One issue that kept accountants and businessmen on tenterhooks related to the sharp increase in fines under the Tax Procedure Act, which created the Tax Innocence Project, which already has half a sanction from lawmakers and could be turned into law by the nation’s Senate on Friday.

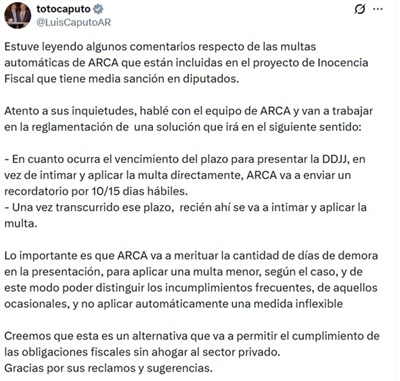

In this context via the social network

In this regard, Caputo pointed out that he has spoken with the ARCA team and they are working on regulating a solution that will go in the following direction:

– As soon as the deadline for submitting the affidavit has expired, Instead of notifying and imposing the fine directly, ARCA sends a reminder for 10/15 business days.

– Once this period has expired, Only then will the fine be announced and imposed.

Source: X

“What is important is that ARCA does this justify the number of days of delay in presentation, impose a small fine, “Depending on the individual case, we can do this and in this way we will be able to distinguish frequent from occasional violations and not automatically apply an inflexible measure,” Caputo said.

“We believe this is an alternative that allows compliance with tax obligations without stifling the private sector,” concluded the minister.

Tax innocence: increase in fines

The “Tax Innocence” initiative, which has already been approved by MPs and forwarded to the Senate, provides for a sharp increase in tax penalties that have been outdated for decades. Specifically, the project, which is already half-sanctioned, notes a general increase in formal violations, information regimes and international obligations.

Specifically, the draft tax procedural law reform focuses on comprehensively updating the fine regime, one of the aspects with the greatest practical impact for taxpayers and auditors.

The initiative recognizes that the current amounts have been completely distorted by inflation, which has reduced the effectiveness of the sanctions system and created incentives for formal non-compliance.

Fiscal innocence: excessive increase in fines imposed by ARCA

One of the most controversial changes is the update of the minimum penalties for formal violations They increase from $200 to $220,000, while the maximum amounts increase from $400 to $440,000.

In the event of failure to file affidavits, penalties are significantly increased and now range from $5,000,000 to $10,000,000 depending on the severity of the failure.

Fines related to complex information systems will also be increased, particularly those related to international operations and multinational corporations.

For example, Failure to provide information about operations involving foreign subjects may be punishable by fines of up to $22,500,000, while failure to name an informant in the country-by-country system may be punishable by penalties of up to $67,500,000.

General violations of Law 11,683, previously punishable by symbolic sanctions, are now penalized with amounts ranging from $150,000 to $2,500,000, with a maximum limit of up to $35,000,000 depending on the type of taxpayer.

In comparison: Some fines are multiplied by more than 200 or 300 times compared to its original values, which represents a sharp turn in the sanctioning policy of the national tax system.

The project also provides for the amount of fines will be automatically updated by UVA starting January 1, 2027to prevent them from becoming obsolete over time.

From the executive it is claimed that this update aims to restore the proportionality of the sanctions regime and strengthen the deterrent effect of fines, particularly on issues of non-compliance with information.

Important changes in the penalty tax system

On the other hand, the project suggests significantly increase the minimum amounts which constitute tax crimes, both at a general level and in relation to social security. Below is a detail of the new scales:

Tax crimes

- Easy dodge: increases from $1,500,000 to $100,000,000 per tax year and fiscal year.

- Aggravated evasion: from $15,000,000 to $1,000,000,000.

- Fraudulent use of tax benefits (exemptions, deductions, etc.): from $2,000,000 to $200,000,000.

- Use of invoices or apocryphal documents: from $1,500,000 to $100,000,000.

- Impermissible use of tax advantages: from $1,500,000 to $100,000,000.

Crimes related to social security

- Easy dodge: from $200,000 to $7,000,000.

- Aggravated evasion: from $1,000,000 to $35,000,000.

- Misappropriation of social funds: from $100,000 to $3,500,000.

Other common crimes

This update has one direct impact on criminal tax proceedingsas it significantly reduces the number of cases that could be prosecuted under current law.

New criterion for preventing criminal acts

Currently the regime allows end the crime by paying the debt and interest only once and before reporting. The new project extend this advantagewhich even makes extinction possible after filing the criminal complaintas long as the taxpayer Pay the entire amount due, interest and an additional 50%..

The aim of this change is to prevent the improper use of mechanisms such as comprehensive repair provided for in the Criminal Code, which is usually the case in reality delay the processes without ensuring effective reimbursement to the state. Aside from that, is expressly prohibited the application of this route in the punitive tax system.

Changes to ARCA’s Whistleblowing Policy

They join in two new assumptions in which the tax authority You should not press chargeswithout the need for a legal opinion:

- If the taxpayer has well-founded technical or accounting criteria used to pay the tax.

- When Submit original or corrective affidavits before you are notified of an inspection.

These cases are in addition to the two cases currently envisaged where a prior opinion is required. The idea is that if the taxpayer acted in good faiththe criminal proceedings are unnecessary and collecting the money owed takes priority.

Shortening of prescription times

Two relevant changes are proposed:

- From 5 to 3 years in tax matters for registered and taxable taxpayers.

- From 10 to 5 years in social security for those who submit their returns on time.

This is how you search positively differentiate the compliant taxpayerand shorten the time periods that the Treasury Department can use for retroactive investigations.

New simplified income tax system

One of the project’s most notable innovations is the creation of a Simplified earning system for human persons and resident undivided goods. This regulation is aimed at taxpayers who: They are not considered big taxpayers and that she:

- Income up to 1 billion dollars

- Inheritance of up to 10 billion dollars

ARCA will suggest a pre-filled affidavitbased on the information available. The taxpayer can accept, supplement or correct it. If accepted and paid on time, the tax will be released and the fiscal period may not reopen except in the following cases:

- Use of apocryphal calculations

- Impermissible deductions

- Lost income

Presumption of correctness and “tax cap”

This is what the law provides assume truthfulness of affidavits submitted under this regime, thereby limiting the ability of the Treasury to initiate audits for the specified periods unless they are verified significant deviations.

In addition, the use of unjustified capital increases as an automatic test trigger will be deactivated. The aim of this measure is to protect taxpayers who comply with the regulation and at the same time to avoid misinterpretation by the debt collection authority.

Protecting the Compliant Taxpayer

In the event that the taxpayer complies with the simplified regime and then switches to another regime, Protection and liberating effects are retained of the statements made. Control may only be extended if relevant discrepancies are identified, without affecting any prescribed timelines or the scope of the money laundering “fiscal cap” or the new regime.