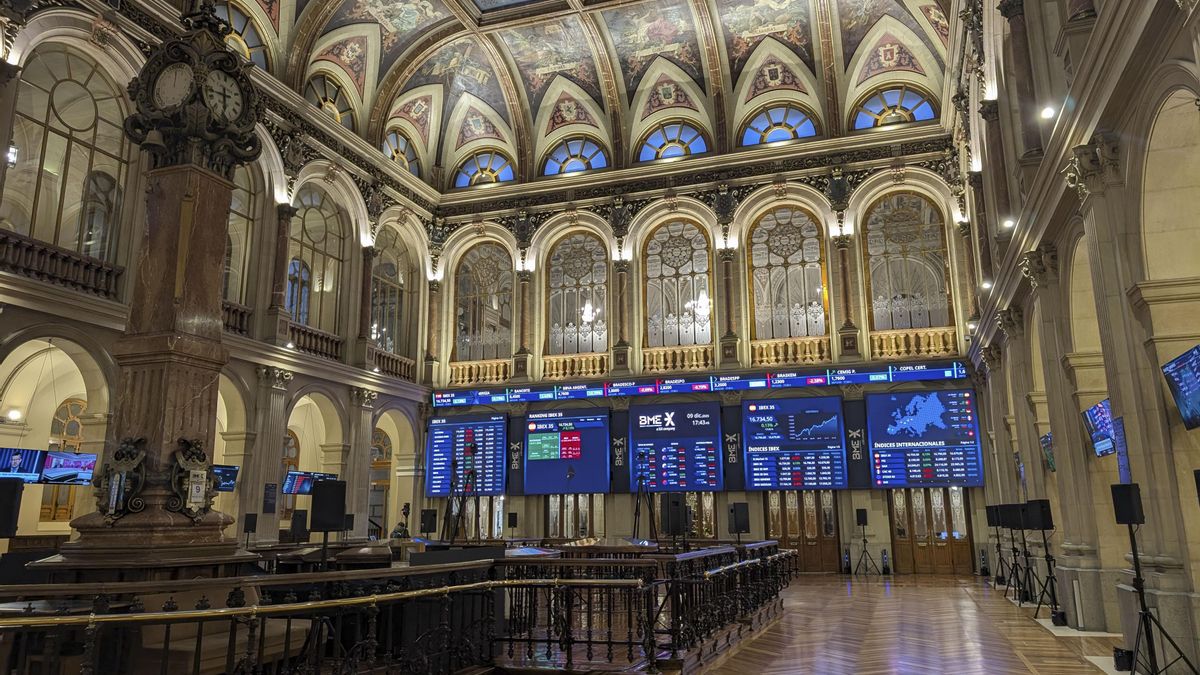

The Ibex 35, the benchmark indicator of the Spanish stock market, stood out this Wednesday from the slight declines of the rest of the European stock markets and recorded a timid increase of 0.17%, to 16,762.5 points, which allowed it to record a new historic high, boosted by the rise in most major stocks and Wall Street.

The selective accumulated an increase of 44.57% during the year, one of the most significant annual revaluations in its history, although still far from the increase of 54% recorded in 1993.

This Wednesday, while the market awaited the decision of the Federal Reserve on interest rates in the United States and with the barrel of Brent oil, the benchmark in Europe, trading lower, with a drop of 0.74%, to 61.48 dollars, the main titles of the selective increased Banco Santander (0.81%), Inditex (0.74%), Telefónica (0.25%), BBVA (0.24%) and Repsol (0.22%). Only Iberdrola fell by 0.31%.

Leading the increases, by more than 2%, are the pharmaceutical group Rovi and the construction company ACS, which received a new record valuation this Wednesday from international analysis firms, in this case Exane BNP Paribas.

The Ibex’s all-time high comes after the German Dax lost 0.13%; the French Cac, 0.37%; and the Italian Mib, 0.25%.