The economist assured that he was “an enemy of the gangs” because when “the dollar moves,” it has an impact on the entire economy. The details

12/16/2025 – 7:39 p.m

:quality(75):max_bytes(102400)/https://assets.iprofesional.com/assets/jpg/2024/10/585502.jpg)

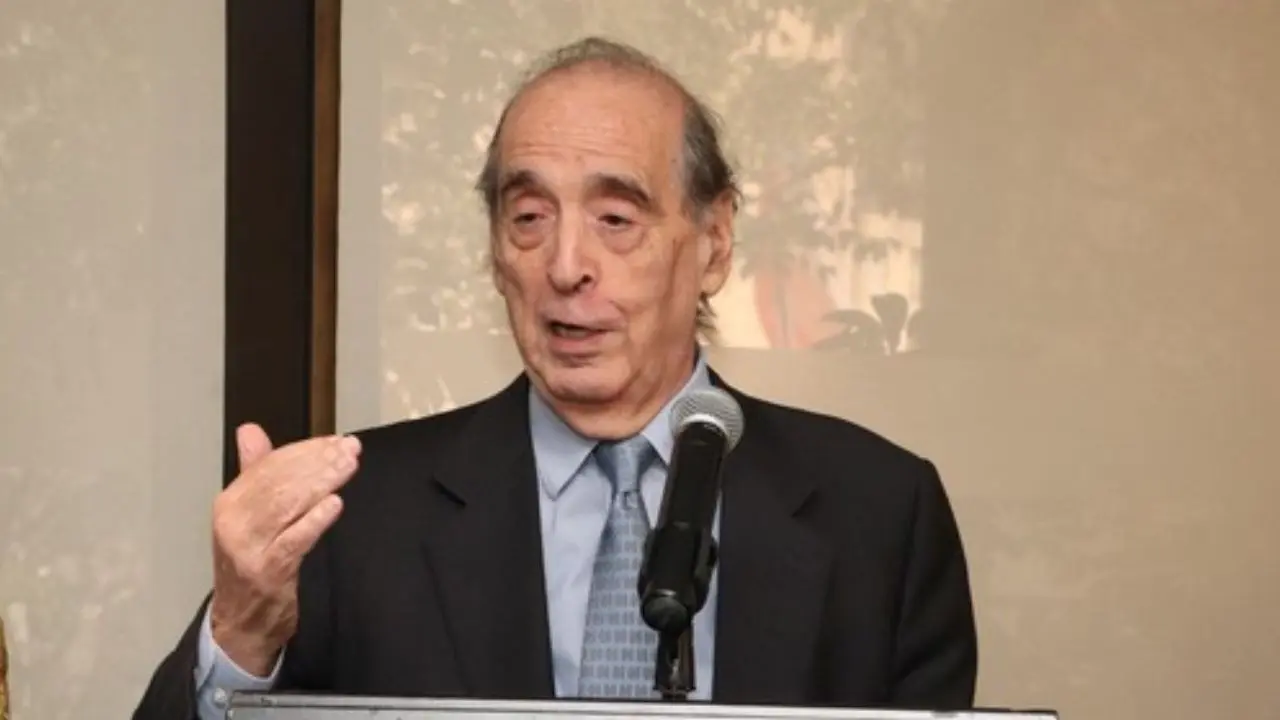

Ricardo Arriazu, one of the most listened to economists Javier Mileicriticized recent government-sponsored exchanges, describing the new system as “Nonsense, but moderate“. Although he clarified that it was not an extreme policy, he warned that the implementation of indexed replacement straps increased uncertainty.

The statements were made during a Meeting with investorswhere Arriazu once again expressed his historic rejection of this type of barter system. As he explained, the biggest drawback of the band system is that it introduces greater volatility in the overall functioning of the economy.

Ricardo Arriazu spoke out against the barter system

“I’m an enemy of the gangs, when the dollar moves everything moves“said the economist. In this sense, he pointed out that the behavior of the Exchange rate has a direct and immediate impact on prices, expectations and investment.

Arriazu compared the current scheme with the previous mechanism of Crawling pegconsisting of a gradual adjustment of the exchange rate. According to his analysis, before the bands were introduced, the Central Bank had achieved positive results in both cases in terms of reserves and economic activity.

“Before the bands were purchased with the phased adjustment $25 billion in reserves, activity grew 11%. With the band.” The risk has doubled, there is more inflation and not a dollar of reserves has been purchased“, argument.

One of the central points of his talk was the impact of uncertainty. The expert emphasized that the lack of predictability entails concrete costs for the economy, especially with regard to investment and financing decisions.

“Uncertainty has its price“, he warned, adding that the changes in exchange rate rules cause doubts among economic actors. In this context, he highlighted the financial support of USA as a key element in maintaining the economic program. Arriazu recalled the exchange agreement for 20 billion dollars and compared it to historical precedents.

“Argentina was in the middle of the fight and that United States Cavalry. They gave us an exchange of 20,000 million dollar. In it tequila “In 1995 there were only 1,000 million,” he compared. Furthermore, it marked a clear difference from the current exchange with China.

“This exchange has nothing to do with it China, which draws reserves. This is from free availability and I have it for when I need it Liquidity issues such as a bet against the peso or repayment of debt“he explained.

Arriazu He also referred to this Country riskwhich remains at a high level despite the improvement in some macroeconomic indicators. According to his vision, this difference is a response to Argentina’s defaults.

“According to our records, Argentina must be the only country with good macro numbers that has 10 times higher country risk than Uruguay and Paraguay.“, he claimed. In this context, he emphasized that investors demand clear certainty about the fiscal direction and the repayment of debts.”People want to know what we will do if we can pay off the debt. Show me the money“, he said.

However, it marked a difference from previous crises: “This time it is different because there is no deficit“he explained. Finally, the economist announced that he had adjusted his assessment of the project’s probability of success downwards Economic plan. According to him, his estimate was from 70% to 50%mainly due to the risks associated with the current exchange rate policy.