer maturities (AL45, AE38 or AL41), which, as has been observed in recent days, react more strongly to news or positive signals.

“Due to their shorter average maturity, debt instruments such as the AL30 have lower volatility. It carries the ‘risk’ of reinvestment of coupons in the context of yield compression. Juan DiedrishsAnalyst at Capital Markets Argentina.

Source 1816 based on RTRS.

Accordingly DiedrichsThese are instruments with different structures: bonds such as the AL30 have lower volatility, semi-annual repayment and income flow, while the AN29 has greater upside potential with higher volatility and 100% of principal payment at maturity. Therefore, he emphasizes, it will depend on each investor’s priorities, taking into account, among other things, investment horizon, risk aversion and capital flow needs.

In both cases attractive and depends on each investor

Pablo Lazzati, CEO of Insider Finance, tends to think so AN29 because it has greater upside potential and a 6.5% coupon, while others, like the AL30, have virtually no coupons. However, he warns against it The new bond has low liquidity compared to classic bonds such as the one mentioned above, as it has a face value of only $1,000 millionan amount that Caputo has set as a target at the time of issuance.

“Although the AN29 Although this bond offers a more traditional and orderly structure compared to the bonds from the 2020 restructuring, we believe that its relative attractiveness within the government bond curve is limited compared to other securities that concentrate larger inflows in the short and medium term. In this scenario, we prioritize instruments that allow us to accelerate the recovery of capital and interest within the current government, with the repayment profile playing a central role in the decision-making,” says Auxtin Maquieyra of Sailing Investments.

The analyst claims that bonds like the AL30 offer “significantly more comfortable” dynamics, both in terms of flow and performance. He AL30 This allows almost 50% of the current price to be captured by interest and amortization in the coming years, while in AN29 this percentage is much lower and does not exceed 15%.

“For this reason and given a history of episodes of sudden stopwhich we do not consider today as a likely short-term scenario, we prefer positioning in instruments that concentrate the bulk of it pay out during the management of Javier Milei. In addition, the AL30 combines a higher tariff with a lower one Length of time compared to AN29, which strengthens its attractiveness in the risk-reward ratio,” adds Maquieyra.