- The IMPSA case: from Mendoza to Miami

- What’s coming

The government is about to complete the first two years of President Javier Milei’s term in office promoted privatization. It was carried out entirely with the metallurgical company IMPSA and is in the middle of the definition phase for the Comahue Dam concession. Intercargo and Transener will be the next focus this year. This allows the Minister of Economy, Luis Caputo, Add dollars for sales and improving budget surplus by reducing public spending.

The government is ending its second year in office at a slower pace than it would have liked fully privatized state-owned company. This is the IMPSA industry, a metallurgical giant based in Mendoza and employing almost 600 people. The new management corresponds to North American capitals and is in the process of exporting cranes and nuclear materials to the United States. President Donald Trump’s alliance with Milei was crucial for IMPSA to become a “strategic supplier” of high-value-added industrial goods to replace China.

The IMPSA case: from Mendoza to Miami

IMPSA’s first year under private management had a crucial milestone: the restructuring of its $583 million in debt in light of the fact that the company was on the verge of default. They settled with 87% of the creditors, representing 97% of the total debt value. The agreement allows them to not pay capital for ten years and only start paying interest after three years. Jorge Salcedo, President of IMPSA, said: “The net present value of the debt was reduced to $120 million. “It gave us a more stable balance.”

With this financial relief, IMPSA was reactivated and is seeking strategic positioning in the United States. The company today fopens harbor cranes for the US militaryThe second reason for this market penetration is participation in the first tender in a port in Miami. The progress can be attributed to two reasons: One is a change in North American politics. First, former President Joe Biden banned the use of Chinese cranes, which dominate 85% of the market. Trump then ordered his replacement. Salcedo revealed that an investigation found that they had been transmitting “information” about international trade to Beijing and that they could “remotely disable themselves and thus completely paralyze a port.”

The second reason for this penetration into the North American market is explained not only by the USA’s search for “reliable” suppliers in the West, but also because of the current connection between Trump and Milei, This could deepen as the trade agreement evolves. In fact, IMPSA is owned by North American capital: it is controlled by the Industrial Acquisitions Fund (IAF) consortium, whose main partner is Arc Energy, a leader in the energy sector. In Argentina there is only one company of the size of IMPSA, in Latin America there are only a few. The difference with the major metallurgical companies in Brazil is that “they will supply China,” while IMPSA will supply the United States, Salcedo explained.

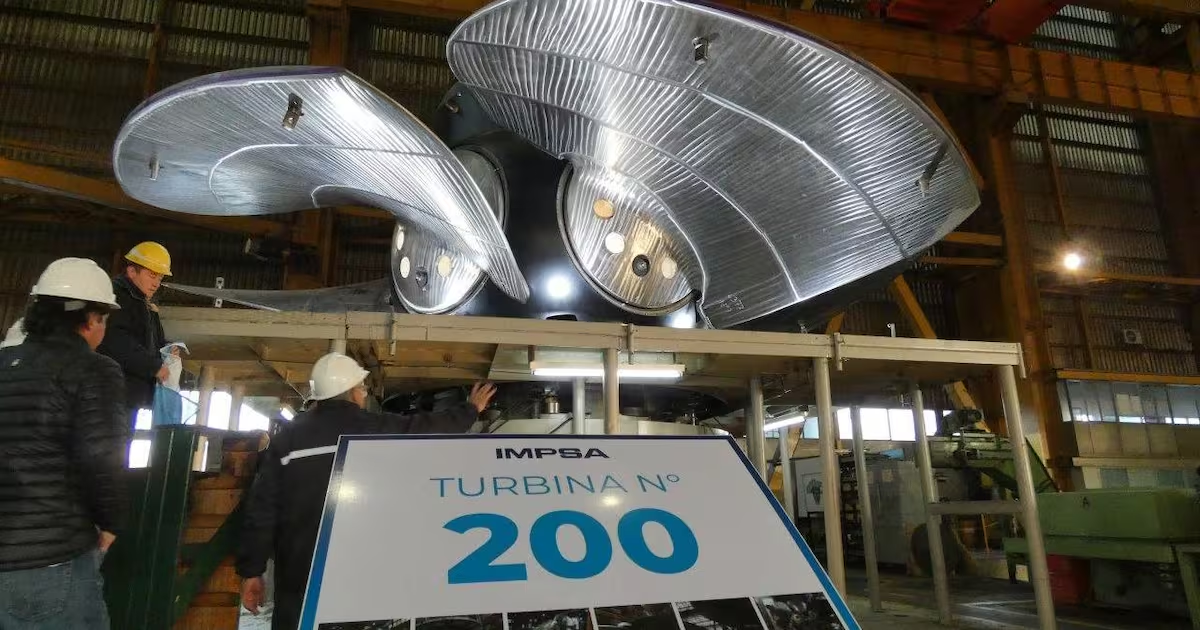

When asked what the key to competing in this market is, Salcedo revealed that it lies in the company’s ability to produce industrial components with very high added value: unique, tailor-made pieces with international nuclear certification. “We make everything from hydro turbines to reactors, we don’t do mass production,” Salcedo explained. Its greatest asset is the specialized engineers and welders trained in its own school, as well as the knowledge in metalworking accumulated over more than 100 years. The company was founded in 1907 by the Pescarmona family.

Going forward, they showed that the strongest demand will come in three ways: the global boom in nuclear componentsgiven the growth that nuclear energy will have due to the intensive use of artificial intelligence. IMPSA manufactured the pressure vessel for the Carem 25 reactor. This is the safety component that prevents the nuclear reaction from leaving the reactor.

“There is no one in the United States who has started manufacturing it yet,” Salcedo revealed. Secondly, for the replacement of 85% of its port cranes, which Trump wants to carry out. And thirdly, because they deliver goods like Turbines for hydroelectric power plantswhere new investments will be required due to concession changes.

What’s coming

In the future, the Comahue dams are on the verge of closure, whose concession has expired and has been put out to tender again. The government could receive $706 million there. Then, before the end of the year, is the maximum goal promote the privatization of Intercargo, company that provides services at airports and Transener, the main company in the Argentine electricity network. In both cases it will be a privatization by tender, so the call will be made in a few days.

Finally, the target for the first quarter of 2026 will be published in AySAthe company that provides water services in the capital and part of the suburbs. The government assures that it would have liked to move faster with these processes, but each company needs its own “internal regulation, updating of the regulatory market”, among many other variables depending on the segment, they explained.

We would like to get to know you!

Register for free at El Cronista for an experience tailored to you.