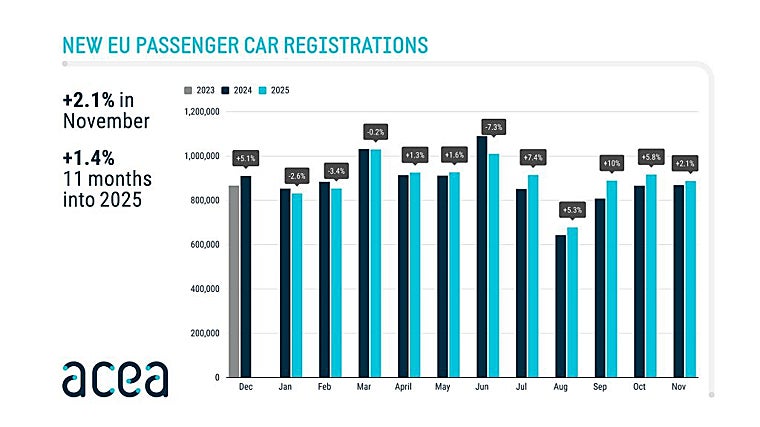

THE registrations of new vehicles in the European Union recorded an increase of 2.1% in November, reaching 887,491 units, according to data published by the European Automobile Manufacturers’ Association (ACEA).

In the aggregate of the first eleven months of … In 2025, the community market will grow by 1.4%, even if total volumes still remain below the levels recorded before the pandemic.

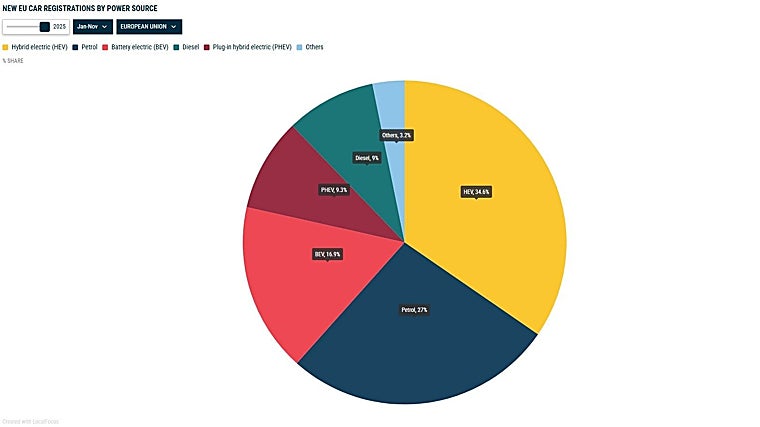

This report confirms the consolidation of alternative engines compared to traditional combustion, highlighting in particular hybrid vehicles, which remain as the preferred option of Europeans with a market share of 34.6% thanks to the push from countries like Spain and France.

Battery electric vehicles have managed to increase their share so far this year to 16.9%, gaining three and a half points from the previous year.

In this same line of growth, plug-in hybrids reached 9.3% of the market driven by very significant increases in Spain, Italy and Germany.

Percentage of registrations by type of propulsion

This transition to electrification contrasts with the collapse of traditional powertrains, where gasoline sales fell by 18.6%, reducing their share to 27% from 33.7% last year, with notable declines led by France and Germany.

Diesel and gasoline sales fall

The decline of gasoline and diesel It continues strongly with a drop of 24.4%, which leaves its representation on the European market at a residual 9% until November. At the end of November 2025, gasoline vehicle registrations fell by 18.6%, with declines in all major markets. France saw the largest decline, with a drop of 32.1%, followed by Germany (-22.4%), Italy (-17.4%) and Spain (-14.6%).

Evolution of the automobile market in Europe

With 2,665,739 new vehicles registered to date, gasoline’s market share fell from 33.7% to 27% during the same period last year. Similarly, the diesel vehicle market declined by 24.4%, a share of 9% so far in November 2025. Furthermore, the annual change in November 2025 showed a decrease of 21.9% for gasoline and 23.2% for diesel.

In the general analysis by country, the notable growth of hybrid and electrified technologies in the four major markets —Germany, France, Italy and Spain—have managed to compensate for the general decline in thermal engines, allowing the final results for the month of November to remain in positive territory and to advance the sector’s energy transition.