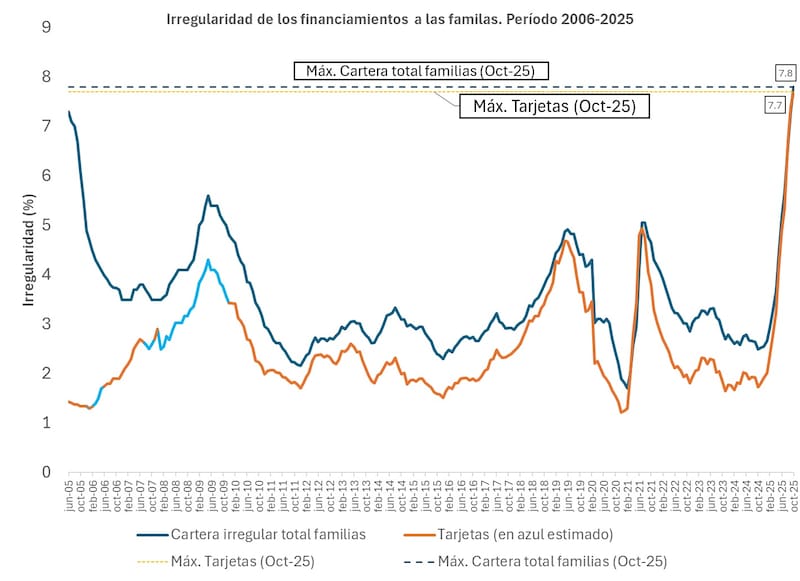

more than 20 years ago that Argentine families did not have as much difficulty paying their debts. Neither the international crisis of 2008, nor the economic crisis at the end of Macri’s rule, nor even the pandemic caused a similar problem to the financial stability of households as it does today as a result of the policies of the national government.

The People’s insolvency rose to 7.8%, a tripling of the number compared to the same month last year. This means that the number It is worrying not only because of its scale, but also because of the speed at which the deterioration is progressing, exceeding all indicators observed over the last two decades and moving. albeit still far away, towards the values of the economic and social outbreak of 2001.

Contrary to what the national government says, the worst has not only not happened, it also appears to be imminent. The financial system has been showing warning signs for months. Signals reinforced by the central bank’s recently published banking report with data from October 2025 Defaults on loans to the private sector reached 4.5%, up 0.4 percentage points from the previous month. This is the highest default rate in Latin America. For companies, the irregularity reached 1.9%, doubling the February 2025 data. Although these are lower percentages than households, the same negative trend remains.

It is worrying not only because of its scale, but also because of the speed at which the deterioration is progressing, exceeding all indicators of the last two decades and continuing.

This situation can be explained mainly by a combination of the increase in the cost of living, the loss and deterioration of employment, and the decline in income and consumption. In order to meet their economic needs, people are increasingly taking on more, more precarious and lower-paid jobs. In particular, in the province of Buenos Aires, the impact of this reality is even more profound, given the characteristics of its economic and productive structure and the specific weight of industry and commerce.

For young people aged 18 to 21, we see that default has increased by more than 14 percentage points to 38.4% in the last year. That means, Many young people sign up for the debtor register before they get their first job. This reinforces a vicious circle in which financial problems affect employment opportunities and undermine medium-term development opportunities.

Another aspect of this situation is elaborated by some non-banking companies that are not covered by the user protection regulations of financial services. Although they facilitate and speed up access to financing, they offer loans with high interest rates, very short terms and without sufficient information for customers. The terms on which they lend are unsustainable and the result negatively impacts families and contributes to the instability of the broader financial system.

The same companies now intend to automatically debit their balances from debtors’ bank accounts to ensure recovery. This would make the picture even more complex considering that the universe of these fintech players has far higher failure rates than the rest of the financial system.

The terms on which they lend are unsustainable and the result negatively impacts families and contributes to the instability of the broader financial system.

In this situation, the answer cannot be to restrict lending, as that would only exacerbate the current crisis. It is necessary to change this and develop responsible products at affordable prices, in addition to setting deadlines that correspond to the reality of homes. And that dIt must be accompanied by a clearly formulated policy at the national level on financial education and user rights protection, allowing people to make decisions in an informed and transparent manner.

From Banco Provincia and Provincia Microcreditos, with the commitment of the public banks of the Government of the Province of Buenos Aires, we carry out refinancing plans that allow us to relieve pressure, reduce interest rates and extend the conditions of those who have problems meeting their obligations. Also We develop inclusion and financial education programs, both in-person and virtual, throughout the Buenos Aires area.

But initiatives like these are not magic solutions, nor can they alone reverse policies that are destroying thousands of jobs, hurting production and hurting domestic consumption. just with With a common strategy between the state and the financial sector, we can restore stabilityGrowth and development towards social integration.

The first urgent measure on this path is urgent It is necessary that national authorities align the conditions and requirements of banks and non-banks, fintechs or payment service providers in terms of information, transparency and protection of the rights of users of financial services. This will ensure that millions of people can make more informed decisions when it comes to taking on debt.