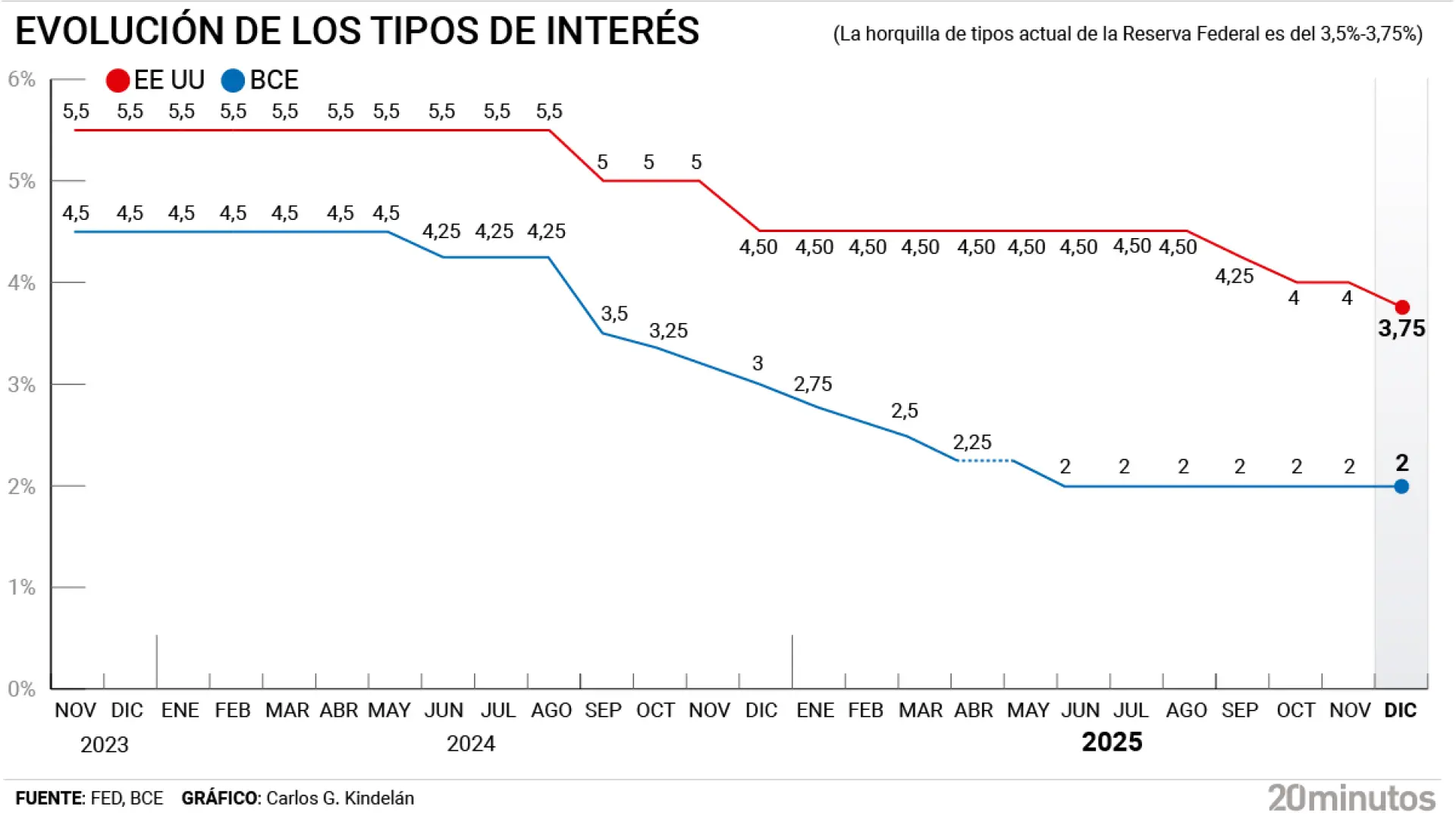

The European Central Bank (ECB) has decided to maintain its interest rates for the fourth consecutive meeting. Thus, the deposit facility, which marks the benchmark of the currency, amounts to 2%, while operations financing principles and marginal credit facility They are placed at 2.15% and 2.4% respectively. The Board of Governors of the Frankfurt-based organization responds to market expectations.

“Their updated assessment continues to confirm that inflation should stabilize around the 2% objective in the medium term,” they explain in a press release. November inflation data supports this decision after closing at 2.1%, a tenth above target, eliminating worst fears on the economic impact of the tariff crisis or the war in Ukraine.

In this context, it revised its growth forecasts upwards, expecting activity to be more “vigorous” than expected in 2017. September due to increased domestic demand. Specifically, it forecasts GDP for the eurozone of 1.4% in 2025, 1.2% in 2026 and 1.4% in 2027, remaining at 1.4% in 2028. At the September meeting, it calculated an expansion in activity of 1.2%, 1% and 1.3% respectively.

On the contrary, expects inflation to close on average at 2.1% this year – no change compared to September -, but it raises the 2026 picture by two tenths, to 1.9%, and places that of 2027 at 1.8%, a tenth less. from the bank The central office explains having revised inflation upwards for the next twelve months, mainly because experts now expect a slower slowdown in services inflation.

The ECB reiterated that it would apply an approach dependent on data, in which decisions are made meeting by meeting“to determine the appropriate direction of monetary policy” and avoid giving clues about future movements. However, the projections would leave aside the hope of undertaking further increases in interest rates to stimulate the economy. Most analysts believe that the ECB will enter a state of hibernation over the next four quarters and that it will take until 2027 for it to start moving.

The silver price decline cycle ends after undertaking reductions of 400 basis points between June 2024 and June 2025, which takes funding costs away from the peak reached in the third quarter of 2023 and confirms the floor at 2%. The most optimistic forecasts bottomed out at 1.5% to 1.75%.

Far from stabilizing the Euribor, the slowdown in monetary reference rates has caused a reversal of this indicator, which serves as a reference when updating variable rate loans. More precisely, the increases started in August from the bottom of 2.079% and they arrive at the end of the year at almost 2.3%, which in practice implies an increase in the cost of housing loans which are revised semi-annually, the second since March 2024, but not for those who receive annually, in which case their quota would be reduced on average by 3% in December.