According to this, the Argentine economy recorded annual growth of 3.3% in the third quarter of 2025 Activity level progress report This was published this Tuesday by the National Institute of Statistics and Censuses (INDEC). The data confirmed the continuity of growth compared to the same period last year. However, with a moderate performance quarter-on-quarter.

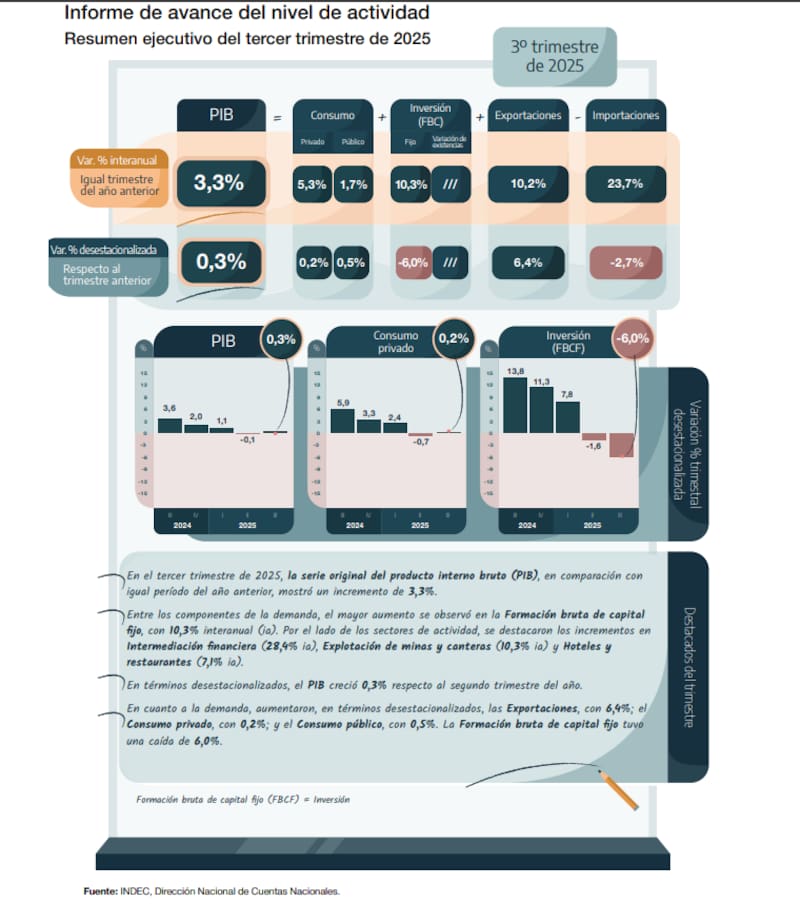

According to the official body, the gross domestic product (GDP) increased by a seasonally adjusted 0.3% compared to the second quarter of the year, which was reflected a slowdown compared to previous records and revealed a heterogeneous behavior between the different demand components and the production sectors.

The third quarter advance came after the first quarterly decline that the economy recorded a 0.1% decline in GDP in the April-June period compared to the first three months of the year. This result marked a break in the sequence The growth set in the second half of 2024, against the backdrop of a strong favorable base effect, warned of a possible exhaustion of the expansion impulse.

From a spending perspective The strongest increase compared to the previous year was recorded in gross fixed capital formationi.e. investments, which grew by 10.3%. The result was mainly due to the increase in machinery and equipment and the transport equipment component, with a strong influence from imported goods. However, in a quarterly seasonally adjusted comparison, investments fell by 6.0%, which meant a slowdown in the rate of capital accumulation.

private consumption recorded annual growth of 5.3%, increasing 0.2% quarter-on-quarter, while public consumption rose 1.7% year-on-year and 0.5% quarter-on-quarter. Exports of real goods and services rose 10.2% year-on-year, registering a strong seasonally adjusted recovery of 6.4% amid greater momentum in the external sector.

As in previous quarters, year-on-year growth continued to be influenced by the low comparison level from 2024when the activity went through a contraction phase. This base effect partially explains the magnitude of some year-to-year fluctuations, although the seasonally adjusted data showed more limited performance and confirmed a growth scenario with less traction in the near-term comparison.

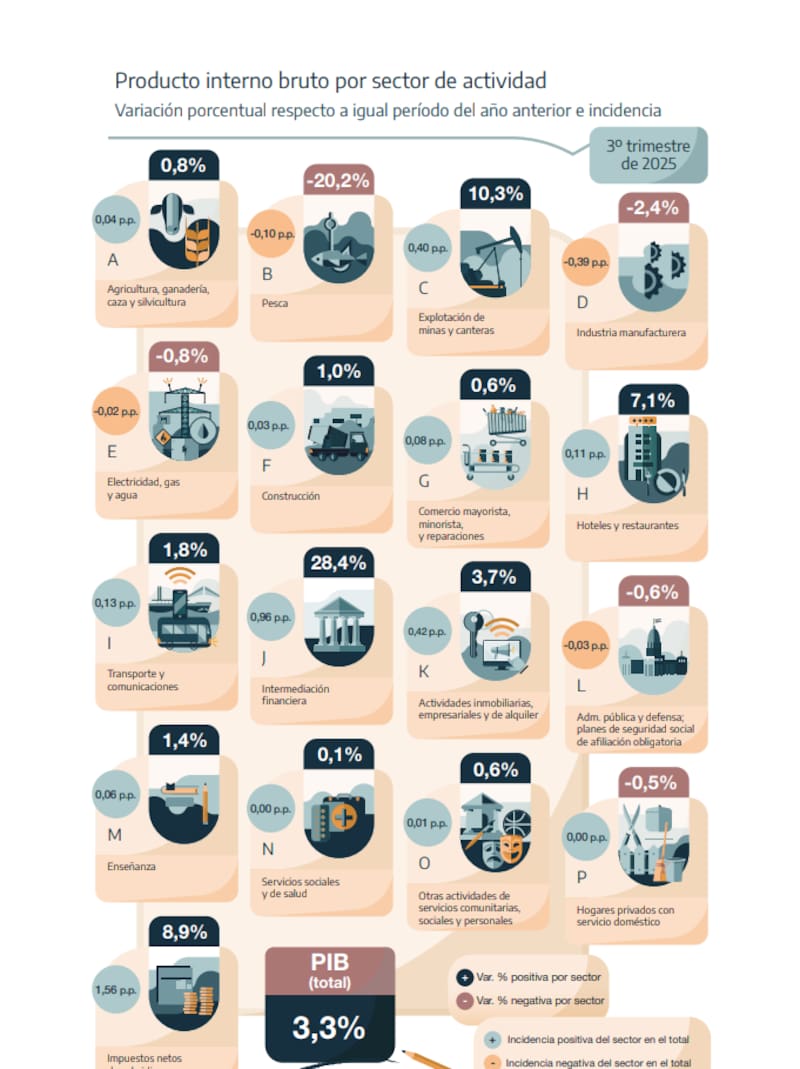

On the supply side, GDP growth was led by a few specific sectors. The increase was led by financial intermediationwith an increase of 28.4% compared to the previous year and was the sector with the greatest positive impact on the overall result. Also highlighted were the exploitation of mines and quarries, which increased by 10.3%, as well as hotels and restaurants, with an increase of 7.1%, linked to tourism and service activities.

Other sectors showed more moderate performances. He Transportation and communication grew by 1.8%, the construction preferred 1.0% and the Wholesale and retail increased by 0.6%. Agriculture, livestock breeding, hunting and forestry recorded an increase of 0.8% Real estate and business activities they grew by 3.7%.

In contrast, some items ended the quarter with a year-over-year decline. The manufacturing industry retreated The decline fell by 2.4%, fishing contracted by 20.2% and the electricity, gas and water sector fell by 0.8%. Public administration and defense activities also declined, with a decline of 0.6%.

In cumulative termsreported the INDEC GDP grew by 5.2% in the first nine months of 2025 compared to the same period last year. The data confirmed a sustained recovery year-on-year, albeit with signs of lower impulse in the immediate dynamics, in a scenario in which the development of investments and the sector appears as one of the main challenges towards the end of the year.

With this result is the economy cumulative growth of 5.2% in the first nine months of the yearHowever, short-term indicators point to a scenario of greater fragility towards the end of 2025. The development of investment, industry and private consumption will be decisive in determining whether growth can be maintained or whether a phase of stagnation with quarterly fluctuations will consolidate.