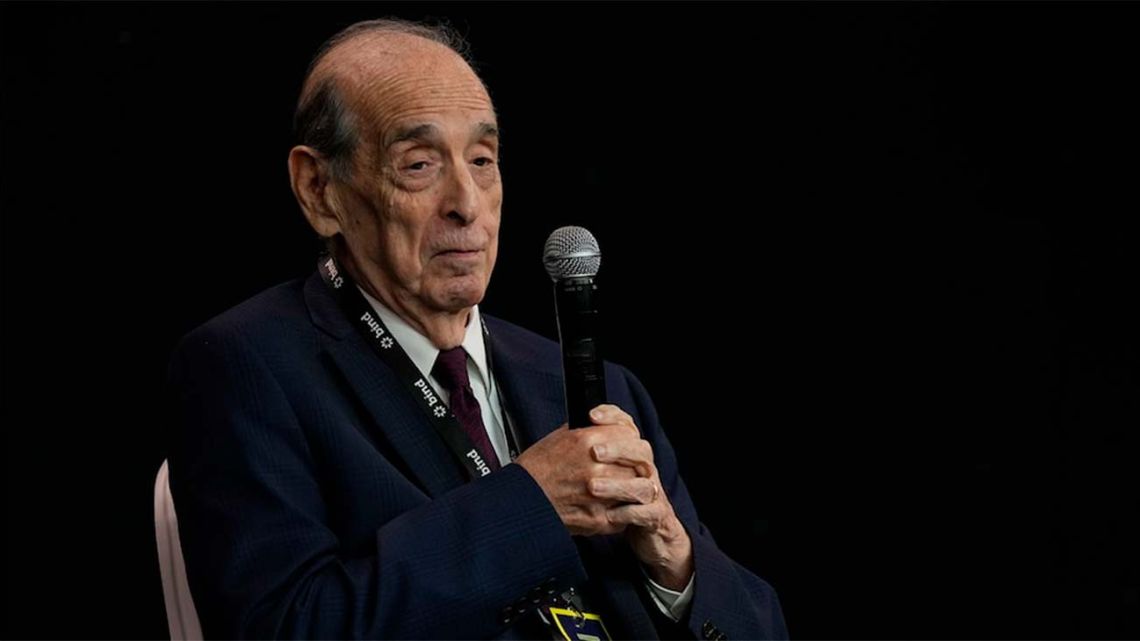

The Economist Ricardo Arriazu, one of the most respected and heard from President Javier Milei, qualified as “silly, but moderate” attributed to the recent foreign exchange measures taken by the government.

This Monday, December 15th, The central bank announced that it will update the lower and upper bounds of the exchange rate bands based on inflation. instead of the monthly rate of 1% that has been in effect since March this year.

During a meeting with investors, Arriazu said: “I’m an enemy of the gangs, when the dollar moves, everything moves.” The economist explained that with the previous 1% crawl peg mechanism in place until March, “$25 billion in reserves purchased, activity up 11%. With the tape, the risk has doubled, there is more inflation and not a dollar of reserves has been purchased,” he said.

Caputo denied that the new banding system accelerates inflation and gave details of the debt repayment, which expires in January

Arriazu stressed that the main consequence of the new regime is the increase in insecurity. “Uncertainty has its price” He warned, although he is mindful that changes in stock market rules affect investment decisions.

United States aid

In this context, he highlighted the financial support of the United States as a key factor in maintaining the economic program. “Argentina was in the middle of battle and the United States cavalry arrived. They gave us a trade of $20,000 million. “In 1995, tequila only cost $1,000 million,” he compared.

Furthermore, he differentiated this agreement from the exchange with China: “This exchange has nothing to do with the exchange by China, which receives reserves. This is freely available and I have it when I need it for liquidity problems such as a bet against the peso or paying off debts.”

According to Arriazu, “Argentina must be the only country that, according to our records, has ten times higher country risk than Uruguay and Paraguay with good macro numbers.”

“People want to know what we’re going to do when we pay off the debt: ‘Show me the money,’” he said, although he believed the current scenario represents a significant difference from previous crises. “This time it is different because there is no deficit,” he concluded.

Finally, the economist revealed that he had reduced his estimate Success of the economic plan: It rose from 70% to around 50%, mainly due to the risks caused by exchange rate policy.

LM